Weight-loss ETFs demand some heavy thinking

Financial Times

Stay informed with free updates

Simply sign up to the Exchange traded funds myFT Digest — delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

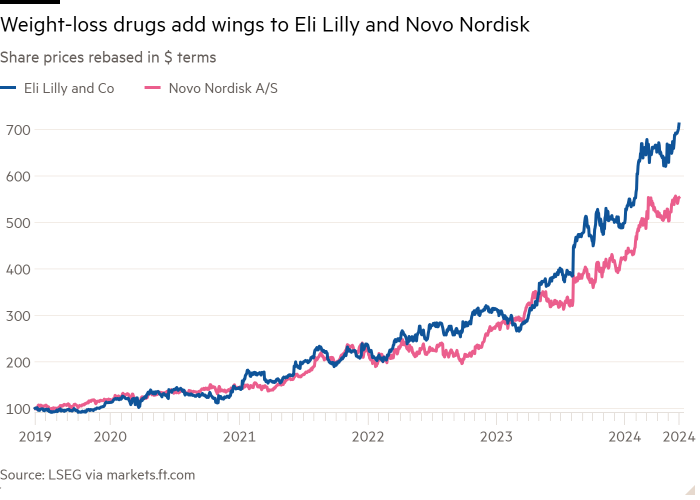

With more than 10 per cent of people globally now suffering from obesity it is no surprise that the share price of the providers of the latest weight-loss drugs has surged.

But investors seeking exposure through two newly launched weight-loss exchange traded funds need to ask if they are the best way to gain exposure to this generation of drugs, industry observers say.

The Roundhill GLP-1 Weight Loss ETF (OZEM) and the Amplify Weight Loss Drug and Treatment ETF (THNR) both launched on May 21 with the same expense ratio of 0.59 per cent. Both also carry an extremely heavy combined weighting — of about 40 per cent in the case of OZEM and 30 per cent in the case of THNR — to industry heavyweights Eli Lilly and Novo Nordisk.

The two pharmaceutical companies are currently the only companies licensed to supply GLP-1 agonist drugs for weight loss under the brand names: Zepbound, which is Eli Lilly’s version, and Wegovy, supplied by Novo Nordisk.

There is much to be excited about. The drugs have been found to promote a reduction in body weight of between 10 and 20 per cent. GLP-1, or semaglutide, drugs have been used to treat patients for nearly two decades, since the first iteration was licensed to treat diabetes, but their use cases are expanding. The results of a long-running trial of Wegovy and Ozempic, Novo’s diabetes drug, has shown they can also reduce the risk of heart attacks and strokes and there are anecdotal reports of success in curbing craving for things such as alcohol.

Sales growth as a result of these drugs’ success is eye-popping. For example, Novo Nordisk reported Q1 sales growth of about 30 per cent compared to the same period in 2023 for diabetes GLP-1 drugs and about 40 per cent for obesity care drugs.

But there are some caveat emptors, as industry observers point out. The first concerns the long-term prospects for the drugs themselves.

“‘Solving obesity’ has been one of the modern holy grails of pharma, with many false dawns,” said Kenneth Lamont, senior research analyst with Morningstar.

A recent research paper from VettaFi, provider of the VettaFi Weight Loss Drug & Treatment Index that THNR

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!