‘Spaghetti cannon’ filings for 25 hot-trend ETFs prompt concerns

Financial Times

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

A US exchange traded fund issuer may have hit “peak 2024” with plans to launch 25 ETFs that would combine two of the hottest current trends — leveraged exposure and option-selling covered calls.

New York-based GraniteShares has filed to launch a family of “YieldBoost” ETFs, many of them based on single stocks, that would sell put options on leveraged ETFs — again many single stock — issued by rival providers.

The ETFs would potentially benefit from significant option-writing premium income, but would combine a capped capital return with an uncapped downside risk from the underlying leveraged exposure.

“I was shocked by the filing,” said Bryan Armour, director of passive strategies research, North America, likening it to a “spaghetti cannon”.

“Product development has gone down the path of throwing as much spaghetti at the wall as possible, then seeing what sticks,” Armour added.

“Wow, this is peak 2024,” added Elisabeth Kashner, director of global fund analytics at FactSet.

GraniteShares’ proposed ETFs would invest in a range of single assets, from individual stocks, such as each of the Magnificent Seven, to bitcoin, gold, volatility and a selection of stocks indices and sectors.

They would then sell put options on ETFs leveraged between 1.5 and 3 times issued by providers such as Direxion and ProShares. The collateral would be primarily invested in fixed income instruments.

The maximum gain would be the premium income earned from selling the options, plus “a limited amount of upside appreciation” up to the option’s strike price — assuming the underlying ETF rises in price to this level.

However, investors would be fully exposed to any loss suffered by the underlying ETF — which could easily be chunky given its leveraged nature — only cushioned by the premium income, which is banked whatever happens.

As such, the proposed YieldBoost ETFs tap into two of the hottest trends in the US ETF market.

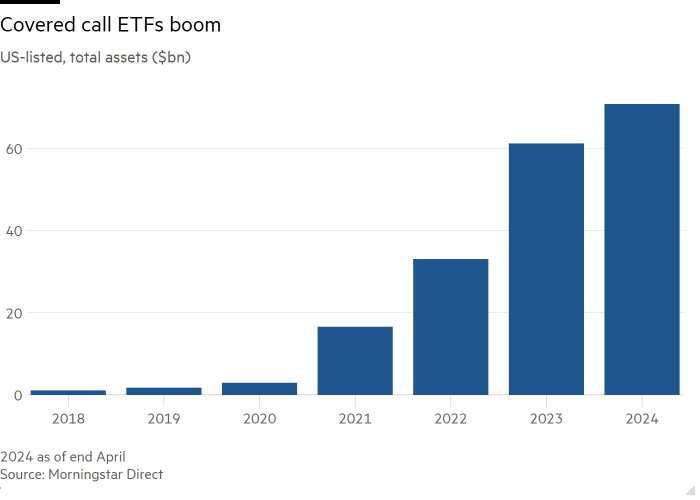

Option-selling covered call ETFs have boomed in recent years, as epitomised by JPMorgan’s wildly popular Equity Premium Income ETF (JEPI), which has surged to $33.6bn in assets, rendering it the world’s most popular active ETF.

US-listed ETFs classified as “derivative income” by Morningstar Direct, which includes most covered call vehicles, hit a record $70.7bn in assets at the end of April, up from just $3bn at the end of 2020.

Leveraged and inverse ETFs have also attracted more attention, even

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!