The Federal Reserve is now calling for only one interest rate cut in 2024. But their forecast is likely overly cautious, and we think there will be two or more cuts this year.

As was widely expected, the Fed kept the federal-funds rate unchanged at a target range of 5.25%-5.50% at its June meeting. At the start of the year, markets expected rate cuts to be in full swing by this point. However, cuts have been delayed because of inflation’s upward surprise in early 2024.

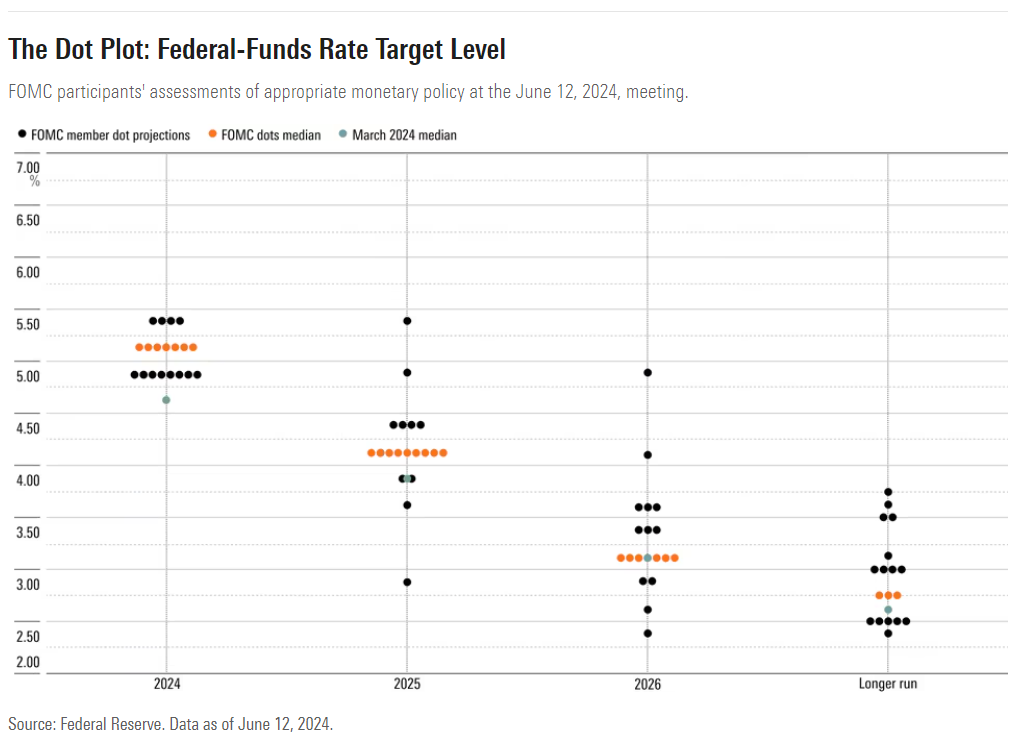

More newsworthy are the new economic projections from the Federal Open Market Committee, last updated at the March meeting. The Fed is now expecting a December 2024 federal-funds rate of 5.1%, implying one 0.25% cut from current levels. By contrast, in March the Fed called for a 4.6% rate, implying three rate cuts.

Inflation shot up in the first quarter after being subdued in the second half of 2023. Core PCE inflation reached 4.4% annualised in the three months ending in March 2024, compared with 1.9% in the six months ending December 2023.

More recently, however, inflation has started to cool again, with core PCE inflation falling to 2.8% annualised in the three months ending in May (our estimates for May itself are based on CPI data). Suddenly, a benign environment for inflation could be returning, with the first-quarter uptick an aberration.

Making Progress on Inflation?

Wednesday’s Fed’s press release acknowledged “modest further progress toward the Committee’s 2% inflation in recent months” – a shift in language from “a lack of further progress” noted in the May meeting’s press release. Still, the Fed upped its forecast for core PCE inflation in the fourth quarter of 2024 to 2.8% year on year, from 2.6% during the March meeting. This largely accounts for why the central bank has shifted to calling for just one rate cut rather than three in 2024.

It’s unclear to what extent Wednesday’s CPI news was reflected in the latest Fed projections. Chair Jerome Powell mentioned that FOMC members can alter their forecasts post-release, but “most” generally don’t. The inflation projections imply a roughly 2.5% annualised core PCE inflation rate in the final six months of 2024, by our estimates. That marks no progress compared with the 2.5%-2.6% year-over-year core PCE inflation rate likely for May.

That’s too pessimistic, in our view. Instead, we see core PCE inflation at 1.7% annualised in the