Scandinavia’s top performer

Our panelists see Denmark’s GDP growth being the highest in Scandinavia this year and next, after a region-beating performance in 2023. And Novo Nordisk—the Danish pharmaceutical giant with a market capitalization larger than Denmark’s GDP—has a significant part to play in these rosy projections. The company is behind the blockbuster drugs Ozempic and Wegovy, which tackle diabetes and obesity, respectively. Surging sales of the drugs saw Novo Nordisk’s profits rise by half last year, and potentially by a further quarter in 2024.

The Novo factor

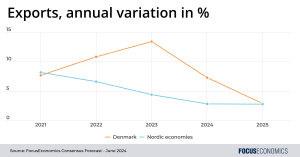

Rising drug sales led Denmark’s exports to increase by a massive 13.4% year on year in 2023, and our panelists pencil in a further 7.4% rise for 2024. But it’s not just the external sector that Novo Nordisk is benefiting: The company is also spending billions of euros to expand its manufacturing capacity within Denmark, and its growing corporate tax payments are helping fund public spending priorities from defense to the green transition. The company paid close to EUR 3 billion in tax last year, more than double the level of four years ago. To really put into perspective the importance of Novo Nordisk for the economy, consider that Denmark’s GDP growth of 1.9% last year would have been roughly zero without the firm’s outsized contribution.

The danger of overreliance

In the early 21st century, telecoms giant Nokia dominated Finland’s local economic landscape and was at the forefront of the mobile phone market. But the firm fell behind technologically in the late 2000s and had to lay off thousands of Finnish employees, with the company’s decline contributing to half the fall in Finnish GDP in 2009. It’s a cautionary tale which bears a certain resemblance to Denmark’s current situation. Like Nokia, Novo Nordisk relies on a narrow set of products to generate revenue. And like Nokia—whose bête noire was Apple and the iPhone—Novo Nordisk has a growing set of rivals; U.S. company Eli Lilly is already selling its own anti-obesity drug, and a host of other pharmaceutical firms are racing to grab a slice of the market.

With this in mind, Denmark’s government would be wise to use the economic proceeds from Novo Nordisk’s rise to build out the wider pharma ecosystem and turbocharge other economic sectors. If it simply pockets the proceeds, the economy’s time in the sun may not last long.

Insights from our