Stirrup previously headed up Brooks’ UK distribution arm, where he spent the last four and a half years. In his new role, Stirrup will take charge of Ascot Lloyd’s commercial function, with responsibility for its 150 face-to-face advisers located across the UK, paraplanning, commercial strategy and advice policy, assurance and development. Trio exit Brooks Macdonald private client and wealth management teams “We are really pleased that Gary has joined the executive committee at Ascot Lloyd as chief commercial officer,” said Nigel Stockton, CEO at Ascot Lloyd. “Our focus has been…

Private equity house Coller Capital launches secondaries fund for wealth investors

The SICAV fund, now accessible to eligible private wealth investors outside of the US, will be seeded with over $400m of capital from investors globally, the firm said. Structured as an open-ended fund, the Coller International Secondaries Private Equity fund (CollerEquity), seeks to deliver absolute and risk-adjusted returns, diversification and the opportunity for more liquidity than traditional private equity funds. Available to professional and qualified investors in certain jurisdictions, the fund offers monthly subscriptions, quarterly redemptions and a lower minimum commitmen…

Turnspire acquires Swanson Industries and Tiefenbach North America

An affiliate of Turnspire Capital Partners has acquired Swanson Industries, a US provider of manufacturing, remanufacturing, repair and distribution services of mining equipment, hydraulic cylinders and related equipment.

The transaction includes Swanson’s controlling stake in Tiefenbach North America, which focuses on hydraulic controls and hose assemblies for mining, energy and industrial applications.

Founded in 1964 and headquartered in Morgantown, West Virginia, Swanson offers services including designing and manufacturing new products as well as remanufacturing and repair solutions.

Wilkie Farr & Gallagher and Macquarie Capital advised Turnspire.

The big threat to dollar dominance is American dysfunction

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

HIG Growth Partners sells CarltonOne to GSAM

HIG Growth Partners, the dedicated growth capital investment affiliate of HIG Capital, has sold portfolio company CarltonOne Engagement, a SaaS engagement and e-commerce platform, to Goldman Sachs Asset Management.

Headquartered in Markham, Ontario, CarltonOne creates B2B employee recognition, customer loyalty, rewards and sales/channel incentive programmes.

Since first investing in the business in 2017, HIG has overseen the scaling of operational infrastructure, product launches and entering new markets through “tuck-in” acquisition and via the expansion and growth of the financial services category.

According to a press statement, during HIG’s investment, the company grew its revenues approximately 4x and increased its EBITDA over 6x.

Baird, Canaccord Genuity and Paul Hastings advised CarltonOne.

Faegre Drinker appoints funds partner in London

Faegre Drinker has appointed Michelle Moran as a partner in the law firm’s investment management group in London. Her practice covers all aspects of fund management, including UCITS, hedge funds, private funds and credit funds.

Moran previously led the London asset management and investment funds practice at an international law firm.

Moran is an advisor to European and American clients on establishing, authorising, managing and distributing retail and institutional investment funds in the UK, Ireland, Luxembourg, and Jersey. Her experience spans transactions involving investment managers, brokers, custodians, fund service providers and operating platforms.

Thoma Bravo eyes private debt for $3.5bn ConnectWise financing

Thoma Bravo is reaching out to private credit lenders as it looks to secure approximately $3.5bn in new financing for its automated professional services provider, ConnectWise, according to a report by Bloomberg.

The report cites unnamed sources familiar with the matter as confirming that the financing will be used to refinance existing debt and fund an acquisition. Direct lenders are being asked to provide leverage exceeding seven times the combined company’s earnings, according to Bloomberg’s sources with Thoma Bravo also in discussions with banks over the financing.

While banks typically offer the lowest pricing, putting pressure on private credit lenders, direct lenders can compete by offering higher leverage. According to PitchBook data, banks’ broadly syndicated first-lien loans have averaged less than five times leverage over the past year.

The ongoing competition between banks and private credit for financing leveraged companies has recently seen traditional lenders regain some lost ground. However, securing the ConnectWise deal would signify a shift in the company’s capital structure away from banks and a victory for the $1.7 trillion private credit industry.

Details of the deal are subject to change, according to Bloomberg’s sources.

Thoma Bravo acquired ConnectWise in 2019 and secured a $1.1bn credit package in 2021, priced at 350 basis points over the benchmark, led by Bank of America Corp, to refinance private credit, according to Bloomberg data.

