Bank of England bond sales blamed for cash shortage

Financial Times

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The Bank of England’s vast sale of government bonds is causing a shortage of cash in corners of the money markets and may need to end, investors have warned.

Over the past two years, the BoE has shrunk its balance sheet from nearly £1tn to about £760bn largely by reducing its holdings of government debt it bought under numerous rounds of quantitative easing stimulus.

Unlike other central banks, the BoE is not just waiting for bonds to mature but actively selling them.

Under QE, the BoE created money to buy government bonds. As it reverses course, it allows bonds to mature without replacing them while selling others back to investors and the money it receives is destroyed, in a process known as quantitative tightening that is draining the liquidity that has flooded markets in recent years.

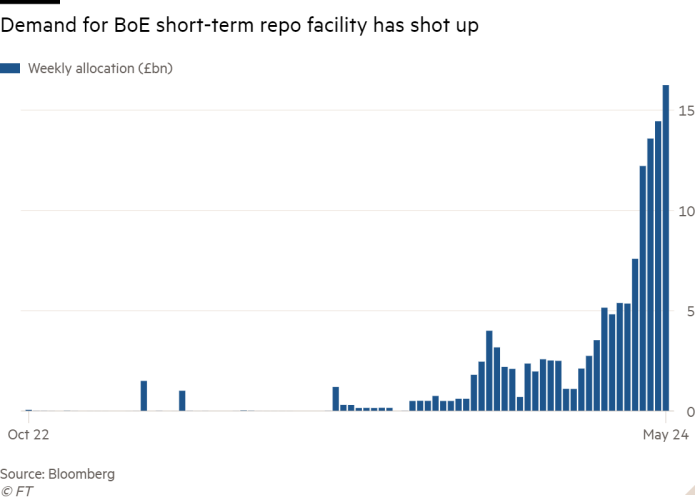

As a result, surges have occurred in short-term lending markets and investors are rushing in to tap a special BoE facility that allows them to borrow cash in exchange for collateral of government bonds.

Investors last week borrowed £16bn from this BoE short-term repo facility, which was set up in 2022 to help borrowers — predominantly banks — access short-term cash. This was a sharp increase from less than £5bn early last month.

The scarcity of cash, which also led to a recent jump in repo rates, could cause the BoE to slow down the process of shrinking its balance sheet when it reviews its policy in September, according to analysts at Barclays, Bank of America and NatWest.

“When you peer beneath the bonnet, there are lots of little things which point to something a bit more profound . . . all of which are pointing to frictions starting to show up in the market,” said Barclays strategist Moyeen Islam. “It was not supposed to happen” so soon in the process of winding down the BoE’s gilt portfolio, he added.

BoE governor Andrew Bailey said last week that the take-up of the repo facility was “encouraging” and that he expects a “significant increase” in its usage. His estimate for the “steady state” of the balance sheet is between £345bn and £490bn.

However, analysts think the actual steady size of the central bank balance sheet that allows smooth functioning of money markets could be considerably larger. A rise in money market lending rates could potentially blunt the

The full article is available here. This article was published at FT Markets.

Comments are closed for this article!