The transforming power of artificial intelligence is of no value unless user data is protected, George Zhao, CEO of Chinese smartphone company Honor, told CNBC in an exclusive interview. His comments come as Apple this month announced it will start rolling out personalized AI tools on certain devices in the U.S. this fall. “We say user data doesn’t leave [the device],” Zhao said. “This is a principle we adhere to.” Honor CEO George Zhao (L) and GSMA CEO John Hoffman on stage at Shanghai Mobile World Congress during an awards ceremony on June 27, 2024.

HANGZHOU, China — The transforming power of artificial intelligence is of no value unless user data is protected, CEO of Chinese smartphone company Honor, George Zhao, told CNBC in an exclusive interview on Thursday.

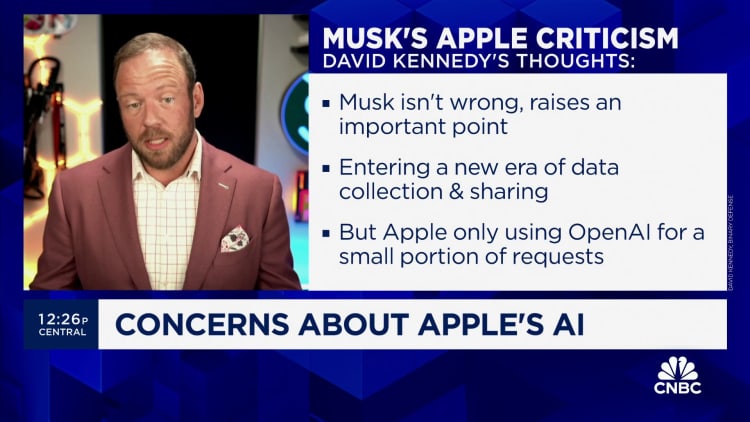

His comments come as Apple this month announced it will start rolling out personalized AI tools on certain devices in the U.S. this fall.

Honor already integrates some AI functions, such as enabling users to open text messages and other notifications just by looking at them, or eliminating copy-paste steps by directly linking Yelp-like apps to navigation or ride-hailing apps.

This week at Mobile World Congress in Shanghai, Honor unveiled new AI tools for detecting the use of deepfakes in videos, and for simulating lenses that can decrease myopia during long hours of screen usage.

Zhao emphasized that Honor’s approach is to keep AI operations involving personal data limited to the smartphone. It’s also known as on-device AI, and stands in contrast with AI tools that tap cloud computing to operate.

“Without data security and user privacy protection, AI will become worthless,” Zhao said in Mandarin, translated by CNBC. “This has always been one of our value propositions.”

“We say user data doesn’t leave [the device],” Zhao said. “This is a principle we adhere to.”

Apple Intelligence, the iPhone company’s AI product, claims that it uses on-device processing and draws on “server-based models” for more complex requests. Apple said its new “Private Cloud Compute” never stores user data.

Honor says its on-device AI is self-developed, and the company is working with Baidu and Google Cloud for some other AI features.

“Overall, my view is that AI’s development to date has two directions,” Zhao said. “Network