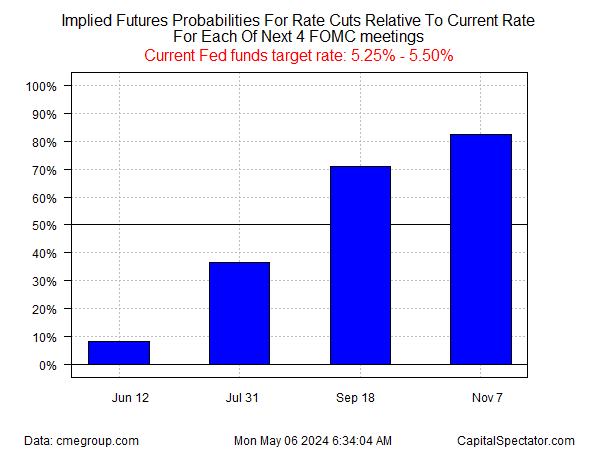

A ‘fair-value’ estimate of the US 10-year Treasury yield was steady in April while the market level for the benchmark rate continued to rise well above the theoretical level. But trading activity this month suggests the trend may be shifting. Yesterday’s sharp fall in the 10-year yield (May 15) substantially narrowed the spread, which implies that the market’s premium over fair value had become extreme.

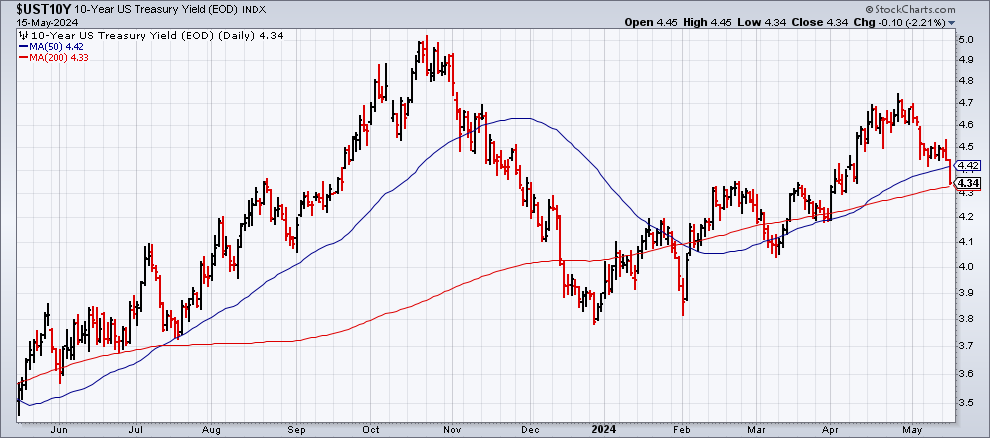

Following yesterday’s upbeat US consumer inflation news for April, the 10-year yield fell on Wednesday to a six-week low of 4.34%. The slide marks a hefty reversal after this rate climbed to 4.71% at one point in April.

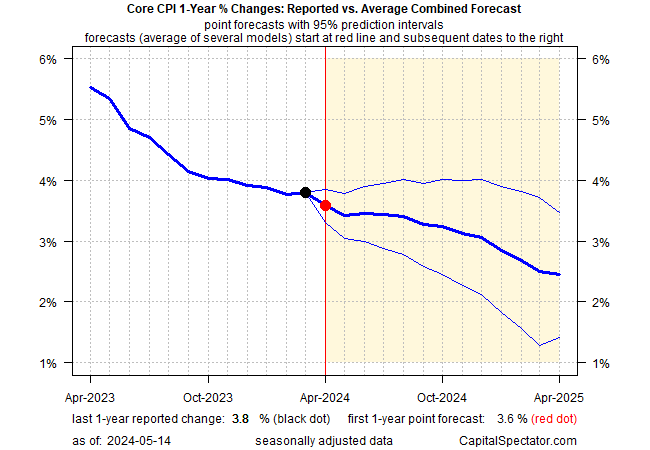

Recall that CapitalSpectator.com’s fair-value estimates for the 10-year yield in recent months have been well below the market rate. As discussed over the past year or so (last month, for example), our modeling suggested that the crowd was pricing in a premium for the 10-year yield that appeared excessive, based on the average estimate for three models (defined here). As a result, the market level looked unsustainable without a dramatic change in the macro fundamentals, such as a sharp rise in inflation. In fact, disinflation, although it stalled recently, persists.

The current fair-value estimate for April is 4.21%, fractionally below the previous month’s level. Based on last month’s data, the market rate rose to a 1.33 percentage-point premium over the average fair-value yield – close to the highest margin since the early 1990s.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

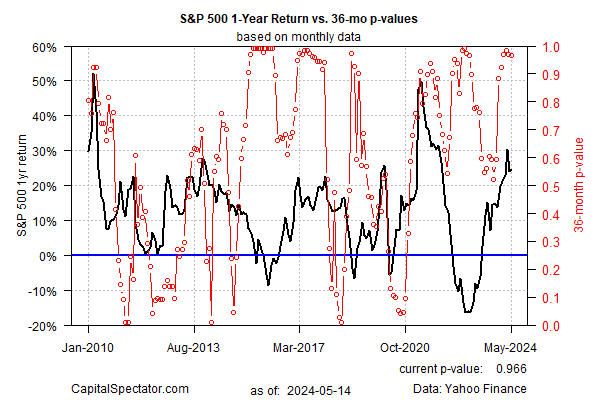

In other words, the market premium baked into the 10-year yield remained lofty last month. Although such extremes aren’t unprecedented, they tend to be relatively short-lived, or so history suggests. As the next chart below reminds, premiums tend to reverse… eventually.

The timing of normalization, as always, is unclear. It’s also worth pointing out that this time could be different, i.e., the market, for whatever reason, maintains a relatively large yield premium for longer than expected. But yesterday’s sharp decline in the market rate for the 10-year yield implies that the premium has started to fade and the history will, in time, repeat.

The thesis on these pages has long been that while the market can maintain a relatively large yield premium for an extended period, the much-lower fair-value estimate will likely restrain the crowd from bidding up the 10-year rate beyond