How thousands of Americans got caught in fintech’s false promise and lost access to bank accounts

CNBC

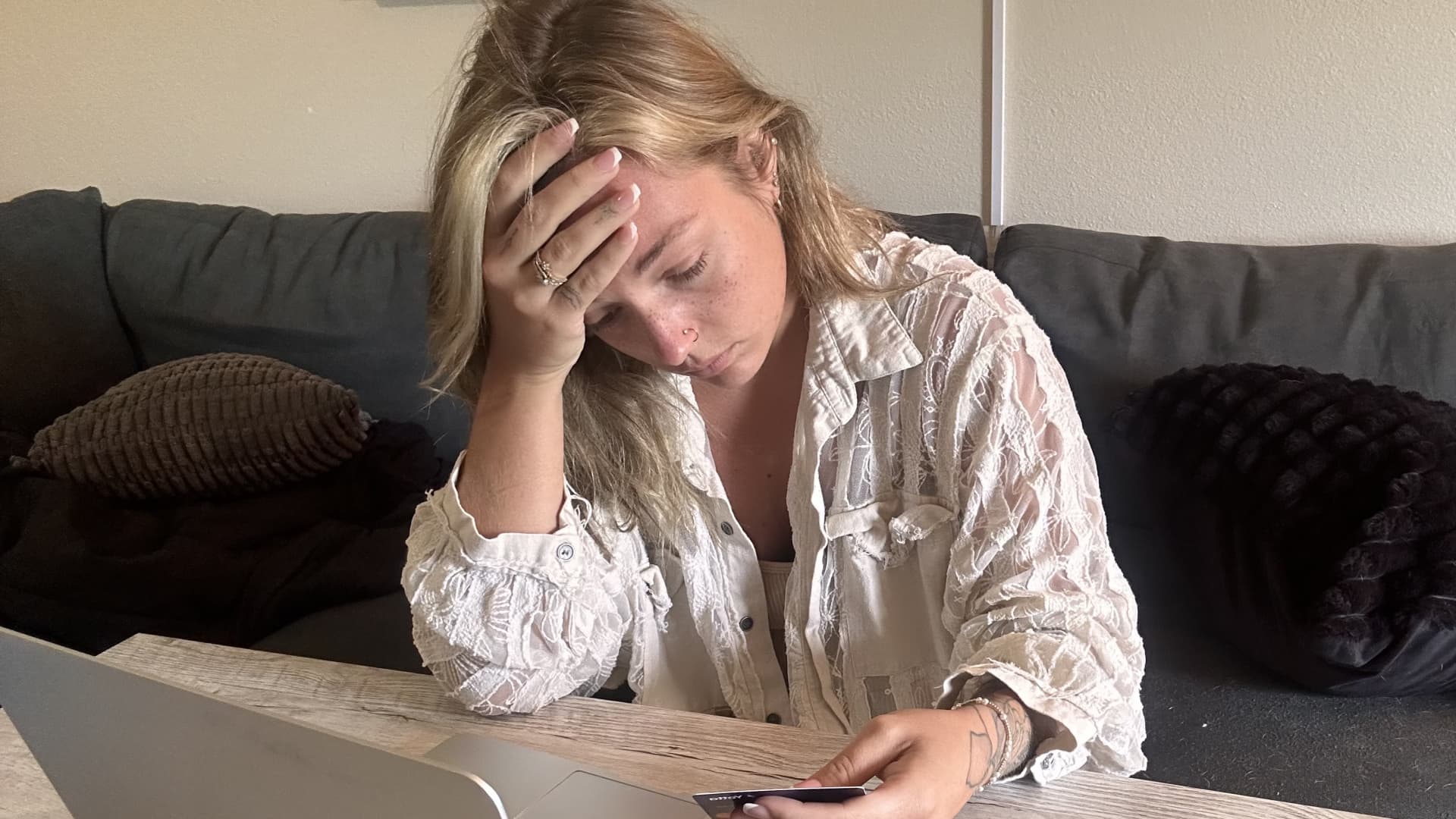

For customers, fintech promised the best of both worlds: The innovation, ease of use and fun of the newest apps combined with the safety of government-backed accounts held at real banks. The collapse of middleman Synapse has revealed fintech’s promise of safety as a mirage. More than 100,000 Americans with $265 million in deposits have been locked out of their accounts. The implications of this disaster may be far-reaching. The most popular banking apps in the country, including Block’s Cash App, PayPal and Chime partner with banks instead of owning them. CNBC reached out to fintech customers whose lives have been upended by the Synapse debacle. They all believed their money was protected by an FDIC safety net. Natasha Craft, a 25-year-old FedEx driver from Mishawaka, Indiana. She has been locked out of her Yotta banking account since May 11. Courtesy: Natasha Craft

When Natasha Craft first got a Yotta banking account in 2021, she loved using it so much she told her friends to sign up.

The app made saving money fun and easy, and Craft, a now 25-year-old FedEx driver from Mishawaka, Indiana, was busy getting her financial life in order and planning a wedding. Craft had her wages deposited directly into a Yotta account and used the startup’s debit card to pay for all her expenses.

The app — which gamifies personal finance with weekly sweepstakes and other flashy features — even occasionally covered some of her transactions.

“There were times I would go buy something and get that purchase for free,” Craft told CNBC.

Today, her entire life savings — $7,006 — is locked up in a complicated dispute playing out in bankruptcy court, online forums like Reddit and regulatory channels. And Yotta, an array of other startups and their banks have been caught in a moment of reckoning for the fintech industry.

For customers, fintech promised the best of both worlds: The innovation, ease of use and fun of the newest apps combined with the safety of government-backed accounts held at real banks.

The startups prominently displayed protections afforded by the Federal Deposit Insurance Corporation, lending credibility to their novel offerings. After all, since its 1934 inception, no depositor “has ever lost a penny of FDIC-insured deposits,” according to the agency’s website.

But the widening fallout over the collapse of a

CNBC

The full article is available here. This article was published at CNBC Finance.

Comments are closed for this article!