Uncle Sam wants you . . . to buy green bonds?

Financial Times

This article is an onsite version of our Moral Money newsletter. Premium subscribers can sign up here to get the newsletter delivered three times a week. Standard subscribers can upgrade to Premium here, or explore all FT newsletters.

Visit our Moral Money hub for all the latest ESG news, opinion and analysis from around the FT

Hello from New York. About $2.6tn of green bonds have been issued by countries and companies all over the world. But the world’s biggest bond issuer — the US government — has been noticeably absent from the green bond party. Is that about to change?

Also today, with renewable power purchase agreements surging, Simon looks at the increasingly urgent debate over how companies should account for them in their books.

Thanks for reading. — Patrick Temple-West

What does diversity and inclusion really mean in a modern workforce — and what is the right approach for companies to take towards these issues? That’s the focus of our next deep-dive Moral Money Forum report, featuring valuable insights from readers. Have your say by completing this short survey.

Sustainable finance Major banks recommend US Treasury issues green bonds

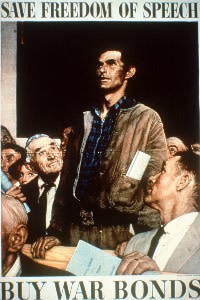

In 1942, Bugs Bunny danced and sang on movie screens to encourage Americans to buy US Treasury war bonds. (The clip of the jingle is here. I won’t judge you for watching it at work, if you don’t judge me for how I procrastinate.)

Irving Berlin wrote Bugs’s song at the request of Treasury secretary Henry Morgenthau Jr as part of a celebrity-soaked propaganda campaign to fund the war. Incredibly, 85mn people — more than half the US population — had bought war bonds by the time the second world war ended.

War bonds were revisited after the 9/11 terrorist attacks when the US issued special “patriot bonds” to fund the war on terror. Clearly, the US has a history of issuing special-purpose debt — typically for war.

Now, Deutsche Bank, Citigroup and other global financial companies have recommended that the Treasury department consider issuing its first ever green bonds. In a report last week, a Treasury borrowing advisory committee comprised of financial companies noted that the US was the only major developed country that had not issued green bonds. The UK, for example, had issued $65bn.

More than half the US population bought war bonds during the second world war © AP

By issuing green bonds, the Treasury could tap into a pool of investors, such as

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!