Labour could borrow more without UK bond market backlash, say investors

Financial Times

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A new Labour government could raise extra money for investment from bond markets without causing a Liz Truss-style gilts crisis, according to fund managers.

Shadow chancellor Rachel Reeves has promised to retain the Conservative government’s commitment that debt as a proportion of GDP must be on track to fall in five years if Labour wins the July 4 election.

She has also ditched an earlier pledge to spend £28bn a year on green investment as she seeks to emphasise Labour’s commitment to fiscal responsibility.

But bond investors said the market could be forgiving if a new government decided to boost borrowing and amend its debt rules, provided funds were channelled towards measures to stimulate the economy.

“If Labour borrows to invest, markets will not worry about it,” said Tom Roderick, portfolio manager at hedge fund firm Trium Capital. “What markets are more worried about is borrowing to cut taxes, or increase social security payments, which doesn’t sound that likely.”

The Labour party has been at pains to reassure markets it will avoid a repeat of former prime minister Liz Truss’s 2022 “mini” Budget, when a package of £45bn of unfunded tax cuts triggered a run on the pound and a spike in UK government borrowing costs.

In an interview with the Financial Times, Reeves emphasised that Labour would focus on growing the economy as “the only way out of this mess”, referring to tax take and borrowing at multi-decade highs.

“Borrowing more is not an alternative because debt as a share of GDP is the highest it’s been since the 1960s,” said Reeves, adding that taxing more was also “not an alternative because tax is already at a 70-year high”.

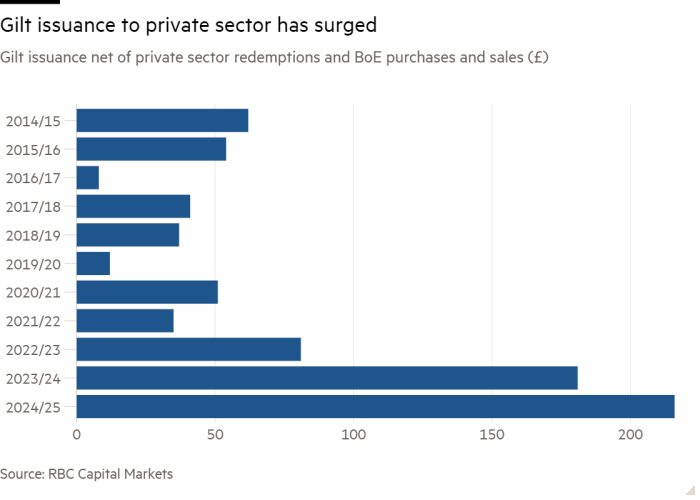

Investors broadly expect Reeves to stick to the current plans for net gilt issuance of £216bn in the current financial year, the highest on record adjusting for Bank of England sales and purchases.

With Labour enjoying a commanding lead in opinion polls, her fiscal cautiousness has helped the gilt market to remain relatively calm leading up to the election, in contrast to turmoil in French debt sparked by the prospect of a far-right government.

Sterling has been the only major developed market currency to hold its value against a rising dollar this year.

However, investors say there is scope for modest increases in borrowing in 2025.

“If the UK were to borrow

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!