Fresh gold price forecasts following May’s record highs

FocusEconomics

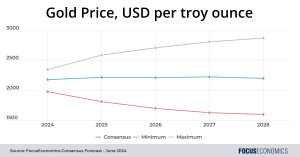

Our gold prices forecast points to a bull run

Gold prices hit a record of over USD 2,400 per troy ounce in mid-May. The commodity is up by around 20% over the last year and is up by close to 50% since late 2022, and is now nearly double the level that prevailed for much of the 2010s. Two key factors are at play behind this bull run. The first is smoldering geopolitical tensions amid U.S.-China frictions and wars in the Middle East and Europe, which have stoked safe-haven demand. The second—and perhaps most important—is central bank purchases. Monetary authorities snapped up more than 1,000 tons of the metal in 2022 and 2023, around double the average of the prior decade, and gobbled up a record amount in Q1 2024 as they looked to diversify their reserves and hedge against potential currency depreciation. These drivers outweighed a strong U.S. dollar and high interest rates, which generally tend to weigh on gold prices.

Price projections are bright

Our panelists have become increasingly optimistic on the outlook so far this year: Our average gold prices forecast for 2024–2028 is about 10% higher now than back in January. The metal in the coming years will remain—for the first time in history—comfortably above USD 2,000 per troy ounce, according to our gold price forecast. The drivers of this bright projection are manifold. Firstly, gold jewelry consumption is set to rise globally as emerging market consumers become ever-wealthier. Moreover, geopolitical risk will likely remain, spurring safe-haven demand. Furthermore, the growth of high-tech manufacturing will also require more gold; the metal is used in most automobiles and consumer electronics. Finally, production of the metal is seen as fairly stagnant ahead, as declining grades and the depletion of mine reserves offset the impact of new mines and expansions.

The outlook for silver prices, gold’s sister metal, is also upbeat

Gold and silver prices tend to move in close correlation, given that both are used in jewelry and as investment and safe-haven assets. As with gold prices, silver prices peaked in mid-May at an over-decade high, and are seen at historically elevated levels of over USD 25 per troy ounce over our forecast horizon to 2028. But silver has one crucial difference to gold: It is more widely used in industry, particularly in high-growth sectors such as solar panels and electric cars, which

The full article is available here. This article was published at FocusEconomics.

Comments are closed for this article!