In Search of the Exclusion Premium

ESG Investor

Cheng-En Li, Research Analyst at MainStreet Partners, explores how market performance of large-cap companies is influenced by poor ESG practices.

While grappling with uncertainty in capital markets caused by the exacerbation in inflation, mounting policy rates, and geopolitical tensions in 2023 and 2024, many institutions are now looking to align themselves more closely with good ESG practices in response to increased regulation and market demand. But a question in the mind of any investor is how ESG-related controversial behaviours can affect performance over the medium term.

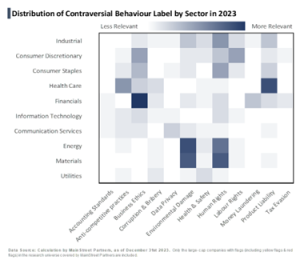

Recently, we conducted research analysing data from 2023 to investigate this relationship between ESG behaviour and capital market performance, using the MSCI ACWI large-cap index as a benchmark. The study first examined whether the share prices of companies flagged for negative ESG behaviour show any discernible trends over the ensuing six months and over the full year in 2023. We then analysed the distribution of companies that have been flagged to determine if certain industries are more prone to ESG-related controversies.

Furthermore, leveraging sector return data, we assessed the performance implications of flagged companies in various industries, examining whether such industries underperform and if there is evidence of an ‘exclusion premium’. This is when outperformance is generated by ‘being selective’ and excluding companies with relevant ESG-related controversial behaviour.

Finally, we created sub-universes based on different ESG flags to explore how incorporating ESG behaviour into investment strategies can enhance performance and mitigate risk.

The findings indicate that this approach may affect the risk and return profiles of large-cap firms.

Negative impact of ESG controversies

ESG controversies/negative ESG behaviour refers to company practices that raise ethical, environmental or social concerns. We developed a framework to classify controversial events based on severity. The framework has five key performance indicators — scale, frequency, response, effectiveness, and transparency — to rate the news for the company with numeric score (ie, severity score) ranging from one to five; the company is assigned a yellow flag/red flag once the severity score exceeds the corresponding threshold.

We would then issue a red flag to a company that has engaged in any controversy that poses a significant threat to the company’s business and future performance, alternatively issuing a yellow flag to a company if the controversy is likely to develop into a material ESG risk.

Among the companies that were newly flagged in 2023, those with controversies over accounting standards and human rights

The full article is available here. This article was published at ESG Investor.

Comments are closed for this article!