Around 99.9% of investors voted in favour, with just 0.02% voting against the repurchase of shares at 1p each. The tender offer plans, first revealed last month, are part of a ‘seven-year promise’ from OIT made at its IPO in 2018. OIT’s board promised shareholders at the time it would give them the opportunity to realise the value of their investment at net asset value, excluding costs, in the seventh year after the listing and every seven years thereafter. Odyssean investment trust proposes tender offer as part of ‘seventh year’ promise According to a stock exchange notice on W…

First Solar is the clean tech sector’s meme stock bet

Standard DigitalWeekend Print + Standard Digital

wasnow $75 per month

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Pictet AM’s Paolini: AI productivity gains to be offset by other factors in the next five years

In January this year, the International Monetary Fund stated that around 60% of jobs in advanced economies would be impacted by AI, with around half benefiting from AI integration, which is expected to bolster productivity. Separately, speaking at the Future of Investment Festival on Wednesday (5 June), Royal London Asset Management head of sustainable investments Mike Fox argued generative AI would impact the latest round of technology products. This includes Apple’s next iPhone cycle, which is expected to focus development in this area. Pictet launches investment research institute …

Hope of a commodities boom rests in inflation, not China

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

In Search of the Exclusion Premium

Cheng-En Li, Research Analyst at MainStreet Partners, explores how market performance of large-cap companies is influenced by poor ESG practices.

While grappling with uncertainty in capital markets caused by the exacerbation in inflation, mounting policy rates, and geopolitical tensions in 2023 and 2024, many institutions are now looking to align themselves more closely with good ESG practices in response to increased regulation and market demand. But a question in the mind of any investor is how ESG-related controversial behaviours can affect performance over the medium term.

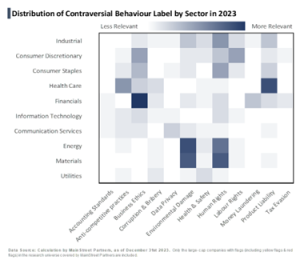

Recently, we conducted research analysing data from 2023 to investigate this relationship between ESG behaviour and capital market performance, using the MSCI ACWI large-cap index as a benchmark. The study first examined whether the share prices of companies flagged for negative ESG behaviour show any discernible trends over the ensuing six months and over the full year in 2023. We then analysed the distribution of companies that have been flagged to determine if certain industries are more prone to ESG-related controversies.

Furthermore, leveraging sector return data, we assessed the performance implications of flagged companies in various industries, examining whether such industries underperform and if there is evidence of an ‘exclusion premium’. This is when outperformance is generated by ‘being selective’ and excluding companies with relevant ESG-related controversial behaviour.

Finally, we created sub-universes based on different ESG flags to explore how incorporating ESG behaviour into investment strategies can enhance performance and mitigate risk.

The findings indicate that this approach may affect the risk and return profiles of large-cap firms.

Negative impact of ESG controversies

ESG controversies/negative ESG behaviour refers to company practices that raise ethical, environmental or social concerns. We developed a framework to classify controversial events based on severity. The framework has five key performance indicators — scale, frequency, response, effectiveness, and transparency — to rate the news for the company with numeric score (ie, severity score) ranging from one to five; the company is assigned a yellow flag/red flag once the severity score exceeds the corresponding threshold.

We would then issue a red flag to a company that has engaged in any controversy that poses a significant threat to the company’s business and future performance, alternatively issuing a yellow flag to a company if the controversy is likely to develop into a material ESG risk.

Among the companies that were newly flagged in 2023, those with controversies over accounting standards and human rights

New Capital’s Sam Glover: This US-Europe interest rates pattern could be an intriguing signal

There is a pattern emerging that investors might want to delve into given what it could mean for European equities. Back in 1993, central banks across Europe such as the Bundesbank were cutting interest rates owing to lacklustre economic growth, while across the Atlantic, the US economy was performing strongly and the Federal Reserve was gearing up to increase its policy rate. This rather rare divergence of the interest rate path between the two regions proved to be a potent combination for equity returns across the European continent in the mid-1990s. ECB cuts interest rates for t…

Storage Systems can Empower Emerging Markets

Andrea Webster, Senior Advisor at SustainFinance, says innovation must disrupt the status quo in traditional energy systems.

