Ranked: The World’s Top 10 Billionaires in 2024

Published

10 seconds ago

on

June 20, 2024

See this visualization first on the Voronoi app.

The World’s Top 10 Billionaires (June 2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Elon Musk has reached a net worth of $205.4 billion in 2024, securing his position as the richest billionaire in the world, ahead of Jeff Bezos at $203.2 billion and Bernard Arnault at $200 billion. Arnault, the billionaire chairman and CEO of the global luxury goods company LVMH, led the ranking at the beginning of the year.

Using data from Forbes’ Real-Time Billionaires List, we provide a snapshot of the top 10 billionaires in the world as of June 11, 2024. It is important to note that the rank changes frequently due to fluctuations in stock prices, market conditions, and significant business transactions.

$1.6T in Combined Wealth

The wealth of the top 10 wealthiest people ($1.6 trillion) is almost equivalent to Mexico’s GDP, the 14th largest economy in the world.

At the top of the list, Elon Musk’s wealth derives primarily from his stake in Tesla, his holdings in SpaceX, and the social media platform X.

RankNameNet Worth (USD in Billions)Source 1Elon Musk$205.40Tesla, SpaceX 3Jeff Bezos$203.20Amazon 2Bernard Arnault & family$200.00LVMH 4Mark Zuckerberg$176.50Facebook 5Larry Ellison$153.70Oracle 6Larry Page$145.10Google 8Sergey Brin$139.00Google 7Warren Buffett$134.00Berkshire Hathaway 9Bill Gates$131.00Microsoft 10Steve Ballmer$126.50Microsoft

Recently, Tesla shareholders voted to approve a pay package worth approximately $50 billion for Musk at the company’s annual shareholder meeting. This decision is being challenged by a Delaware judge, who has described Musk’s award as “unfathomable.”

Never incorporate your company in the state of Delaware

— Elon Musk (@elonmusk) January 30, 2024

Meanwhile, Amazon founder Jeff Bezos overtook Bernard Arnault as the second-wealthiest person in June 2024, after LVMH’s shares fell and Amazon’s shares slightly increased.

As a relevant side note, Arnault has also been carefully laying succession plans for LVMH this year, with the 75-year-old recently appointing two more of his sons to the company’s board in April 2024. This leaves just his youngest son without a spot on the

The Case For Portfolio Rebalancing Looks Compelling

By nearly any measure you cite, US equities are enjoying a stellar run. Despite numerous global risks, investor sentiment for American shares is resilient. The question, as always, is when is it timely to take some of the winnings and redeploy to other assets classes?

There are countless ways to engage in opportunistic portfolio rebalancing analytics, but a good way to start is by profiling performance. For US equities, the case for tamping down expectations looks persuasive. To the extent that expected return evolves inversely with trailing performance, recent history provides a baseline for thinking about risk.

Meanwhile, the view that the bear-market for bonds is over is attracting more attention. The future’s uncertain as always, of course, but one can argue that the foundation is in place for a round of portfolio rebalancing.

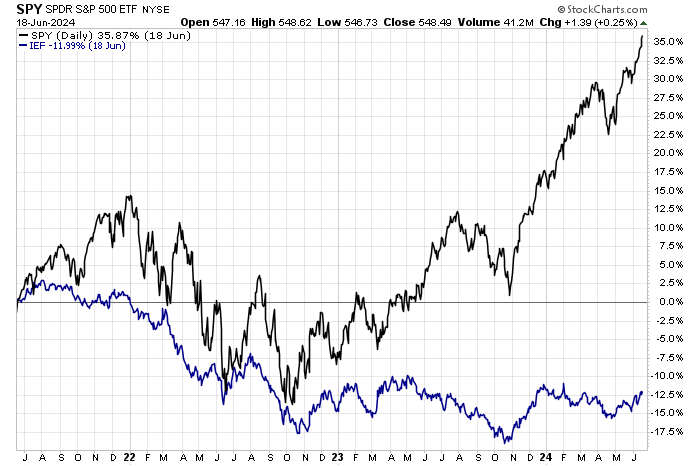

Consider how US stocks and Treasuries compare over the past three years, based on a set of ETFs: SPY for equities and IEF for government bonds. The divergence is a chasm.

