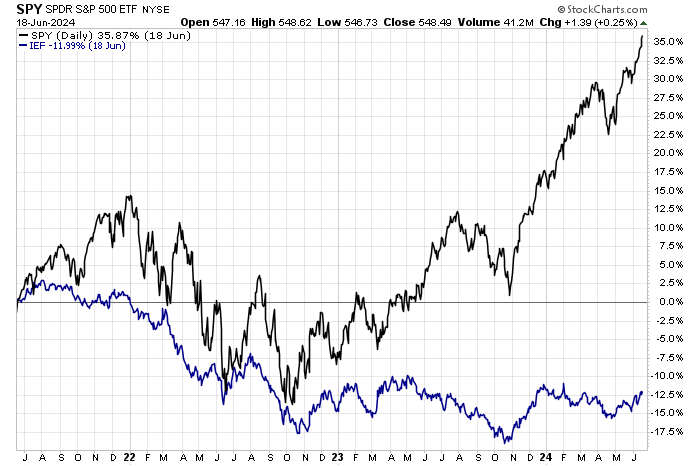

There was a brief period earlier this year when US shares gave up the leadership crown to commodities, but American stocks have retaken the performance throne in June, based on a set of ETFs through Friday’s close (June 21).

Vanguard Total US Stock Market ETF (VTI) closed last week with a strong 13.5% year-to-date gain. In close pursuit in the number-two slot: commodities (GCC), which had been leading in 2024 back in April and early May.

Stocks ex-US are well behind their US counterparts, but respectable gains in offshore shares are still conspicuous this year. Equities in emerging markets (VWO) have rebounded and are currently posting a third-place win in 2024 of 7.5%. Shares in developed markets ex-US (VEA) are in fourth place with a 4.0% year-to-date increase.

US bonds have recovered over the past two months but have yet to post a meaningful year-to-date gain. Vanguard Total Bond Market (BND) is essentially flat in 2024.

There are plenty of losers elsewhere in global markets, including property shares and foreign bonds. The biggest decline is currently found in developed-market government bonds ex-US (BWX), which is in the hole by 6.2%.

Notably, a forecast-free, passive measure of holding all the world’s markets in market-value weights continues to generate solid results this year. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies. GMI is currently up 9.7% in 2024, outperforming all its components except two: US stocks and commodities.