Mnatsakanian took on the role in January last year, charged with leading the expansion of UBS AM’s impact investing offering, research and impact measurement capabilities. Her departure comes amid a sweep of senior changes at UBS as the lender enters the final stages of its takeover of Credit Suisse. The formal merger of UBS AG and Credit Suisse AG – the former owner of Credit Suisse bank – completed on Friday (31 May). Credit Suisse CEO steps down in major UBS board shake-up A spokesperson for UBS AM said the firm was still solidifying its respective teams by “bringing together th…

AllianzGI appoints BlackRock’s Krautzberger as global fixed income CIO

Krautzberger will join the asset manager in August after 19 years at BlackRock, where he most recently worked as head of EMEA fundamental fixed income. Before that, he was CIO at BlackRock Asset Management Deutschland. Before joining Merrill Lynch Investment Managers in 2005, which later merged with BlackRock in 2006, he headed up the European fixed income team at Union Investment. In his new role, Krautzberger will oversee the management of €171bn fixed income assets, reporting to global head of investments Deborah Zurkow. He will also become a member of AllianzGI’s investment execut…

Polar Capital Global Financials names co-portfolio manager

Dorner will share management responsibilities with current co-managers Nick Brind and George Barrow. He is replacing veteran John Yakas, who is set to retire at the end of June and will step back into an advisory position, as announced in February last year. Brind has worked closely with Yakas for over a decade, having managed the fund with him since its inception in 2013, while Barrow joined the team in 2008 and was promoted to co-manager in 2019. Polar Capital Global Financials trust co-manager and chair steps down PCFT’s board said: “The board welcomes the appointment of Tom as …

Daiwa stake in Aozora could help in the battle of Japan’s brokers

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In Japan, Nomura is hard to beat. Japan’s largest brokerage house has a market share of about a third at home. That is more impressive if you consider how fragmented the market is, with more than 200 competitors.

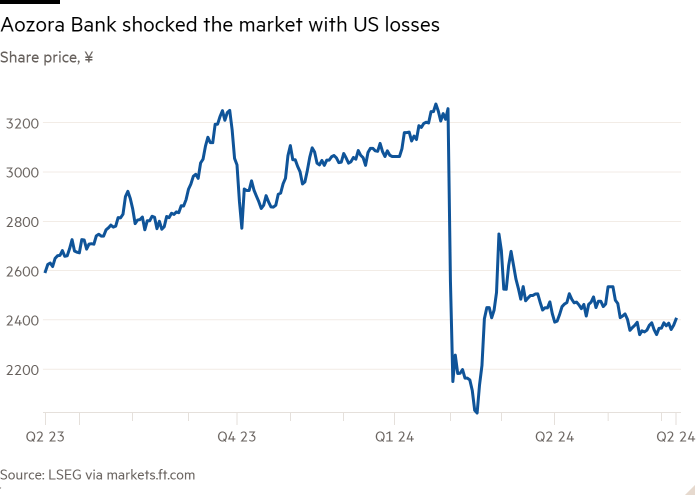

Of them, Daiwa Securities is a strong runner-up. But bridging the gap with Nomura has long seemed a tall task. Its latest effort — taking a big stake in Aozora, Japan’s worst-performing major bank stock — went down badly. Daiwa shares fell nearly 5 per cent on Tuesday, despite the deal giving Daiwa a discount on its stake compared with the undisturbed price. This bet may not be as reckless as the market reaction suggests.

Daiwa, Japan’s second-largest brokerage house, has agreed to buy a stake in Aozora Bank — a mid-sized bank with a market value of $1.8bn — from a fund with ties to Yoshiaki Murakami, Japan’s most famous activist investor. This raises its stake in Aozora to 24 per cent.

The concern from Daiwa’s investors is understandable. Shares of Aozora have had a rollercoaster ride, after it posted its first loss in 15 years earlier this year. Large losses on its portfolio of US office property loans shocked its conservative retail investor base.

But Aozora’s history in the US commercial real estate and US agency bonds market is not necessarily a bad thing for Daiwa. Like local brokerage peers, Daiwa has a strong record in stable businesses such as mutual funds and wealth management. It has stuck to a conservative management style, similar to larger names such as Mizuho.

These brokers are starting to face unprecedented, intense competition from online brokers in Japan. The worry is that upstart online rivals have been undercutting each other to offer zero commission fees for cash and margin trading in Japanese stocks over the past year. A more aggressive shift in strategy is in order.

