Major Asset Classes | May 2024 | Performance Review

The Capital Spectator

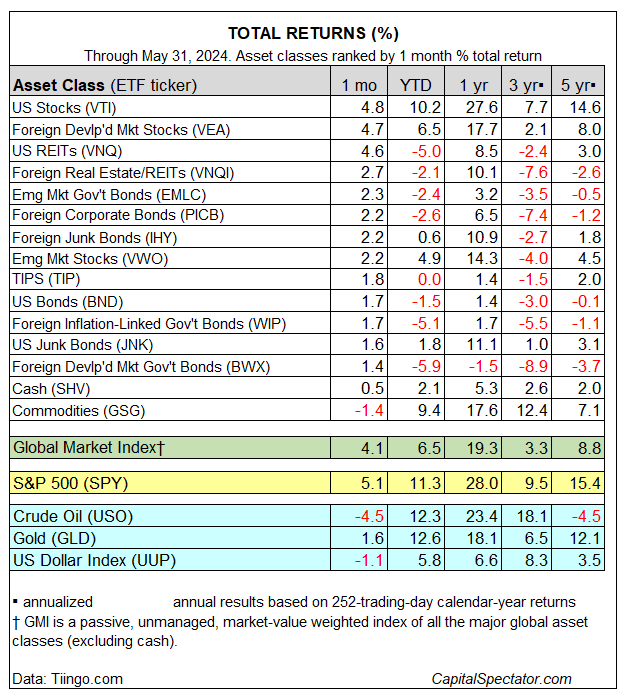

Global markets rebounded sharply in May, with the exception of commodities, based on a set of ETF proxies. Otherwise, gains dominated the major asset classes after April’s widespread pummeling.

US stocks led the rally in May: Vanguard Total US Stock Market Index (VTI) jumped 4.8%. The gain marks the best monthly gain for American shares since February.

Developed-market stocks ex-US (VEA) and US real estate investment trusts (VNQ) also posted strong gains in May.

The downside outlier last month: commodities (GSG), which lost 1.4% — the first monthly decline for the fund so far this year.

Year-to-date performances for the major asset classes continue to reflect mixed results. In the winner’s circle, US stocks (VTI) continue to lead with a robust 10.2% advance. Commodities (GSG), thanks to a weakness in May, have been demoted to second-place status for 2024 with a 9.4% gain. Note, however, that gold (GLD) continues to shine: another monthly rise in May has lifted the price of the precious metal 12.6% in 2024 – the best performer this year in the table below.

For losers in 2024, the deepest shade of red ink is in foreign government bonds in developed markets ex-US (BWX) via a 5.9% decline.

The Global Market Index (GMI) posted a solid recovery in May, rising 4.1% — the benchmark’s strongest month to date in 2024. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios. Year to date, GMI is up 6.5% — only US stocks (VTI) and commodities (GSG) are enjoying stronger rallies in 2024.

For the one-year window, GMI is ahead by 19.3%. US stocks (VTI) are posting a much stronger gain (27.6%) while US bonds (BND) are up a tepid 1.4%.

The full article is available here. This article was published at The Capital Spectator.

Comments are closed for this article!