GameStop soars in meme stock flashback as ‘Roaring Kitty’ reappears

Financial Times

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

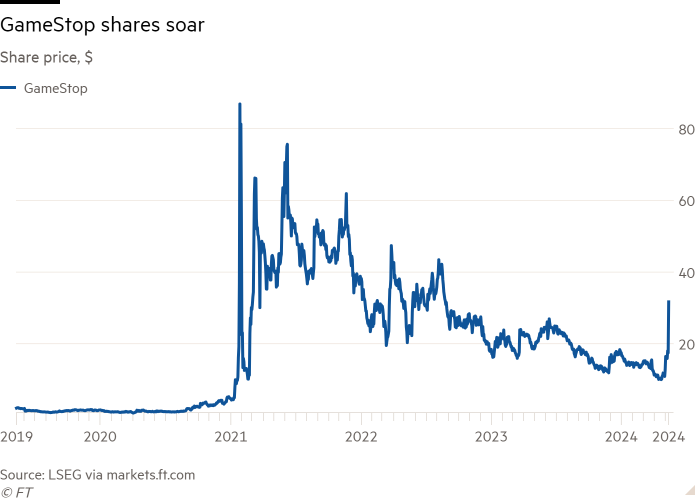

Shares of video game retailer GameStop almost doubled in value on Monday after a single post by a social media account named “Roaring Kitty”, in a frenzy that recalled the “meme stock” craze at the start of the decade.

Roaring Kitty is the account on social media platform X of Keith Gill, a day trader whose videos during the meme-stock bubble encouraged millions of others into the market, in turn propelling stocks such as GameStop to dizzying heights.

Gill’s account, inactive since June 2021, came back to life on Sunday when it posted a posted a meme of a man leaning forwards in his chair, an image that GameStop had posted on its own X account in February. The post had been viewed more than 14mn times by midday in New York.

GameStop’s shares, which had already climbed by more than 60 per cent between May 1 and Friday, soared by as much as 118 per cent in early trading on Monday. After being halted by rules designed to stop excess volatility in single stocks, the gains had eased to about 70 per cent at midday.

Monday’s jump suggests “there’s still a cult of equity” for some retail investors, said Kevin Gordon, a senior investment strategist at Charles Schwab.

GameStop became an emblem of the meme-stock turmoil when its price rose by as much as 2,400 per cent in 2021.

Gill, who is also known on Reddit as DeepFuckingValue, had in 2020 drawn attention to the sizeable bets against the company, correctly predicting that a price increase could force short sellers to buy the stock to cover their large short positions.

One of the highest-profile victims of the short squeeze was New York hedge fund Melvin Capital, which lost 53 per cent of fund’s value that January. Gill’s former employer, the insurer MassMutual, was later fined $4mn for failing to oversee his social media use.

Investors in so-called meme stocks also targeted other businesses whose shares were heavily shorted in 2021, including AMC Entertainment and BlackBerry. Both of those companies climbed on Monday, with AMC Entertainment shares up 44 per cent by midday and BlackBerry up 7 per cent.

“But it’s not a clear frenzy across the board,” Gordon said, noting that prices for cryptocurrencies and other so-called speculative assets remained subdued on the day.

Data from S&P Global

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!