Fed meeting and inflation report both hit Wednesday, and the impact could be huge

CNBC

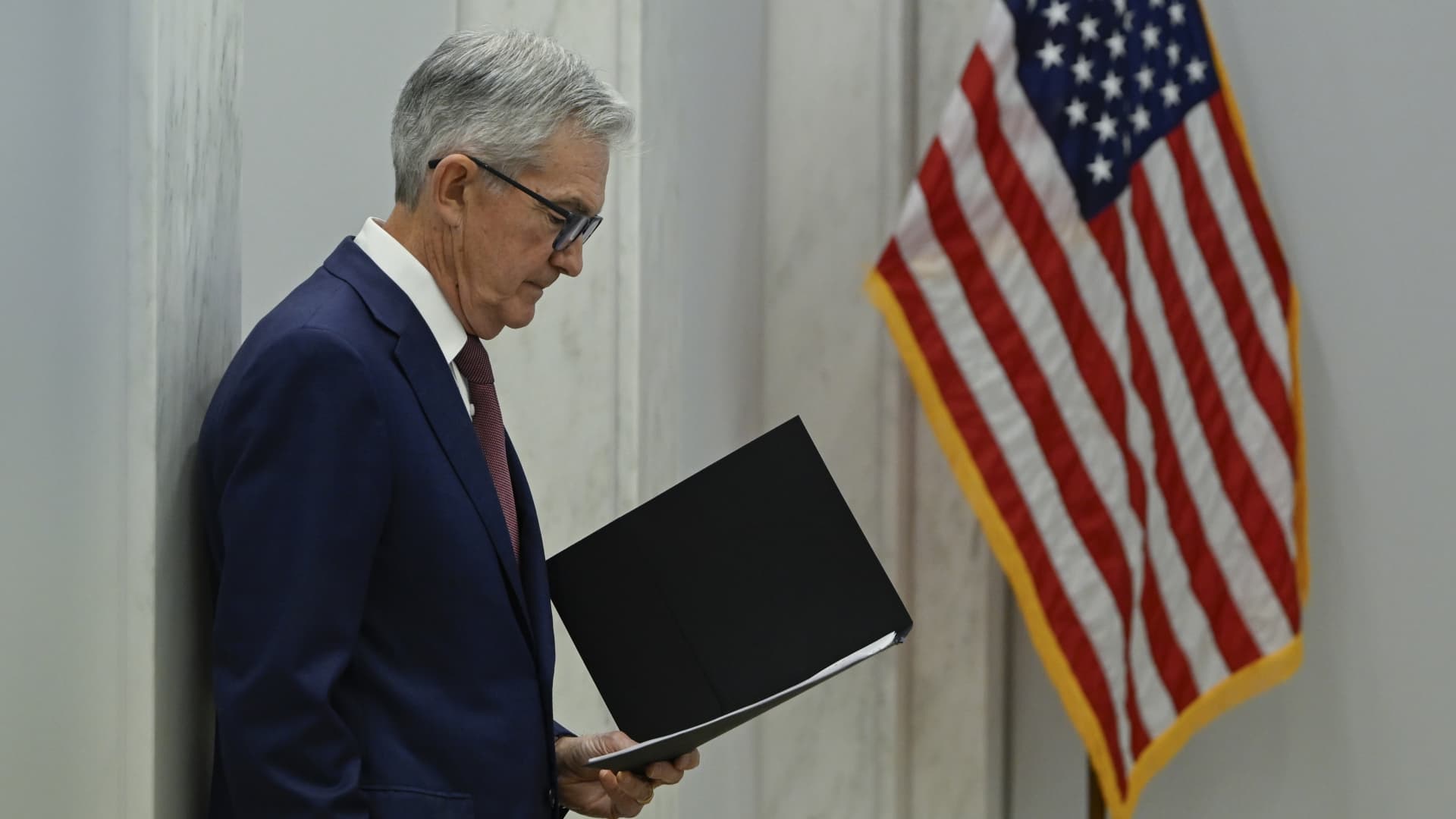

Wednesday features a one-two punch of news that starts in the morning with the pivotal consumer price index reading for May, and ends with the Fed’s policy meeting in the afternoon. Economists expect CPI to show just a 0.1% increase from April, though that still would equate to an aggregate annual rise of 3.4%. Core PCI is projected to show a 0.3% monthly gain and a 3.5% annual rate. When it comes to interest rates, the Fed will do nothing. However, officials will offer a variety of economic forecasting updates that will include the central bank’s much-watched “dot plot” of interest rate expectations. Jerome Powell, Chairman of the U.S. Federal Reserve, speaks during the conference celebrating the Centennial of the Division of Research and Statistics, Board of Governors of the Federal Reserve System in Washington D.C., United States on November 08, 2023. (Photo by Celal Gunes/Anadolu via Getty Images) Celal Gunes | Anadolu | Getty Images

Wednesday is shaping up to be one of the most important days of the year for economic news, as investors will hear about the path of inflation and the manner in which the Federal Reserve plans to react.

In a one-two punch that starts in the morning with the pivotal consumer price index reading for May and ends with the Fed’s policy meeting in the afternoon, vital signals will be sent about the direction of the economy and whether policymakers can soon take their foot off the brake.

The day “packs months of macro risk into one day,” wrote UBS economist Jonathan Pingle.

Like many others on Wall Street, Pingle expects the CPI report, combined with last Friday’s surprisingly strong nonfarm payrolls reading and other recent data releases to lead Fed officials to tinker with their outlook for inflation, economic growth and interest rates.

Optimists are hoping that the moves fall largely within the realm of expected outcomes and don’t do much to rattle the frayed nerves of market participants.

“While both typically have proven to be market-moving events, we expect very little fireworks from both releases given our expectations for rather benign outcomes,” said Jack Janasiewicz, lead portfolio strategist at Natixis Investment Managers.

In broad strokes, here are anticipated outcomes of both events.

CPI inflation

The measure of how much a broad basket of goods and services

CNBC

The full article is available here. This article was published at CNBC Economics.

Comments are closed for this article!