Rate Cuts May Boost ESG Bond Funds

Morningstar

Until March 2022, sustainable bond funds experienced a positive five-year period in terms of returns and low volatility compared to traditional bond products, but then the relationship reversed. That’s “because of their higher average duration, which made them suffer greatly in a period of rising interest rates,” Mara Dobrescu, head of fixed income analysis at Morningstar, explained on Thursday.

“Investors looking to invest in green, social and sustainable bond funds should be mindful of the biases these funds may introduce in their portfolio,” according to Dobrescu. “Indeed, our data has shown that most sustainable bond funds have a higher average duration than their traditional global bond peers, meaning that they will be more sensitive to variations in interest rates. This should benefit them when rates fall.”

What Are Green, Social and Sustainability-Linked Bonds?

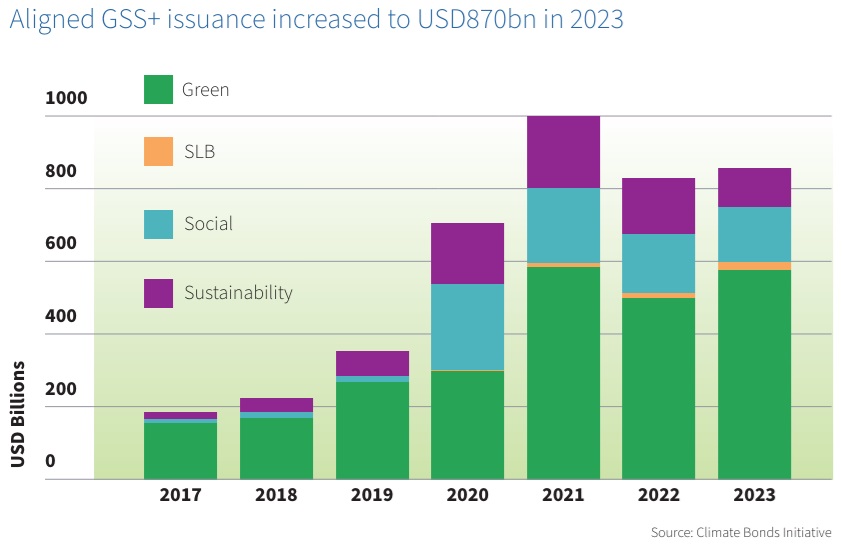

USD 870 billion in new sustainable bonds were issued globally in 2023, pushing the outstanding amount at year-end towards the record threshold of USD 4.4 trillion, across over 43,000 individual bonds worldwide, according to data from the non-profit Climate Bonds Initiative.

As the chart below shows, green bonds continue to account for two-thirds of the market. But what exactly are they? They are issued to raise money for the sole purpose of financing new or existing projects or activities that have a positive impact on the environment. These projects can include renewable energy, energy efficiency, waste management, sustainable transport and other green initiatives.

However, there are other types of sustainable bonds: Social bonds, for example, are intended to finance new projects and refinance existing ones, with a positive social impact. The projects are most commonly aimed at supporting low-income, unemployed or otherwise vulnerable parts of the population.

Meanwhile, sustainability-linked bonds (SLB) have structural features, such as interest rates, that are linked to the achievement of sustainability goals. Unlike green bonds, they are not linked to the realisation of a single sustainability project. The proceeds from the bond issue can be used for general purposes, linked to an overall sustainability strategy with targets that can be measured year by year. These bonds are the most ‘generalist’ category within ESG fixed income in that they can include environmental targets, social targets or a combination of both.

Funds and ETFs Exposed to Sustainable Bonds

There are just under 300 bond funds and ETFs in Europe that are classified under Article 9 by the SFDR, the European Union’s regulation on sustainable

The full article is available here. This article was published at Morningstar Investment Managers & Funds.

Comments are closed for this article!