As I wrote earlier this week, a multi-factor measure of the directional bias for Treasury yields suggests that the worst for the bear market in bonds has passed (see chart below). Other analysts are coming to the same conclusion. We’ve seen the peak in yields,” says Stephen Miller, an investment strategist at GSFM in Sydney. “Bonds are now back as having a deserved place in a multi-asset portfolio.”

US Treasuries (IEF) are starting to show an upside bias lately. Although it’s still early for the rebound narrative, it’s plausible that we’re in the early stages of an extended rebound. If so, the odds are beginning to tip in favor of a bullish view for bonds.

Meanwhile, US stocks appear overextended. Let’s start with a rolling one-year-return profile for the S&P 500 Index. The 24% rise over the past year (through June 18) has yet to reach the extreme peaks in history, but it’s clearly at a lofty level that’s rarely experienced.

For a clearer view of how the S&P’s current one-year change compares with decades past, the next chart reminds that a 24% increase is well above the inter-quartile range that (gray box) that marks the lion’s share of the return distribution for the past 60 years-plus.

Taking a longer-term view, it’s also clear that the trailing 10-year return for the S&P 500 is also elevated. The 10.9% annualized gain for

Bank of England Holds Rates Despite Hitting 2% Target

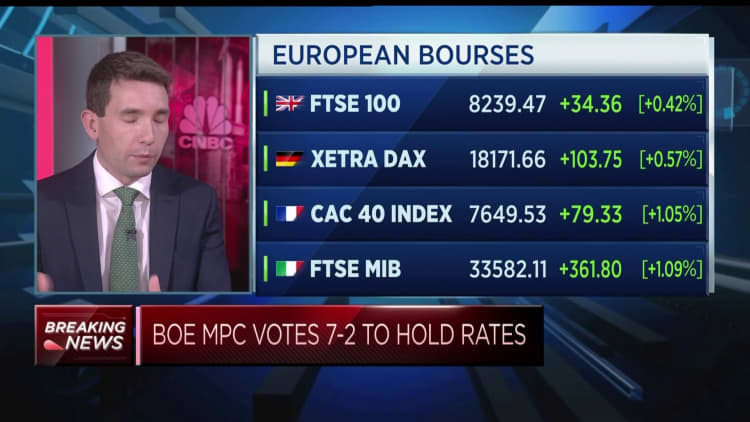

The Bank of England has repeated its previous policy of holding rates, mirroring precisely its Monetary Policy Committee’s (MPC) prior 9 May vote on UK interest rates.

At a meeting yesterday, a majority of 7-2 once more opted to hold rates, in defiance of what some felt was a pressure to lower rates now that inflation has hit the Bank’s own 2% target.

The decision means the Bank of England’s so-called “base rate” will be held at 5.25% – for the seventh consecutive time. A cut is now seen as most likely to occur in August.

The move was widely expected by markets, as demonstrated by overnight futures trading. Indeed, the market response was muted. Ahead of the vote, the FTSE 100 was up, and is now only slightly higher than at opening this morning, at 0.36%.

Why Has The BoE Held Rates?

In a statement, the BoE said a return to the 2% target had not been enough to convince the MPC to vote wholeheartedly for a cut.

“For some members within this group, the return of headline inflation to 2%, while welcome, was not necessarily indicative of the required sustained return to target,” it said.

“Continued high levels of, and upside news to, services inflation supported the view that second-round effects would maintain persistent upward pressure on underlying inflation.

“Wage growth had continued to exceed model-based estimates. Indicators of domestic demand were stronger than had been expected, and the risks to the outlook for activity were skewed to the upside.

“For these members, more evidence of diminishing inflation persistence was needed before reducing the degree of monetary policy restrictiveness.”

The statement will indicate to investors and traders that the BoE is approaching a rate cut very cautiously indeed, and that it could be some time before rates come down.

This is something of a departure from the upbeat picture markets had expected at the end of last year, when it was thought 2024 would be punctuated with multiple cuts by multiple central banks. In the US, some expected as many as five rate cuts in 2024.

How Are Fund Managers Reacting to the Rate Hold?

In a note, Georgina Hamilton, fund manager of the Morningstar 4 Star and Gold-Rated Polar Capital UK Value Opportunities Fund, says the BoE is now clearly pursuing a “no surprises” approach.

