Whitmore announced he was leaving Jupiter after 17-years back in January, but the firm confirmed today (5 June) that his final day would now be “at least” 31 October 2024. Originally, Whitmore had been set to leave at the end of July, but Jupiter said this had been extended to “facilitate a seamless handover with his successors”. Jupiter Merlin to retain £480m investment in Global Value fund after Whitmore exit The announcement of his departure has thrown up serious questions about the future management of his various portfolios. His Global Value fund was handed over to Brian Mc…

From Co-benefits to Core Benefits

Social impacts on local communities can make or break carbon sequestration projects.

The prime purpose of voluntary carbon markets (VCMs) is to limit climate change, by allocating capital to projects that offset, remove or avoid emissions through the generation and sale of credits. Despite controversies, VCMs are growing. A 2023 survey of businesses across the US, UK and Europe found that 89%…

Subscribe

Subscribe to ESG Investor to gain access to the leading platform for news, analysis, and interviews across sustainable investing. Select subscribe below to view our subscription packages or you can email us at subscriptions@esginvestor.net to discuss your options.

Request a Trial

Get in touch today to discuss a trial giving you unrestricted and unlimited access to ESG Investor for you and/or your team(s) for a limited period. Email us at subscriptions@esginvestor.net

Related Items:CARBON BUDGET, CARBON CREDITS, CARBON EMISSIONS, CARBON MARKETS, CARBON PRICING, CARBON TRADING, CLIMATE SOLUTIONS, DECARBONISATION, EMISSION REDUCTION, ENVIRONMENTAL, Featured, ICVCM, NATURE-BASED SOLUTIONS, SOCIAL, SOCIAL IMPACT, VCMs, VOLUNTARY CARBON MARKETS Recommended for you

Goldman-backed Starling says no plans to pursue EU bank license, expansion to come from software

Digital bank Starling will not re-apply for a European Union banking license and will instead pursue international expansion through its software business Engine, incoming CEO said. Engine is a software platform that Starling sells to other companies, so that they can set up their own digital banks. Raman Bhatia outlined the company’s international expansion plans, in his first public remarks since his March appointment as Starling CEO in March. Raman Bhatia, incoming chief executive officer of Starling. Bhatia moved over from OVO Energy Ltd., where he was CEO. Zed Jameson | Bloomberg | Getty Images

AMSTERDAM — Digital bank Starling will not re-apply for a European Union banking license and instead pursue international expansion through its software business, the incoming CEO said, in a diverging approach to overseas growth from some of its rivals.

Starling is among the U.K.’s breed of so-called “neobanks” — digital-only banks that usually have no branches. It started life in 2014, has racked up 4 million customers and was last officially valued at £2.5 billion ($3.2 billion).

The digital bank, which is backed by Goldman Sachs, has traditional offered banking services, like current accounts and more recently lending. Starling’s customers are mainly in the U.K. The company sought to expand abroad by applying for an Irish banking license, which would have given the bank access to the European Union market. Starling withdrew that application in 2022.

Raman Bhatia outlined the company’s international expansion plans on Wednesday, in his first public remarks since his appointment as CEO in March, taking over from founder Anne Boden.

Bhatia said that the company has no plans to re-apply for the EU banking license to push into new countries. Instead, international expansion will be driven by Engine, a software platform that Starling sells to other companies, so they can set up their own digital banks.

“I am very bullish about this approach around internationalization of what is the best of Starling, the proprietary tech versus market by market, idiosyncratic regulatory regime, capital requirements, and building trust and brand extension, which is unproven for any plan,” Bhatia said during a fireside chat at the Money 2020 conference moderated by CNBC.

He described opportunities in places like Thailand and the Middle East as “immense.”

Engine is a unique model amongst neobanks, which have tended to pore

CNBC

How to recognise a slowdown

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Why EU countries are nervous about funding a US loan to Ukraine

This article is an onsite version of our Europe Express newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday and Saturday morning. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning. A scoop to start: Gazprom will probably need more than a decade to recover gas sales lost to European markets as a result of Russia’s full-scale invasion of Ukraine, according to a confidential internal report seen by the FT.

Today, our finance correspondent previews the EU discussion over whether to back a US loan to Ukraine, and our climate correspondent asks whether yesterday’s tame farmers’ rally in Brussels marked the end of their successful protest season.

Listen to the last two episodes of Untold: Power for Sale, a podcast series from the Financial Times looking into Qatargate, an alleged corruption scandal that exposed major flaws in how European democracy works. Available on Apple Podcasts, Spotify or wherever you get your podcasts.

Moneyball

Should the EU agree to repay a US loan to Kyiv using future cash siphoned off from immobilised Russian sovereign assets? That’s the question being weighed up by the bloc’s finance ministers today, writes Paola Tamma.

