Richard Gardiner, EU Public Policy Lead at the World Benchmarking Alliance, says CSDDD offers a rare opportunity to improve corporate human rights risk accountability.

The EU’s recently approved Corporate Sustainability Due Diligence Directive (CSDDD) has the potential to systematically change the way corporations approach their human rights risks, both within their operations and supply chains. It will do this by setting a legal baseline outlining exactly how the largest multinationals operating in the EU are expected to address these risks across their global supply chains.

The passing of this law has been hailed as a significant victory in the sustainability community. Investors in particular should be paying close attention to these developments, as CSDDD presents both challenges and opportunities that can significantly impact their portfolios.

Why CSDDD matters to investors

One of the most compelling reasons for investors to care about and invest time in understanding CSDDD is the enhanced leverage it provides. The law offers a legal and political framework to mandates companies to proactively tackle their human rights risks, which investors can utilise to push for greater corporate accountability. By directly referencing these legal obligations, investors can exert pressure on companies to engage more deeply with human rights issues within their value chains. Unlike the existing voluntary global standards, the leverage provided by CSDDD is not just theoretical. It has practical implications for improving corporate behaviour and, by extension, protecting the long-term value of investments.

Investors are not merely passive observers of corporate performance but have a proactive role to play. By incorporating CSDDD in their responsible investment practices, investors can ensure that the leverage provided is not just a by-product of the law but becomes a mainstream expectation across the investment community. This mainstreaming is vital for preventing and addressing both current and potential negative impacts on people, managing financial risks, and meeting the evolving expectations of beneficiaries, civil society, regulators and clients.

Current landscape and investor opportunities

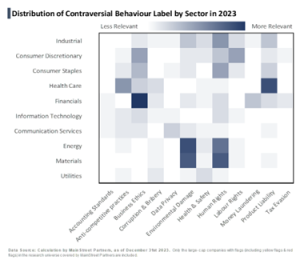

This pressure point is more important now than ever. Data from the World Benchmarking Alliance’s Corporate Human Rights Benchmark (CHRB) underscores the urgency of CSDDD. Although 66% of benchmarked companies in high-risk sectors have demonstrated improvement on key human rights indicators, a staggering 40% still disclose no or insufficient evidence of a human rights due diligence process. This indicates a significant gap between current practices and the standards that the CSDDD aims to enforce. Investors, armed with the