Has the Euro area escaped its low-inflation trap for good?

FocusEconomics

For much of the 2010s, inflation in Euro area countries undershot the European Central Bank’s 2.0% target, due to a combination of domestic factors—chiefly weak demand—and external factors, such as peak globalization and depressed oil prices from 2015 onwards. That all changed after the end of the Covid-19 pandemic, with global supply chains snarling up as demand recovered rapidly; inflation has now overshot the ECB’s target for over two years. But what does the future hold for inflation in Euro area countries?

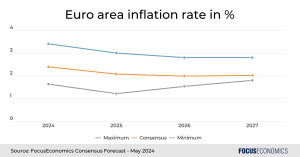

Inflation in Euro area countries expected to meet target

Our Consensus is for inflation in Euro area countries to finally converge to the 2.0% target by the middle of next year, and to then remain roughly steady on average over the medium to long term. This would be a notable increase from the 1.4% average in the 2010s. There is a large discrepancy among our panelists though: Average inflation forecasts for 2025 range from 1.2% to 3.0%, while those for 2026 range from 1.5% to 2.8% for instance.

Multiple factors will drive price pressures

The EU’s push away from Russian gas and toward clean energy will raise costs for industry and consumers, as will rising global protectionism and a general desire among countries to boost supply chain security over out-and-out efficiency. Plus, the EU labor market is forecast to remain tight in coming years amid population aging, with our panelists forecasting wage growth around 50% higher than during the 2010s as a result; this will prop up inflation in Euro area countries in turn.

Upside risks to inflation abound

Escalating tensions between the EU and China are a key upside risk to inflation. The bloc could impose tariffs on Chinese electric vehicle imports later this year, and has recently launched investigations into several other aspects of China-EU trade relations. Then there is a potential Donald Trump win in the U.S. presidential elections this November: He has threatened to impose tariffs on all imports, which could lead Europe to retaliate by raising its own trade barriers in turn. And conflicts in the Middle East and Ukraine could intensify, disrupting global shipping as well as oil and agricultural output. So while inflation in Euro area countries is set to return to target, don’t bank on it staying

The full article is available here. This article was published at FocusEconomics.

Comments are closed for this article!