Context: EU finance ministers meeting virtually today are weighing up a US proposal to advance cash to Ukraine with a loan leveraged against the forthcoming profits derived from Kremlin assets immobilised in the wake of its full-scale invasion of Ukraine in February 2022. Most of that cash pile is in the EU.

Any such scheme would need the backing of all EU countries. That’s already a tall order, but there’s more: Even if member states give their blessing to the scheme being discussed by G7 countries, a requirement to unanimously renew sanctions every six months would give any government in the bloc a chance to halt the scheme, with potentially ugly consequences for Ukraine and western credibility.

According to a leaked discussion paper for today’s meeting, Washington could issue the loan if the EU finds a way to get around this twice-yearly confirmation. This would also require unanimous approval.

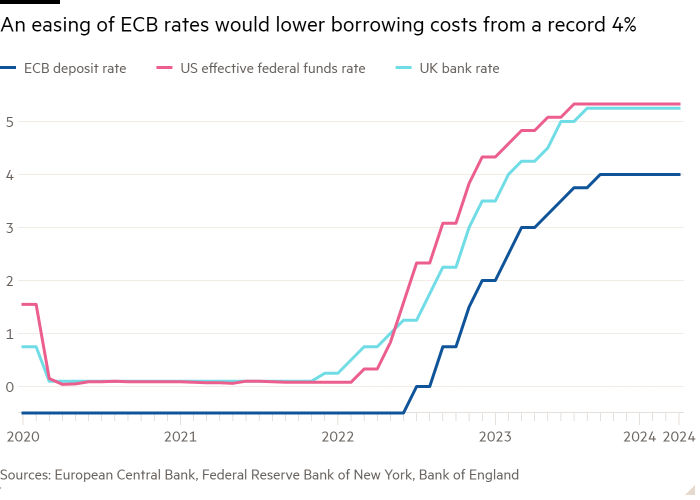

Aside from vetoes, there are other issues making some capitals this side of the pond nervous about backing the US scheme: crucially, who would be on the hook if the profits from Russian assets, which are meant to repay the loan, fall short of the total loan value. That’s not impossible given that once interest rates start coming down, the proceeds will slow.

The burden sharing

Gazprom badly hurt by Ukraine war, says company-commissioned report

Standard DigitalWeekend Print + Standard Digital

wasnow $75 per month

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

‘Spaghetti cannon’ filings for 25 hot-trend ETFs prompt concerns

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

A US exchange traded fund issuer may have hit “peak 2024” with plans to launch 25 ETFs that would combine two of the hottest current trends — leveraged exposure and option-selling covered calls.

New York-based GraniteShares has filed to launch a family of “YieldBoost” ETFs, many of them based on single stocks, that would sell put options on leveraged ETFs — again many single stock — issued by rival providers.

The ETFs would potentially benefit from significant option-writing premium income, but would combine a capped capital return with an uncapped downside risk from the underlying leveraged exposure.

“I was shocked by the filing,” said Bryan Armour, director of passive strategies research, North America, likening it to a “spaghetti cannon”.

“Product development has gone down the path of throwing as much spaghetti at the wall as possible, then seeing what sticks,” Armour added.

“Wow, this is peak 2024,” added Elisabeth Kashner, director of global fund analytics at FactSet.

GraniteShares’ proposed ETFs would invest in a range of single assets, from individual stocks, such as each of the Magnificent Seven, to bitcoin, gold, volatility and a selection of stocks indices and sectors.

They would then sell put options on ETFs leveraged between 1.5 and 3 times issued by providers such as Direxion and ProShares. The collateral would be primarily invested in fixed income instruments.

The maximum gain would be the premium income earned from selling the options, plus “a limited amount of upside appreciation” up to the option’s strike price — assuming the underlying ETF rises in price to this level.

However, investors would be fully exposed to any loss suffered by the underlying ETF — which could easily be chunky given its leveraged nature — only cushioned by the premium income, which is banked whatever happens.

As such, the proposed YieldBoost ETFs tap into two of the hottest trends in the US ETF market.

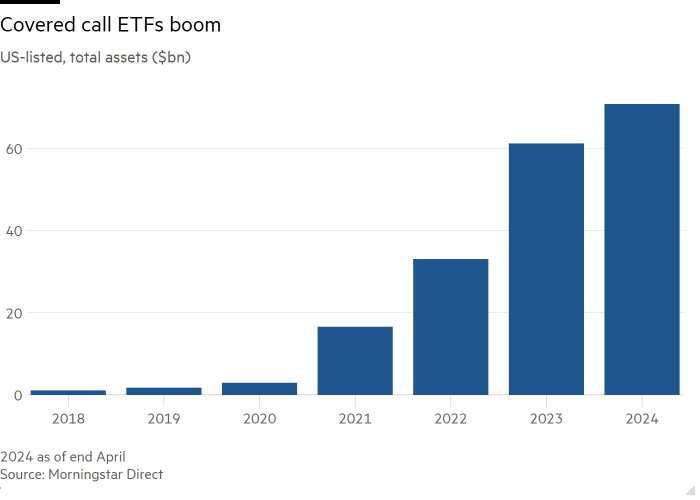

Option-selling covered call ETFs have boomed in recent years, as epitomised by JPMorgan’s wildly popular Equity Premium Income ETF (JEPI), which has surged to $33.6bn in assets, rendering it the world’s most popular active ETF.

