Emerging market junk bonds are top performers in sovereign debt markets

Financial Times

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Bonds issued by some of the world’s poorest countries have been the best performers in sovereign debt markets this year, shrugging off the impact of high US borrowing costs, which often spook investors in riskier economies.

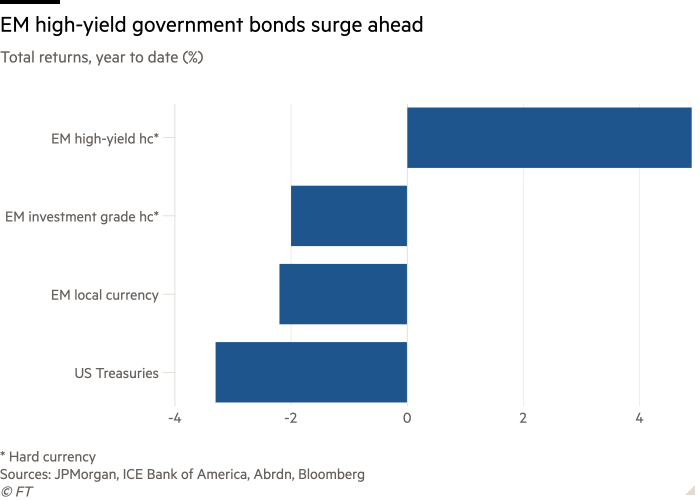

Emerging market sovereign bonds denominated in foreign currencies — mainly the dollar — and holding a triple B “junk” rating or lower have delivered a 4.9 per cent total return for investors this year. That compares with a loss of 3.3 per cent for an index of US Treasury bonds.

The gains have come as the resilience of the global economy surprised investors, while higher commodity prices have benefited countries such as oil exporters Nigeria and Angola and copper producer Zambia. Meanwhile, support from lenders such as the IMF has helped those in debt distress or default such as Sri Lanka and Zambia.

“Emerging markets have done much better than anyone would have expected,” said David Hauner, head of global emerging markets fixed income strategy at Bank of America.

“Clearly the credit component of EM sovereign bonds has held up well because the fundamentals have been improving,” he added, referring to the premium investors demand to hold riskier debt rather than US Treasuries.

Higher bond yields in the US and Europe usually spell trouble for developing countries because capital is lured back to the improved returns on offer in home markets, and because the cost of refinancing dollar or euro-denominated debt increases.

This year investors have pulled close to $12bn from emerging market debt funds as they chase returns elsewhere, for instance in US high-yield debt funds, which have had net inflows of $2bn, according to JPMorgan analysts.

However, some investors believe these outflows are set to reverse, particularly if the outlook for US corporates worsens.

“As capital flows back into EM this should be supportive for the asset class. In contrast, the tide that has lifted the US high-yield market is on the wane,” said Grant Webster, co-head of emerging market and sovereign FX at asset manager Ninety One.

Resilience across emerging economies has come alongside progress on domestic reforms and restructuring talks in a number of countries.

Argentina’s bonds have been among the top performers, gaining 39 per cent year to date, as investors have welcomed a radical austerity package and deregulation by President Javier Milei.

Meanwhile, dollar bonds in Sri Lanka, Ghana

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!