Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

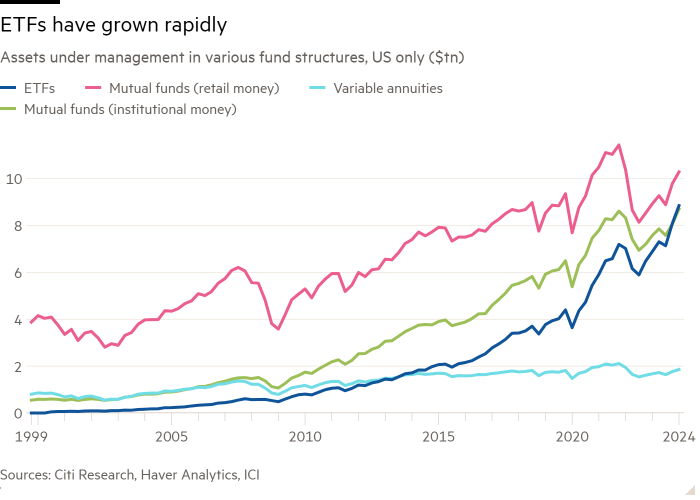

The rapidly growing exchange traded funds industry could seize half of the money currently held by long-term US mutual funds in the coming decade, according to estimates by Citi.

US investors have gradually been switching from mutual funds to ETFs for at least the past decade, attracted by lower costs, better liquidity and greater tax efficiency. Mutual funds, excluding money market funds, have seen net outflows in nine of the past 10 years in the US, according to data from the Investment Company Institute, even as ETFs have seen constant inflows.

Despite this, however, the mutual fund industry remains far larger, with $19.6tn in long-term funds at the end of 2023, according to the ICI, dwarfing the $8.1tn in US-listed ETFs.

This could reverse in the coming decade, though, according to Citi, which believes $6tn to $10tn of the remaining money in long-term mutual funds is at risk of capture by ETFs.

“The US asset management industry is clearly in an ongoing paradigm shift,” said Scott Chronert, global head of ETF research at Citi. “The flow trends speak for themselves.

“All told, we project that an additional $6tn to $10tn in mutual fund AUM is at potential risk of ETF replacement or cannibalisation,” he added.

Most vulnerable to predation are mutual funds held outside of tax-exempt retirement accounts, which are unable to compete with the ability of many ETFs to defer capital gains tax liabilities that accumulate within a fund.

Citi estimates that between half and all of the $2.4tn currently held by retail investors in non tax-exempt mutual funds is a potential target for replacement by ETFs.

In addition, between a quarter and a half of the $4.1tn of equivalent money held by institutional investors, and up to a fifth of the $1.3tn non-taxable variable annuity market is also up for grabs.

Chronert pointed to the rising use of model portfolios, which are typically built using ETFs, as a key factor driving this trend.

The $11.9tn worth of mutual funds held within tax-exempt retirement structures, such as 401k defined contribution schemes and individual retirement accounts, are likely to prove stickier, as ETFs do not have any tax advantage here.

Nevertheless, Citi argued that there were a number of trends in place that would allow ETFs to chip away at mutual funds’ dominance in this arena.

Firstly, IRAs are accounting for a