Winning the renewables race is all about location, according to Richard Lum, Co-CIO, Victory Hill Capital Partners.

The transition to a low-carbon economy is creating a once-in-a-generation dislocation in energy markets, fundamentally bringing the longevity of current energy infrastructure into question. For example, whereas energy systems designed for oil, coal and gas were predicated on centralised power generation, there is now a burgeoning need to upgrade or reform power grids to a distributed model, accommodating the growth of renewable energy sources as we progress towards net zero goals.

This gap between legacy energy infrastructure and a sustainable, low-carbon future provides an opportunity for astute investors. But capitalising upon uncertainties like supply security and price volatility at peak times is not as simple as swapping every coal-powered energy plant for a wind farm. Globally, the energy transition is taking place at varying speeds in different locations, leading to profound differences in how renewables assets perform.

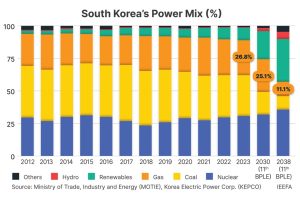

These differences are partly due to inherent regional characteristics that render some methods of clean energy generation more effective than others depending on where you are. For instance, France’s robust nuclear power infrastructure, supported by strong policy and regulation, has lessened the demand for new sources of renewable energy in its electricity grid. Or China, where expansive land mass and suitable climate conditions have allowed renewables developers to build 2,919GW of solar capacity.

But identifying beneficial investment opportunities requires more than locating wind farm projects where there is wind, and solar fields where there is sun, or ‘copying and pasting’ one lucrative project framework into regions with physical and regulatory similarities.

The value drivers are local

While a broadbrush approach to green infrastructure investment might go some way towards meeting global energy needs, the drivers of value are inherently local. Taking a broad approach could come at the cost of investor returns, ultimately jeopardising the long-term financing prospects for the transition. Investors will need to evaluate each project at a granular level, assessing its merits in consideration of its location by looking at everything from weather, geography, politics and regulation, to the stage of the energy transition journey that the country is currently in.

In other words, varying market conditions mean that to fruitfully participate in transition projects globally, investors must account for the fact that renewable technology will perform differently in different places, with direct knock-on effects on performance and investor returns.

A good example