What sort of economy will the next French government inherit?

FocusEconomics

Next French parliament likely to be skewed toward the political extremes

On 30 June, French citizens voted in the first round of parliamentary elections, with the right-wing National Rally (RN) party and a coalition of multiple left-wing parties both obtaining a higher national vote share than President Macron’s centrist political movement, which had been by far the largest party in the outgoing parliament. A second round is set for 7 July. Tactical voting will likely feature heavily: As such, governments led by the RN, the left-wing coalition or Macron’s own party—with or without absolute seat majorities—are all possibilities.

Muted current economic conditions

The next administration will be faced with a challenging in-tray. The European Commission recently opened an excessive deficit procedure against France; the country’s budget deficit is forecast to be close to 5% of GDP this year, above the 3% limit set by Brussels. This came just after S&P Global Ratings’ decision to cut France’s credit rating in late May due to the large budget shortfall and a public debt that is the third-highest in the Eurozone as a share of GDP. Overall economic growth is minimal, and barely positive in per-capita terms.

France’s economic forecasts are weak

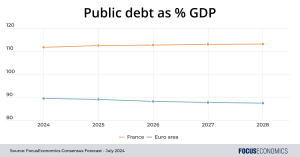

Our panelists’ base case is for the French economy to muddle through in the coming years, with GDP growth seen below the Euro area average out to 2028 despite relatively strong demographics, and the fiscal deficit and public debt elevated at over 3% and 110% of GDP respectively.

Both RN or left-wing administrations—if they emerge—could push these deficit and debt numbers higher; both have talked about boosting spending, and the RN has also floated tax cuts. But even if they have the numbers in Parliament to pass such plans, pressure from the European Commission to comply with the EU’s deficit ceiling could give political leaders pause for thought. Failing that, financial markets will impose their own limits on the government’s ability to loosen its fiscal stance, such as occurred with Liz Truss—namely, by dumping government bonds, in turn leading to surging bond yields and debt ratings downgrades. In sum: France’s current economic projections are not exactly rosy, and could get considerably worse depending on the results of the elections.

Insight from our analyst network

On the political outcome, EIU analysts said:

“We believe that the most likely outcome […] is another hung parliament with a

The full article is available here. This article was published at FocusEconomics.

Comments are closed for this article!