ADP reported that companies added 152,000 jobs in May, fewer than the downwardly revised 188,000 in April and below the Dow Jones consensus estimate for 175,000. Nearly all the hiring came from the services sector, with goods producers contributing just a net 3,000 to the total. Trade, transportation and utilities led with 55,000 new jobs, while education and health services added 46,000, and construction contributed 32,000.

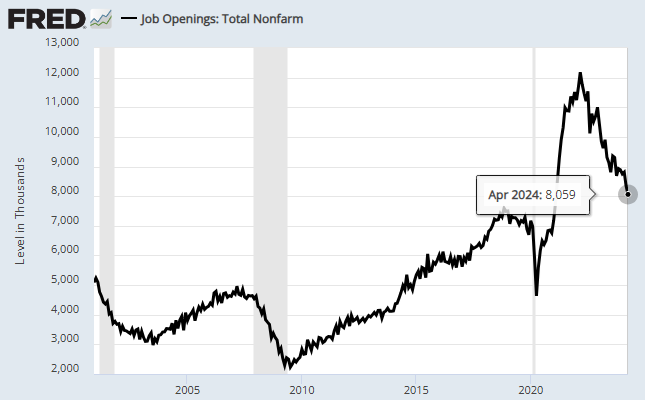

Private job creation slowed more than expected in May, according to a report Wednesday from ADP that signals further sluggishness in the labor market.

The payroll processing firm said that companies added 152,000 jobs on the month, fewer than the downwardly revised 188,000 in April and below the Dow Jones consensus estimate for 175,000. This was the lowest monthly level since January.

Along with the slowdown in job creation, annual pay growth gains held at a 5% rate, where they have been for three months running.

“Job gains and pay growth are slowing going into the second half of the year,” ADP’s chief economist, Nela Richardson, said. “The labor market is solid, but we’re monitoring notable pockets of weakness tied to both producers and consumers.”

A bartender prepares drinks in Le Central restaurant in San Francisco, California, US, on Tuesday, May 7, 2024. David Paul Morris | Bloomberg | Getty Images

Nearly all the hiring came from the services sector, with goods producers contributing just a net 3,000 to the total.

Trade, transportation and utilities led with 55,000 new jobs, while education and health services added 46,000, and construction contributed 32,000. The other services category added 21,000, but leisure and hospitality, a leading contributor over the past several years, saw a gain of just 12,000.

A number of sectors saw job losses on the month.

Manufacturing, which has been in contraction for most of the past year and a half, lost 20,000 jobs. Others seeing decreases included natural resources and mining (-9,000), information (-7,000), and professional and business services (-6,000). Small business also saw a decline, with companies employing between 20 and 49 workers down 36,000.

The report comes two days ahead of the more closely watched nonfarm payrolls count from the Bureau of Labor Statistics. ADP sometimes can provide a preview of what’s ahead in the BLS

CNBC