IEEFA Energy Finance Specialist Michelle Kim explains why the country’s East Sea gas development will not strengthen its energy security.

South Korea’s Yoon Suk-yeol administration recently announced the exploratory drilling of potentially massive oil and gas reserves in the East Sea, estimated to hold up to 14 billion barrels of oil and gas. This project aims to address the country’s natural gas demand for 29 years and oil demand for four years.

The government will launch the project, which costs around ₩100 billion (US$73 million), by the end of the year, with initial results expected in the first half of 2025. However, as South Korea’s natural gas demand declines, large oil and gas developments in the East Sea could become stranded assets due to the country’s accelerating decarbonisation efforts.

In the long term, the transition to clean energy will better support national energy security and sustainability rather than an overreliance on fossil fuels.

Declining gas demand amid energy transition

By the time the East Sea gas field becomes commercially operational around 2035, South Korea’s natural gas demand will have significantly decreased due to the energy transition. The country’s natural gas demand is already declining, falling 4.9% in 2023 due to higher nuclear and renewable power generation and reduced city gas demand, impacted by high import costs.

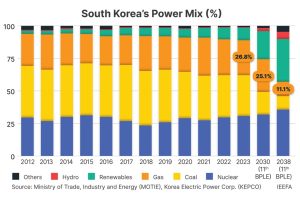

Given South Korea’s strengthened decarbonisation targets, this trend will persist in the coming years. The recent 11th Basic Plan for Long-Term Electricity Supply and Demand (BPLE) implementation guideline indicated that the share of liquefied natural gas (LNG) in the power mix will decline to 11.1% by 2038, a substantial drop from 26.8% in 2023.

South Korea’s Ministry of Trade, Industry and Energy also estimates that natural gas demand will decline to 37.66 million metric tons per annum (MTPA) by 2036, with an average annual decline of 1.38%, due to a shrinking population and slowing economic growth rates.

In addition, the global natural gas market is expected to face an oversupply from 2026 onwards, driven by massive expansions from the US and Qatar. The Institute for Energy Economics and Financial Analysis (IEEFA) estimates that the world’s total nameplate liquefaction capacity could reach 666.5 MTPA by 2028. This suggests that cheap natural gas supply will be available in the market, with existing contracts and purchases from the glutted spot market able to cover future gas needs.

Growing stranded asset risks

Investing taxpayers’ money