Invesco bucks trend with launch of first European ChiNext 50 ETF

Financial Times

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Invesco is launching the first European exchange traded fund tracking China’s tech-heavy ChiNext 50 index, in a rare western vote of confidence in the world’s second-largest economy.

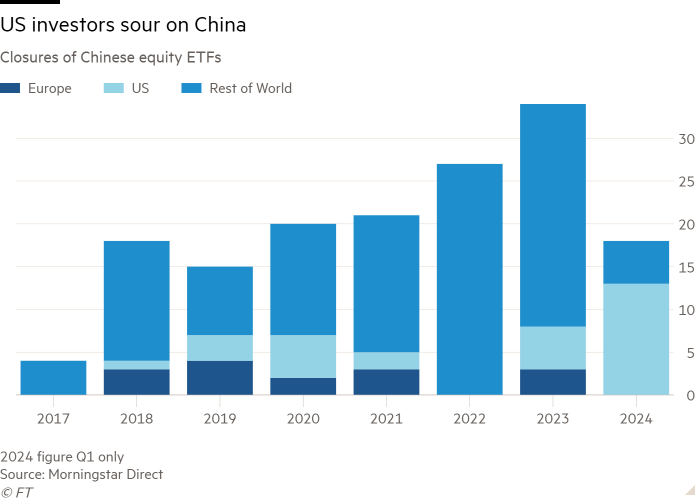

The listing comes as closures of China-focused ETFs have risen to a record level, with investors and fund houses recoiling from years of poor stock market performance and rising geopolitical frictions that have led some to question the ethics of investing in the increasingly authoritarian state.

Fund managers globally scrapped 18 China ETFs in the first quarter of 2024, more than half of last year’s record total of 34 closures, according to data from Morningstar Direct, with Global X, Xtrackers and KraneShares among those wielding the axe.

The rate of launches has also slowed sharply, with just 33 China ETFs unveiled in Q1 — all but three of them domiciled in either China or Taiwan. This compares with 160 launches during calendar year 2023 and a record 291 during the peak of Sino mania in 2021.

Poor performance has been a key driver of souring sentiment, with China’s blue-chip CSI 300 index still 39 per cent below its peak of February 2021 — despite robust intervention by Beijing’s “national team” of state-backed institutions, which ploughed Rmb410bn ($56bn) into domestic equity ETFs in the first two months of 2024 alone, according to calculations by UBS.

Chris Mellor, head of Emea equity ETF product management at Invesco, disputed any notion that this meant Chinese stock prices were being propped up at artificially high levels, arguing instead that they were now cheap.

“Multiples are only marginally above the lowest that we saw in 2019, at 20 times forward earnings,” Mellor said. “They had traded as high as 40-50 times in 2020/21. China looks cheap, rather than expensive, in terms of other markets.”

The Invesco ChiNext 50 Ucits ETF (CN50) will invest in 50 of the largest and most liquid securities among the 1,300 listed on the ChiNext market of China’s mainland Shenzhen stock exchange.

This gives it an innate sector skew: at launch about 90 per cent of its weight will be in technology, industrials, healthcare and financial stocks, Mellor said, with no exposure to real estate, energy, utilities or consumer stocks.

The largest holdings at launch will be Contemporary Amperex Technology Co (CATL), the world’s largest maker of electric vehicle batteries, followed by Shenzhen Mindray

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!