Published

15 seconds ago

on

July 2, 2024 Article/Editing: Graphics/Design:

See this visualization first on the Voronoi app.

Mid-Year Interest Rate Cut Forecasts for 2024

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

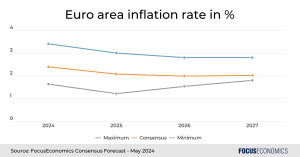

Today, many institutions are trimming back their rate cut expectations given strong labor market data and slow progress on inflation.

At the beginning of 2024, several banks forecasted five or more interest rate cuts over the year, while the median projection for Federal Reserve policymakers was three quarter-point cuts by fiscal year-end in March. Now, it has pared this back to one rate cut this year.

This graphic shows mid-year interest rate forecasts, based on institution reports via Nick Timiraos of the Wall Street Journal.

Will the Fed Cut Interest Rates This Year?

Below, we show interest rate forecasts across 21 institutions as of June 2024:

Forecasted Rate Cuts

in 2024Number of Institutions

as of JuneNumber of Institutions

as of AprilNames of Institutions 0 bps31Jefferies, Mizuho, Societe Generale 25 bps80Bank of America, Barclays, BNP Paribas,

Deutsche Bank, HSBC, JP Morgan,

LH Meyer, RBC 50 bps71Evercore ISI, Goldman Sachs, Nomura,

Oxford Economics, TD Securities, UBS,

Wells Fargo 75 bps29Citigroup, Morgan Stanley 100 bps15MUFG 125 bps03N/A

Overall, more than half of the institutions seen in the above table anticipate the first rate cut to take place in September.

Citigroup, for example, is forecasting quarter-point rate cuts in September, November, and December. In June, the bank scaled back their projections, which were previously calling for four cuts beginning in July. A key indicator that the bank is watching is the unemployment rate, which slowly increased to 4% in May, up from 3.9% a month earlier. It also expects inflation to continue cooling over the coming months.

Like Citigroup, Goldman Sachs and Nomura see the first rate cut taking place in September.

In more of a hawkish camp, JP Morgan anticipates the first cut to be in November due to continued momentum in the labor market. This year, the bank has shifted from three interest rate cuts to one, citing that job weakness may take several months to play