While the stock market reaction to Aozora’s loss was dramatic in February, US office loans accounted for less than a tenth of its total loan book. The sell-off was as much a reflection of how stable its performance has been since 2008 as it was of investor concern about its overseas business strategy. Its shares trade at just over 0.7 times tangible book value, a discount of about a quarter to local rivals

Daiwa will get an

WisdomTree launches global core sustainable equity ETF

The WisdomTree Global Sustainable Equity UCITS ETF (WSDG) will track the price and yield performance, before fees and expenses, of the Solactive WisdomTree Global Sustainable Equity UCITS index. The index uses the UN Sustainable Development Goals (SDGs) framework to invest in developed market companies with products and services that aim to tackle climate change and social inequalities, promote a circular economy and help protect natural capital. WisdomTree launches US Quality Growth ETF for European clients Negative externalities are avoided through ‘Do No Significant Harm’ (DNSH…

DLA Piper’s Max Mayer: Private credit is coming of age

Borrowers are also embracing private credit as an alternative means to raise capital compared to traditional bank financing – its flexibility, user-friendliness, and different deployment approach also continue to be seen as beneficial. This influx, or maybe continuation, of private credit activity has ushered in a new generation of talent into private credit, bringing fresh perspectives and innovative approaches to the market. Private Markets Summit: How the industry is embracing ‘remarkable’ innovation and tackling wealth manager pain points While a sector driven by plentiful capi…

Roaring Kitty’s favourite stock tends its cash hoard as sales dwindle

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Mapped: Where Tesla and BYD Make Their Cars

Published

19 seconds ago

on

June 11, 2024 Graphics/Design:

See this visualization first on the Voronoi app.

Mapped: Where Tesla and BYD Make Their Cars

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In 2023, Tesla and BYD were the world’s two largest electric vehicle (EV) companies by a large margin, holding 19.9% and 17.1% market shares respectively.

With no other company able to match their scale, these two automakers have found themselves locked in a competition for the global EV crown. In Q4 2023, BYD outsold Tesla for the first time ever by 41,000 vehicles (526,000 vs 485,000). In Q1 2024, however, their positions were switched after Tesla outsold BYD by 87,000 vehicles (387,000 vs 300,000).

To gain insight into this rivalry, we’ve visualized the locations of both companies’ present and future EV factories, along with their estimated maximum annual output. Figures come from a variety of sources, and represent the latest information pertaining to planned production facilities (as of April 2024).

Tesla’s EV Factories

Starting with Tesla, this graphic highlights the locations of their four operational factories. Gigafactory Shanghai is the largest in terms of production output, at 750,000 vehicles per year.

Note that Gigafactory Nevada is not on this list because it produces battery cells, rather than finished vehicles.

CompanyLocationMax Annual OutputEst. Completion Tesla🇺🇸 Fremont, CA650,000– Tesla🇺🇸 Austin, TX250,000– Tesla🇩🇪 Berlin, Germany250,000– Tesla🇨🇳 Shanghai, China750,000– Tesla🇲🇽 Monterrey, MexicoTBD2026

Tesla’s China factory is unique in that it’s fully owned by Tesla itself, rather than a joint venture with a local company.

Looking to the future, Tesla’s next factory will be Gigafactory Mexico, which was announced (with few details) in March 2023. According to reporting by Electrek, the Mexican government is eager for the factory to begin construction, despite CEO Elon Musk voicing concerns about today’s high-interest rate environment.

BYD’s EV Factories

Although EV demand is not growing as quickly as it was in previous years, BYD is putting the pedal to the floor when it comes to global expansion. The company has announced factories in various regions including Europe, Southeast

These Dividend Stock Opportunities Are ‘Screaming Buys’

The Morningstar Star Rating for Stocks is assigned based on an analyst’s estimate of a stocks fair value. It is projection/opinion and not a statement of fact. Morningstar assigns star ratings based on an analyst’s estimate of a stock’s fair value. Four components drive the Star Rating: (1) our assessment of the firm’s economic moat, (2) our estimate of the stock’s fair value, (3) our uncertainty around that fair value estimate and (4) the current market price. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn’t. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here

Quantitative Fair Value Estimate represents Morningstar’s estimate of the per share dollar amount that a company’s equity is worth today. The Quantitative Fair Value Estimate is based on a statistical model derived from the Fair Value Estimate Morningstar’s equity analysts assign to companies which includes a financial forecast of the company. The Quantitative Fair Value Estimate is calculated daily. It is a projection/opinion and not a statement of fact. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Quantiative Fair Value Estimate, please visit here

The Morningstar Medalist Rating is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either

Raspberry Pi shares jump a third after IPO pricing

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital