Investor enthusiasm drops in signature Trump economic programme

Financial Times

Money is drying up for one of the signature US economic development programmes of the Trump administration, as investors balk at inflation, higher interest rates and the looming expiry of a lucrative tax benefit.

Then-president Donald Trump signed so-called Opportunity Zones into law in 2017 as part of broad tax legislation. The zones, which had bipartisan support, were designed to attract private investors to economically distressed areas by allowing them to defer taxes on capital gains.

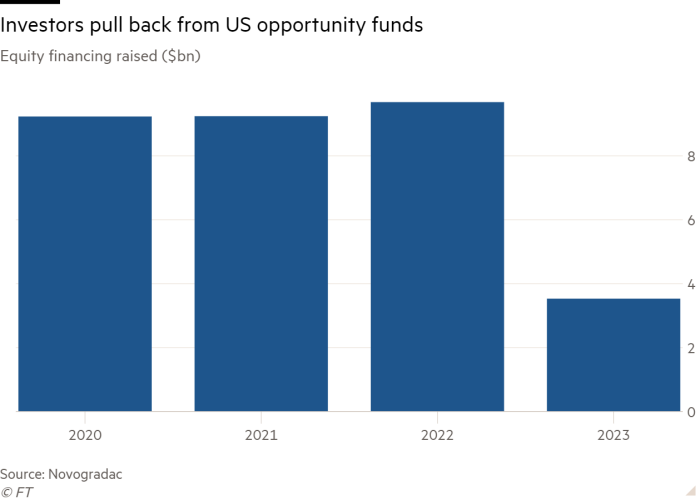

Investors are now hesitating. Opportunity Zone funds received $229mn in equity investment inflows in the first quarter, down by two-thirds from $682mn the same quarter a year before, according to Novogradac, an accounting firm that tracks the industry. The funds raised $3.5bn in the full year 2023, compared with $9.7bn in 2022.

There are “an awful lot of projects under water right now”, said Robert Hutchins, founder of the New Jersey-based OZ fund Ellavoz Impact Capital. He said he was getting “no less than” 10 calls or emails a week from cash-strapped peers that were “stuck and need more money”, compared with almost zero a year ago.

More than 1,400 opportunity funds have attracted at least $38bn in equity investment, according to Novogradac. They invest in projects ranging from multi-family housing to shopping centres to hotels, and have built up to 700,000 homes since the programme began in 2018.

The programme came under scrutiny early in its life for investing in luxury condominiums and giving tax benefits to the rich without adequately helping low-income communities. Charitable foundations were among the first to back out.

“I don’t think it is a good public policy to craft our tax code around delivering personalised and niche investment vehicles for ultra-high net worth individuals,” said Aaron Seybert, managing director of the Social Investment Practice at the Kresge Foundation, which stopped making new commitments to the programme after providing a $15mn financial guarantee for an OZ fund in 2019.

Stubborn inflation and higher interest rates are to blame for the recent slowdown in funding, industry insiders said, because they burdened opportunity funds with a surge in construction and capital costs.

Robert Silverman, managing partner at LJJ Fund, a New York-based opportunity fund, said the low interest rate environment during the first few years of the programme “fuelled an enormous amount of people entering this space”, as they had access to the cheapest construction loans they had “ever been able to take

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!