“Core inflation should [now] start to show progress, paving the way for

Bank of England holds interest rates steady despite inflation easing to 2% target

General view of the Bank Of England building in London. Sopa Images | Lightrocket | Getty Images

LONDON — The Bank of England on Thursday opted to keep interest rates steady at its June meeting, confirming market expectations even after U.K. inflation hit its 2% target.

It keeps the central bank’s key rate at a 16-year high of 5.25%, where it has been held since August 2023.

Seven members of the Monetary Policy Committee voted to hold, while two favored to cut by 25 basis points, the same as during the bank’s May meeting.

In a statement, the MPC noted inflation had reached the central bank’s target and said indicators of “short-term inflation expectations” and wage growth had eased.

It was “very difficult to gauge the evolution of labour market activity” because of uncertainty around estimates from the Office for National Statistics, the MPC added.

In a repeat of previous messaging that some analysts had thought it may drop, it again said monetary policy needs to “remain restrictive for sufficiently long to return inflation to the 2% target sustainably.”

Inflation data on Wednesday showed headline price rises cooled to 2% in May, meeting the central bank’s target ahead of the U.S. and the euro zone, despite the U.K. suffering a sharper spike inflation over the last two years.

However, economists say the U.K.’s continued high rates of services and core inflation suggest the potential for ongoing upward pressure.

The U.K. decision to hold comes just two weeks out from a general election in which the state of the economy and proposals for rebooting sluggish growth have emerged as a key battleground.

Despite speculation that the politically-independent BOE might act more cautiously as a result of the upcoming vote, Governor Andrew Bailey had emphasized that it would remain focused on its own data.

Attention will now turn to the prospects of an August rate cut. Money market pricing indicated just a 40% chance of this following Thursday’s statement.

The British pound extended losses against the U.S. dollar, trading 0.2% lower at $1.2685 at 12:24 p.m. in London.

Other central banks in Europe have already begun to ease monetary policy, including the Swiss National Bank, European Central Bank and Sweden’s Riksbank, as they seek to reboot economic growth.

That’s even as the U.S. Federal

CNBC

Bank of England holds rates at 5.25% in final pre-General Election decision

Two MPC members, Dave Ramsden and Swati Dhingra, voted again for a 25 basis points cut to 5%, against a majority of seven, who opted to hold rates. UK inflation returns to 2% target but June BoE cut remains unlikely The move follows positive inflation data for May from the Office for National Statistics, which revealed on Wednesday (19 June) that the Consumer Prices Index (CPI) fell back to 2% for the 12 months to May 2024 – reaching the BoE’s inflation target. The most concerning data, however, included core CPI, which stood at 3.5% last month, and services inflation at 5.7%, whil…

Two people arrested in London on suspicion of running illegal cryptoasset exchange

The Financial Conduct Authority explained it has been working with the Metropolitan Police Service to carry out an investigation into the two people and their enterprise. It is believed that more than £1bn worth of unregistered cryptoassets have been been bought and sold through the business. UK crypto regulation is ‘catching up’ to other markets while maintaining ‘bottom-up’ benefits Both suspects have been released on bail after being interviewed under caution by the FCA, but the investigation remains ongoing. The regulator said it had inspected offices associated with the sus…

New emissions data offers ‘little encouragement’ for green transition

Standard DigitalWeekend Print + Standard Digital

wasnow $75 per month

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Trading apps remain under FCA review over gamification concerns

Consumer Duty was cited by the regulator in its rationale for keeping the apps under review, noting that the programmes “must ensure services are designed and tested so they meet consumers’ needs and enable them to make effective, timely and properly informed investment decisions, including for those with characteristics of vulnerability”. FCA delays publication of politically exposed persons review until after General Election The move follows a research note authored by the FCA, which revealed the digital engagement practices (DEPs) used by apps, including push notifications and pri…

Green and social bond volume hits quarterly record of $272.7bn

According to a report by the Climate Bonds Initiative, Q1 2024 has been the “most prolific” quarter for sustainable finance volumes, up 15% from the $237.2bn recorded in Q1 2023 and 41% higher than the $193bn of Q4 2023. Green bonds alone contributed $195.9bn, another quarterly record, with lifetime green bond volume crossing the $3trn mark since its market inception in 2006. The quarterly figure marked a 25% increase from Q1 2023 and was 43% higher than the last quarter of 2023. Social bonds followed suit at $42.3bn, while sustainability and sustainability-related bonds added $31.4bn…