Why EU countries are nervous about funding a US loan to Ukraine

Financial Times

This article is an onsite version of our Europe Express newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday and Saturday morning. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning. A scoop to start: Gazprom will probably need more than a decade to recover gas sales lost to European markets as a result of Russia’s full-scale invasion of Ukraine, according to a confidential internal report seen by the FT.

Today, our finance correspondent previews the EU discussion over whether to back a US loan to Ukraine, and our climate correspondent asks whether yesterday’s tame farmers’ rally in Brussels marked the end of their successful protest season.

Listen to the last two episodes of Untold: Power for Sale, a podcast series from the Financial Times looking into Qatargate, an alleged corruption scandal that exposed major flaws in how European democracy works. Available on Apple Podcasts, Spotify or wherever you get your podcasts.

Moneyball

Should the EU agree to repay a US loan to Kyiv using future cash siphoned off from immobilised Russian sovereign assets? That’s the question being weighed up by the bloc’s finance ministers today, writes Paola Tamma.

Context: EU finance ministers meeting virtually today are weighing up a US proposal to advance cash to Ukraine with a loan leveraged against the forthcoming profits derived from Kremlin assets immobilised in the wake of its full-scale invasion of Ukraine in February 2022. Most of that cash pile is in the EU.

Any such scheme would need the backing of all EU countries. That’s already a tall order, but there’s more: Even if member states give their blessing to the scheme being discussed by G7 countries, a requirement to unanimously renew sanctions every six months would give any government in the bloc a chance to halt the scheme, with potentially ugly consequences for Ukraine and western credibility.

According to a leaked discussion paper for today’s meeting, Washington could issue the loan if the EU finds a way to get around this twice-yearly confirmation. This would also require unanimous approval.

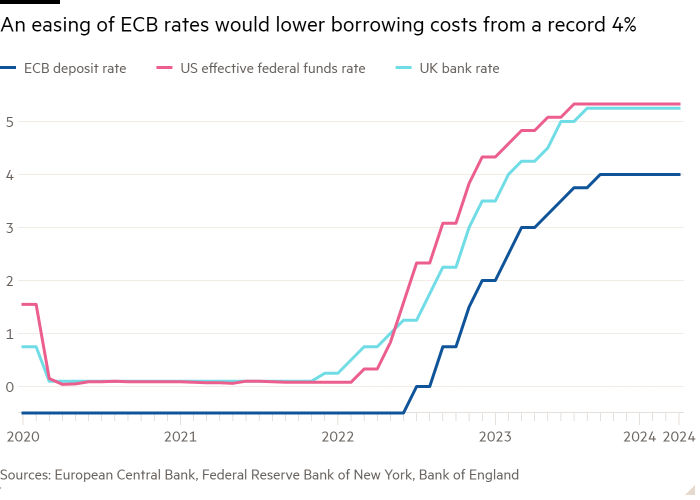

Aside from vetoes, there are other issues making some capitals this side of the pond nervous about backing the US scheme: crucially, who would be on the hook if the profits from Russian assets, which are meant to repay the loan, fall short of the total loan value. That’s not impossible given that once interest rates start coming down, the proceeds will slow.

The burden sharing

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!