Idealists imagine clean renewable energy powering a content and peaceful world around us. Solar panels adorn rooftops and wind turbines swoop to catch the breeze. Reality paints a very different picture; we not only need to re-think and re-engineer the world around us, we also need to persuade many people it is a priority that needs paying for. While the cost of renewable energy is falling, resistance to re-engineering our daily lives is growing.

This is a battle for the narrative. One size does not fit all and motivations to embrace change differ depending on where you are sitting in the world.

For developed economies, the energy transition means replacing existing reliable but high-carbon energy sources with a clean and affordable alternative. Meeting national net zero commitments creates the imperative; however rises in inflation, interest rates and supply chain woes have pushed up the cost of living and reset priorities. We are seeing this reflected in politics with a move to the right.

For developing economies, the challenge is building new sources of affordable energy to meet increasing demand. Reliable energy is fundamental to economic development because it generates prosperity which ultimately helps underpin social order. Providing reliable, clean supply to millions on a low income is a political challenge for many governments.

Fundamental changes

While the global push toward renewable energy has made remarkable strides, with solar and wind power leading the charge, it is simply not fast enough. This was finally acknowledged in Dubai, reaching a new level of global consensus on the need to tackle climate change. COP28 did not go far enough for the scientists, but it was historical in its commitment to phase down unabated coal power. This text will translate into a scaling of fundamental changes in how electricity is generated, stored and distributed; in other words, it will accelerate the structural shifts taking place in electricity supply across the world.

Within the electricity supply chain, energy storage stands out as the crucial piece in building trust with end users and governments to reshape our power supply systems. Robust storage is needed to integrate and manage renewable energy sources to smooth out the intermittent nature of renewable generation. Being able to manage the peaks and troughs of changing user demands and ensuring a reliable power supply from

Saudi Aramco prices stock offer at low end of range in $11.2bn sale

Standard DigitalWeekend Print + Standard Digital

wasnow $75 per month

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

PE sector facing years of lower returns

Private equity leaders are cautioning that the industry is likely to face years of lower returns as they work to sell off assets accumulated during the investment boom of the coronavirus pandemic, according to a report by the Financial Times.

Following a period of rapid growth and record fundraising, buyout groups are now challenged with exiting investments in unsold companies worth trillions of dollars. Many of these deals were made during the low interest rate and high market valuation period of 2021 to 2022.

The report quotes Pete Stavros, KKR’s co-head of global private equity, as saying at the SuperReturn industry conference in Berlin: “During that period, rates were low and valuations were high. These are going to be tough vintages. They’re probably going to underperform.”

As well as navigating the challenge of selling off over $3tn worth of companies as they look to investors, fund managers are also sitting on $3.9tn of un-deployed capital, or “dry powder,” according to a mid-year report from consultancy Bain & Co.

Executives at the conference suggested that the industry needs to adapt by focusing on deals where funds can drive operational or strategic improvements to generate profits. This includes deals such as carving out divisions from larger companies or investing in founder-owned businesses.

Marc Nachmann from Goldman Sachs emphasised that the industry’s previous model of paying high prices for companies using cheap debt and selling them at higher prices within a few years “won’t work in the next 10 years.”

MFA names Head of EMEA Government Affairs

MFA, the trade association for the global alternative asset management industry, has appointed Rob Hailey as Managing Director, Head of Europe, Middle East and Africa (EMEA) Government Affairs.

In his new UK-based role, Hailey will lead MFA’s London and Brussels offices. He will also oversee MFA advocacy in the Middle East.

Hailey most recently led Bank of America’s government affairs in the UK and Ireland, having previously spent a decade at Lloyds Banking Group, where he led a team focused on public policy issues, policy research, EU affairs and regulatory affairs. He has also held government affairs roles at Banco Santander in London and Madrid, and at British bank HBOS.