Gold rally leaves wealth managers wondering if price is still right

Financial Times

Chinese leader Xi Jinping and Russian president Vladimir Putin vowed last week to work together against what they called the “destructive and hostile” US. And few commodities have been as affected by their policies as gold.

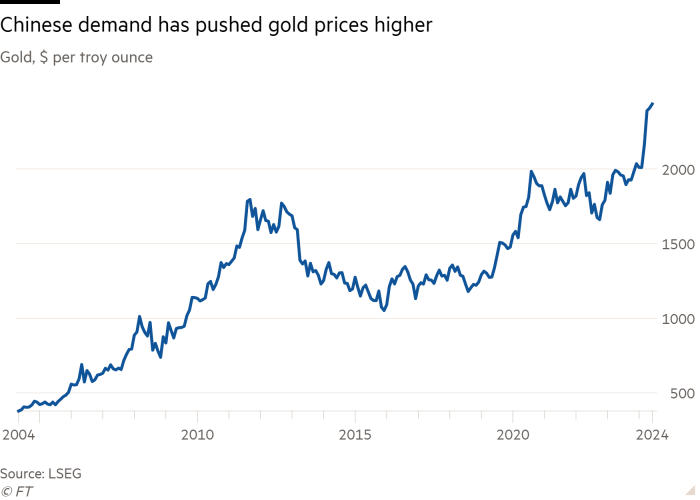

Just days later, on Monday this week, the precious metal’s price soared to a record high of $2,450 per troy ounce — taking its gains to 25 per cent since October 5, just before conflict erupted in the Middle East. It is a rally that has been underpinned by the fracturing of the global monetary system, as nations like Russia and China seek to loosen their dependence on the US dollar.

With the safe haven asset trading at this all-time high, however, Chris Forgan, multi-asset portfolio manager at Fidelity, says: “the million dollar question, as an investor, is: is it still warranted?”

One of the puzzling elements when assessing gold’s recent rally is its disconnect from two usually closely-linked variables: the US dollar and the inflation-adjusted yields on US Treasuries.

“The jaws have opened up” between them, says Forgan, who has reduced the allocation to gold in his portfolio from 6 to 3 per cent, to take profits from the recent price surge.

A big factor behind this disconnect is that central banks have been boosting the bullion holdings in their reserves at an unprecedented rate since the start of 2022, to increase their resilience against western sanctions that could weaponise the primacy of the US dollar in global trade.

$600bnRussian US dollar reserves frozen by Washington after Russia invaded Ukraine

Official institutions led by China made their largest ever early-year gold purchases — buying 290 tonnes of the metal in the first three months, according to the World Gold Council, an industry group. The west’s move to freeze about half of Russia’s $600bn reserves, which are denominated in US dollars and euros, in the wake of Putin’s invasion of Ukraine was the main catalyst for the buying spree.

Added to that has been a pivot to buying gold by Chinese consumers, as the real estate market and local equity markets disappoint, and concerns persist over stubborn inflation and high levels of global debt. All of this has pushed the precious metal’s price higher.

Even as expectations of US interest rate cuts were wound back in recent months, gold continued to roar higher.

John Reade, chief market strategist at the WGC, says this indicates that the reasons people are buying

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!