This financing effort follows an unsuccessful attempt to sell the company more than a year ago, according to one source. In a market where private equity sponsors have struggled to offload portfolio companies, many have turned to private lenders to facilitate add-on acquisitions or dividend recapitalisations.

Stocks making the biggest moves premarket: DraftKings, Carvana, Southwest Airlines, Planet Fitness and more

Ranked: The 10 Most Visited Countries in 2023

Published

21 seconds ago

on

June 10, 2024

See this visualization first on the Voronoi app.

Ranked: The 10 Most Visited Countries in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The development of commercial aviation over the last few decades has made much of the world accessible to many. In 2023 alone, global inbound tourist arrivals reached 1.3 billion.

This graphic depicts the most visited countries in 2023, based on the total number of foreigners entering each country. The data is from to The World Tourism Organization (UN Tourism) and the National Immigration Administration of China.

Europe is the Top Destination

Europe is the most sought-after destination, drawing the most international visitors worldwide. Seven of the top 10 destinations are in the region.

At the top of the list, France received 100 million visitors last year. The country is expected to repeat the number in 2024, influenced mainly by the 2024 Paris Olympics taking place in July and August.

RankCountryRegionTourists (millions) 1🇫🇷 FranceEurope100 2🇪🇸 SpainEurope85 3🇺🇸 United StatesNorth America67 4🇮🇹 ItalyEurope57 5🇹🇷 TürkiyeEurope/Asia55 6🇲🇽 MexicoNorth America42 7🇬🇧 United KingdomEurope37 8🇨🇳 ChinaAsia36 9🇩🇪 GermanyEurope35 10🇬🇷 GreeceEurope33

Spain followed France with 85 million visits in 2023, and the United States came in third place with 67 million tourists arriving in that year.

China has been among the top destinations for years, but the number of visitors has dropped drastically in recent years due to COVID-19 restrictions. Foreign visitors to China dropped from 65.7 million in 2019 to only 35.5 million in 2023 after the country adopted stringent restrictions.

No African, South American, or Oceanian countries appear on our list.

If you enjoyed this post, check out Visualized: The World’s Busiest Airports, by Passenger Count. In this graphic, we use data from Airports Council International (ACI) to rank the top 10 busiest airports in the world.

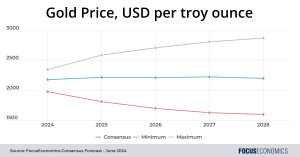

Fresh gold price forecasts following May’s record highs

Our gold prices forecast points to a bull run

Gold prices hit a record of over USD 2,400 per troy ounce in mid-May. The commodity is up by around 20% over the last year and is up by close to 50% since late 2022, and is now nearly double the level that prevailed for much of the 2010s. Two key factors are at play behind this bull run. The first is smoldering geopolitical tensions amid U.S.-China frictions and wars in the Middle East and Europe, which have stoked safe-haven demand. The second—and perhaps most important—is central bank purchases. Monetary authorities snapped up more than 1,000 tons of the metal in 2022 and 2023, around double the average of the prior decade, and gobbled up a record amount in Q1 2024 as they looked to diversify their reserves and hedge against potential currency depreciation. These drivers outweighed a strong U.S. dollar and high interest rates, which generally tend to weigh on gold prices.

Price projections are bright

Our panelists have become increasingly optimistic on the outlook so far this year: Our average gold prices forecast for 2024–2028 is about 10% higher now than back in January. The metal in the coming years will remain—for the first time in history—comfortably above USD 2,000 per troy ounce, according to our gold price forecast. The drivers of this bright projection are manifold. Firstly, gold jewelry consumption is set to rise globally as emerging market consumers become ever-wealthier. Moreover, geopolitical risk will likely remain, spurring safe-haven demand. Furthermore, the growth of high-tech manufacturing will also require more gold; the metal is used in most automobiles and consumer electronics. Finally, production of the metal is seen as fairly stagnant ahead, as declining grades and the depletion of mine reserves offset the impact of new mines and expansions.

The outlook for silver prices, gold’s sister metal, is also upbeat

Gold and silver prices tend to move in close correlation, given that both are used in jewelry and as investment and safe-haven assets. As with gold prices, silver prices peaked in mid-May at an over-decade high, and are seen at historically elevated levels of over USD 25 per troy ounce over our forecast horizon to 2028. But silver has one crucial difference to gold: It is more widely used in industry, particularly in high-growth sectors such as solar panels and electric cars, which