Pipeline battle shows how legal strife is clogging US energy development

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Philippines courts investors for ‘China-free’ nickel supply chain

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The Philippines is scouting for western investment to further develop its nickel reserves, pitching itself as an alternative to the China-dominated supply chain for the critical battery metal.

The country, which is the world’s second-largest producer of nickel, is seeking a critical minerals agreement with the US and investment from foreign companies to build more refining plants, as it taps into rising concerns over China’s control of the electric vehicle ecosystem.

“There is room now for the Philippines to be a significant player for batteries,” Ceferino S Rodolfo, under-secretary of the Department of Trade and Industry, told the Financial Times in an interview.

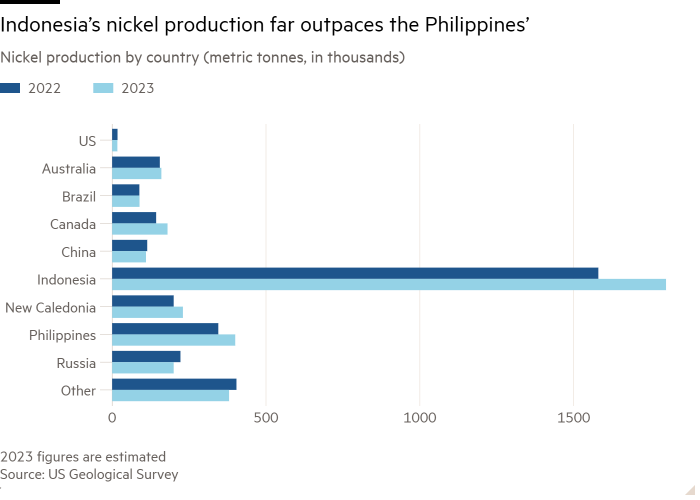

The Philippines’ nickel output is just a fraction of top player Indonesia, where government officials say 90 per cent of the industry is controlled by Chinese companies.

But unease about the concentration of nickel supply in the hands of Indonesia and China — as well as low prices that have curbed output from other producers — have prompted buyers to seek other sources of the commodity, which is also a critical steelmaking ingredient.

The US, UK, Australia, Japan and South Korea are among countries that have shown interest in investing in the Philippine nickel industry, Rodolfo said. But so have Chinese companies.

“It’s a race between China and the US,” he said, noting that the Philippines had “a really strong argument to go for a non-Chinese investor so that we can be the supplier of non-Indonesian, non-Chinese nickel”.

The Philippines’ push also comes as it seeks to build closer economic ties with the US and its allies amid escalating tensions with Beijing in the South China Sea.

Last week, Chinese coast guard vessels rammed and boxed in Philippine military resupply boats, an incident that left one Philippine soldier severely injured.

The Philippines wants to sign a critical minerals agreement with the US, which would make it eligible for tax credits. It has also asked to join an existing agreement between the US and Japan, Rodolfo said.

But no deal is on the table for now due to US reluctance to sign an agreement in the middle of an election year, officials in Manila said.

The Philippines is also aiming to produce “greener” nickel with the help of investors by using renewable energy to power smelters, Rodolfo said — distinguishing it from Indonesia, which relies on coal-fired power plants extensively,

Financial services shun AI over job and regulatory fears

Standard DigitalWeekend Print + Standard Digital

wasnow $75 per month

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

‘Flood’ of cheap Russian fertiliser risks Europe’s food security, industry says

Standard DigitalWeekend Print + Standard Digital

wasnow $75 per month

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Growth, value stocks could see boost from Russell rebalancing

A bullish move may be ahead for both value and growth in the year’s second half.

VettaFi’s Todd Rosenbluth thinks value stocks, which have been market laggards, could get a lift from one of the biggest Wall Street events of the year: the FTSE Russell’s annual rebalancing.

“It’s worth paying attention to value,” the firm’s head of research told CNBC’s “ETF Edge” this week. “It feels like … [for a] long time that growth has outperformed value.”

On Friday, the Russell indexes underwent their annual reconstitution to reflect changes in the market as companies grow and shift. The iShares Russell 1000 Growth ETF is up 20% so far this year, while the iShares Russell 1000 Value ETF is up almost 6%.

“We do think there’s a place for both growth and value within a broader portfolio — just people are skewed more toward growth heading into the second half of the year,” he added. “There have been periods when the pendulum has swung back in favor of value.”

FTSE Russell CEO Fiona Bassett said on “ETF Edge” the indices are built to reflect the nature of the market.

“One of the benefits of the Russell franchise generally is our ability to provide different sleeves of exposure,” she said. “So, for those people who want to get concentrated exposure to value or to growth, we have the indices available to do that.”

As of May 31, FactSet reports the Russell 1000 Growth ETF’s top three holdings are Microsoft, Apple and Nvidia. Meanwhile, the Russell 1000 Value ETF’s top holdings are Berkshire Hathaway, JPMorgan Chase and Exxon Mobil.

CNBC

Dash for last orders on stock markets stirs concentration fears

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

BlackRock throws support behind effort to move pensions beyond ESG

Stay informed with free updates

Simply sign up to the ESG investing myFT Digest — delivered directly to your inbox.

BlackRock has thrown its weight behind a coalition of US police and firefighter labour groups that is making the case for getting politics out of pensions, in its latest effort to navigate the backlash to environmental, social and governance investing.

The world’s largest money manager is the only financial group among the founding members of the Alliance for Prosperity and a Secure Retirement, a Delaware-registered non-profit that warns on its website that “politics has no place in Americans’ investment decisions”. After coming under fire over its advocacy for sustainable investing, BlackRock has increasingly highlighted the primacy of investor choice.

A handful of small business and consumer non-profits are also members of the alliance, which launched earlier this year amid a flurry of ESG-related activity. Forty-four state legislatures considered 162 bills in 2023, and 76 more proposals have been put forward this year, according to law firm Ropes & Gray. Roughly 80 per cent of the proposals sought to ban consideration of sustainability factors, while the rest actively promoted it.

“We are not pro-ESG. We are not anti-ESG. What we are is ‘pro’ letting investment professionals, who have a fiduciary duty to their beneficiaries, do the work that they’re supposed to do,” Tim Hill, a retired Phoenix firefighter who is president of the alliance, told the Financial Times. “We are ‘anti’ politicians, from either the right or left, interfering with that fiduciary duty so they can carry out a political, social agenda.”

Hill said the group had been set up to rally pension industry participants in support. “We decided we were going to try and take this different tack of enlisting the industry to assist us, primarily in the financial burden of pushing back and protecting our funds and fund managers,” he said.

BlackRock said in a statement that it was “proud” to back the alliance, adding: “As a fiduciary, our mission is to help more people experience financial wellbeing in all phases of life. The alliance is one of many organisations that BlackRock supports which are committed to helping more Americans retire with dignity on their own terms.”

The $10.5tn money manager has been at the centre of the political fight over ESG since 2020 when chief executive Larry Fink beat the drum for sustainable investing, pledging in his annual letter to make “sustainability integral to portfolio construction

What keeps investors up at night? Five questions for wealth managers

Standard DigitalWeekend Print + Standard Digital

wasnow $75 per month

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

JPMorgan and Morgan Stanley boost buybacks and dividends, while Citigroup and BofA take smaller steps

JPMorgan said it was raising its quarterly dividend 8.7% to $1.25 per share and that it authorized a new $30 billion share repurchase program. Morgan Stanley said it was boosting its dividend 8.8% to 92.5 cents per share and authorized a $20 billion repurchase plan. Citigroup said it was raising its dividend 5.7% to 56 cents per share and that it would “continue to assess share repurchases” on a quarterly basis. Bank of America said it was increasing its dividend 8% to 26 cents per share. (L-R) Brian Moynihan, Chairman and CEO of Bank of America; Jamie Dimon, Chairman and CEO of JPMorgan Chase; and Jane Fraser, CEO of Citigroup; testify during a Senate Banking Committee hearing at the Hart Senate Office Building in Washington, D.C., on Dec. 6, 2023. Saul Loeb | Afp | Getty Images

JPMorgan Chase and Morgan Stanley said Friday that they were boosting both dividend payouts and share repurchases, while rivals Citigroup and Bank of America made more modest announcements.

JPMorgan, the biggest U.S. bank by assets, said it was raising its quarterly dividend 8.7% to $1.25 per share and that it authorized a new $30 billion share repurchase program.

Morgan Stanley, a dominant player in wealth management, said it was boosting its dividend 8.8% to 92.5 cents per share and authorized a $20 billion repurchase plan.

Citigroup said it was raising its dividend 5.7% to 56 cents per share and that it would “continue to assess share repurchases” on a quarterly basis.

Bank of America said it was increasing its dividend 8% to 26 cents per share. Its release made no mention of share repurchases.

The big banks announced their plans to boost capital return to shareholders after passing the annual stress test administered by the Federal Reserve this week. While all 31 banks in this year’s exam showed regulators they could withstand a severe hypothetical recession, JPMorgan said Wednesday that it could have higher losses than the Fed initially found.

Still, that would not affect its capital-return plan, the New York-based bank said Friday.

“The strength of our company allows us to continually invest in building our businesses for the future, pay a sustainable dividend, and return any remaining excess capital to our shareholders as we see fit,” JPMorgan CEO Jamie Dimon said in his company’s release.

JPMorgan’s dividend