St James’s Place under scrutiny: what do its customers say?

Financial Times

Last year, Matthew decided to put half his pension into an annuity provided by the wealth manager St James’s Place. But, after the transaction went through, it looked like a chunk of money had just disappeared.

“When I had all the figures, they simply did not add up,” he says. “There was about £4,500 missing.”

Several months later, Matthew, 70, from Oxfordshire, who — like all of the SJP clients in this piece — asked the FT not to use his real name, discovered the lost money was an income tax charge, which neither he, nor his financial adviser, had been expecting. “That is when I threw my toys out of the pram,” he says.

Although he had been happy with the service SJP had previously provided, he said the fact that he and his adviser were surprised by the extra charge was not acceptable.

“I paid SJP quite a lot of money, directly and indirectly, and what I expect for that is really competent advice.”

He was also disappointed with the firm’s reaction which, instead of a giving him a refund, was to send him an unwanted hamper from Fortnum & Mason.

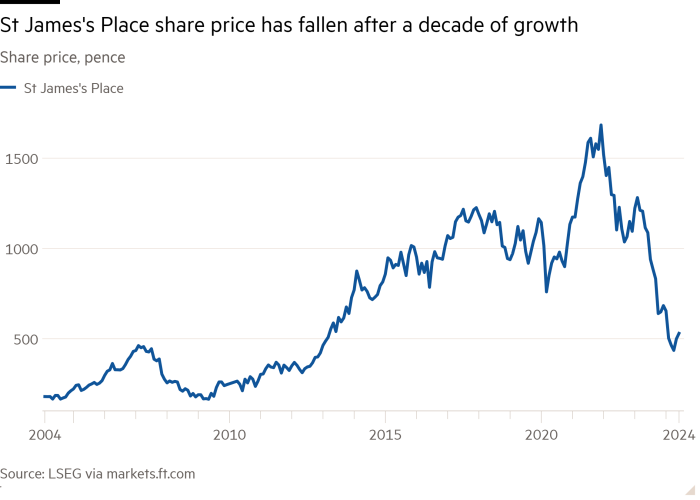

Before he withdrew his money recently, Matthew was among the nearly one million people whose savings and investments are managed by St James’s Place, the UK’s largest wealth manager. The company, founded in 1991, prospered through the 1990s and 2000s, gaining clients and assets and eventually joined the FTSE 100.

But in the past year the wealth management sector has started to undergo a big shift. New regulations introduced last summer, called the Consumer Duty, shone a light on so-called “client outcomes”, forcing firms to act in good faith towards customers, avoid causing foreseeable harm, and enable customers to pursue their financial objectives.

The impact of this has already been seen as the regulator has begun to “flex its muscles”, says Ben Bathurst, an analyst at RBS Capital Markets.

These regulations have had a major impact on SJP, which was warned by the Financial Conduct Authority last year that the adjustments it made ahead of the Consumer Duty being introduced — a fee cut for around 65,000 clients — did not go far enough. The company then announced an overhaul of its entire fee structure, including the removal of much-maligned exit charges for some products.

SJP was subsequently forced to set aside £426mn for potential client refunds over claims that some customers did not

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!