US-listed ETFs classified as “derivative income” by Morningstar Direct, which includes most covered call vehicles, hit a record $70.7bn in assets at the end of April, up from just $3bn at the end of 2020.

Leveraged and inverse ETFs have also attracted more attention, even

Citadel and BlackRock back project to start a national stock exchange in Texas

TXSE Chairman and CEO James Lee said the Dallas-headquartered group has raised $120 million with the support of more than two dozen investors. The Wall Street Journal reported on the endeavor earlier, saying the exchange is billing itself as a “more-CEO friendly” alternative to the New York Stock Exchange and Nasdaq in the face of rising regulation. TXSE’s website said it will be a “fully electronic, national securities exchange that will seek registration with the U.S. Securities and Exchange Commission.” The Texas flag is seen before the game between the Houston Cougars and the Texas Longhorns at TDECU Stadium on Oct. 21, 2023 in Houston. Tim Warner | Getty Images Sport | Getty Images

BlackRock and Citadel Securities are among investors backing a group seeking to start a new national stock exchange in Texas.

TXSE Chairman and CEO James Lee said the Dallas-headquartered group has raised $120 million with the support of more than two dozen investors.

“Texas’s booming economy and the strong economic and population growth among states in the southeast quadrant of the U.S. present incredible opportunities for businesses — and ultimately the Texas Stock Exchange,” TXSE CEO James Lee said on LinkedIn.

The Wall Street Journal reported on the endeavor earlier, saying the exchange is billing itself as a “more-CEO friendly” alternative to the New York Stock Exchange and Nasdaq in the face of rising regulation and a “disaffection with increasing compliance costs.”

A contested Nasdaq rule requires listed companies to disclose diversity information on their board of directors. The SEC approved the plan in 2021, but it now faces a new challenge in a federal appeals court.

TXSE’s website said it will be a “fully electronic, national securities exchange that will seek registration with the U.S. Securities and Exchange Commission.” The TXSE is aiming to start trading in 2025 and host listings in 2026, according to the Journal’s report.

The Dallas Morning News reported TXSE will target companies in the “southeastern quadrant of the U.S.” In an interview with the newspaper, Lee thanked Texas Gov. Greg Abbott for his support and leadership.

CNBC

Fintech firm Nium cuts valuation by 30% in new funding round, eyes 2025 IPO

Financial technology startup Nium told CNBC Wednesday it raised $50 million in a fundraising round was led by an undisclosed Southeast Asian sovereign wealth fund. The round, backed by venture capital firms BOND, NewView Capital, and Tribe Capital, values the company at $1.4 billion — a 30% discount to its previous valuation. Despite the lower valuation, Nium is confident it can go public in the next 18 months and is eyeing the third or fourth quarter of 2025 for its stock market debut. Westend61 | Westend61 | Getty Images

AMSTERDAM, Netherlands — Financial technology startup Nium told CNBC Wednesday it raised $50 million in new funds from investors, and is targeting an initial public offering in the next 18 months.

The fundraising round was led by an undisclosed Southeast Asian sovereign wealth fund and backed by venture capital firms BOND, NewView Capital, and Tribe Capital.

It places Nium’s valuation at $1.4 billion. That marks a 30% discount to its previous valuation of $2 billion, which the firm notched in 2022 when it last raised external venture capital.

Prajit Nanu, Nium’s CEO and founder, said the firm would use the fresh capital to double down on mergers and acquisitions, targeting other growth-stage payment firms.

Nanu said his company’s down round was the result of a broader depression in public market valuations of fintech companies.

Fintechs have seen their stock prices slashed in recent years as a result of macroeconomic pressures, including high inflation and rising interest rates.

“Being realistic, when we raised in early 2022, public markets were killing it,” Nanu said. “The public markets have not been kind to fintech.”

IPO in 18 months

Nanu said that, despite the lower valuation, he is still bullish on the growth story for Nium and is confident the company will go public in the next 18 months, targeting a flotation in the third or fourth quarter of 2025.

He added that valuation isn’t a concern for him and that it won’t matter what value the company prices its shares as markets are volatile by nature.

“Whether you go public at $1 billion, $5 billion, it doesn’t matter. Because the valuation is only when you get bought, or when you go through an IPO,” he said.

He noted the example of Stripe, which raised a $95