London-based private equity giant Hg has agreed to acquire AuditBoard, a cloud-based platform for audit, risk, compliance and ESG management, in a transaction valued at over $3bn including debt.

The acquisition is being led by Hg’s San Francisco-based office, which opened in 2022.

AuditBoard was founded in 2014 and serves more than 2,000 enterprises, including nearly 50% of the Fortune 500, according to a press statement. The California-based company reached $200m in annual recurring revenue late last year.

Scott Arnold, CEO of AuditBoard, described the acquisition as “further validation of our practitioner-first focus”.

Get the week’s top news delivered directly to your inbox – Sign up for our newsletter

Alan Cline, Head of North America at Hg, added that AuditBoard was “exactly the type of business we partner best with – one that truly knows its customers and innovates to bring them the best possible products”.

Goldman Sachs & Co and Cooley are advising AuditBoard.

Family offices in North America allocate 35% of the average portfolio to private equity, the…

Funds advised by European mid-market private equity firm Triton have agreed to sell BlitzLuxCo,…

Paris-based private equity firm Jeito Capital will sell its portfolio company HI-Bio, a…

HMC Capital acquires Payton Capital for $127.5m (AUD)

Australian alternative asset manager HMC Capital has entered the private credit sector with an AUD127.5m acquisition of Melbourne-based real estate fund manager Payton Capital, according to a report by the Australian Financial Review.

The deal, a combination of cash and stock, will be financed through a AUD100m institutional investor raise and a AUD30m share purchase plan, offering shares at $6.50 each. HMC also sold a 2% stake in its HomeCo Daily Needs REIT for AUD50m to support the acquisition.

Payton manages about AUD1.5bn in commercial real estate credit.

Get the week’s top news delivered directly to your inbox – Sign up for our newsletter

David Di Pilla, Founder, Group CEO, and Managing Director at HMC, described the opportunities in private credit as “too big to ignore”.

He added: “Ultimately, this comes down to the ability to do large complex transactions and to have the relationships to be able to get access to those transactions.

If you look at the history of HMC, it’s been built on doing the largest, most complex transactions in Australia – so this is a natural fit for our skill set.”

Alternative Credit Investor reported that the acquisition is the first step in HMC’s plans to establish an AUD5bn private credit asset management platform which will span real estate, corporate, mezzanine and infrastructure loans in the medium-term.

Family offices in North America allocate 35% of the average portfolio to private equity, the…

Funds advised by European mid-market private equity firm Triton have agreed to sell BlitzLuxCo,…

Paris-based private equity firm Jeito Capital will sell its portfolio

Here’s why the minimum wage and some tax breaks don’t budge despite inflation

Annual 401(k) plan contribution limits and federal income tax brackets get an inflation adjustment each year. However, many common financial mechanisms like the minimum wage aren’t indexed to inflation. Others include financial thresholds tied to taxes on Social Security benefits, accredited investors and certain tax deductions. Martin Barraud | Ojo Images | Getty Images

Many Americans are likely familiar with financial thresholds that are adjusted for inflation each year.

They include contribution limits to 401(k) plans, cost-of-living adjustments for Social Security benefits and federal income tax brackets, to name a few.

These tweaks help households keep pace with the rising cost of living.

For example, without adjustments, more households would generally creep into higher tax brackets over time and the buying power of Social Security beneficiaries would fall.

But some thresholds, like the federal minimum wage, aren’t inflation-adjusted.

What is and isn’t inflation-indexed largely depends on lawmakers’ whims when they drafted respective legislation, said Bill Hoagland, senior vice president at the Bipartisan Policy Center. “It’s all over the map,” he said.

Inflation adjustments can be a “double-edged sword,” said Mark Zandi, chief economist at Moody’s Analytics.

During times of high inflation as in 2022, the lack of an adjustment “could quickly become a financial problem” for households, Zandi said.

If everything were indexed, however, it’d be more difficult “to get inflation back in the bottle when everything takes off,” he added.

Here are some common thresholds that don’t get an annual inflation adjustment.

Minimum wage

The federal minimum wage — $7.25 an hour — has remained unchanged since 2009.

That’s the longest period in history without an increase from Congress, according to the Economic Policy Institute, a left-leaning think tank.

The minimum wage has lost 29% of its value since 2009 after accounting for the rising cost of living, according to an EPI analysis. It’s worth less than at any point since February 1956, the group found.

That said, just 1.3% of all U.S. hourly workers (about 1 million people total) were paid wages at or below the federal minimum in 2022, according to the Bureau of Labor Statistics. That’s “well below” the 13.4% share in 1979, it said.

Thirty states plus the District of Columbia have adopted a higher minimum for

CNBC

A year after a failed IPO, WE Soda has lost its fizz

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Satori Capital makes Automatic Fire Protection acquisition

Texas-based private equity firm Satori Capital has invested in Automatic Fire Protection, a provider of fire sprinkler and alarm systems in Texas.

The company’s services include installation, maintenance and inspections for sprinkler, alarm and extinguisher systems.

According to a press statement, AFP maintains the oldest active fire sprinkler license in Texas and employs around 150 employees. AFP said that it had “a leading position in each of its three core markets, a long-standing reputation for quality, and a state-of-the-art training facility to maintain and develop its team members’ technical skills”.

AFP’s CEO, Mike PeCoy, who joined the company in 2002, will continue in his role following the acquisition.

Cerberus acquires Calspan’s hypersonics and test systems units

Cerberus Capital Management has launched North Wind, a business focused on hypersonic test capabilities in the US, following the acquisition of Calspan’s hypersonic and defence test systems business units from TransDigm Group.

North Wind, which is headquartered in Minnesota, will focus on ground-based facility design, build and operations, testing and analysis.

According to a press statement, the business is “uniquely positioned to serve the demands of its customers with high-quality, customised engineering services and integrated solutions”.

The acquisition and subsequent formation of North Wind were led by Cerberus’ supply chain and strategic opportunities platform, which acquires and invests in companies addressing supply chain shortages, defined by critical long-term US national security requirements.

David Meier, who has been the President and CEO of Calspan Aero Systems Engineering since 2015, will lead North Wind as CEO, while Stephanie Mumford, President of Calspan Systems since 2016, will assume the same role albeit of the North Wind Systems business unit headquartered in Newport News, Virginia.

Dr Anthony Castrogiovanni, a technologist in the hypersonics industry who has served as Calspan’s CTO since 2021 and previously founded ACEnT Laboratories, will assume the role of CTO for North Wind.

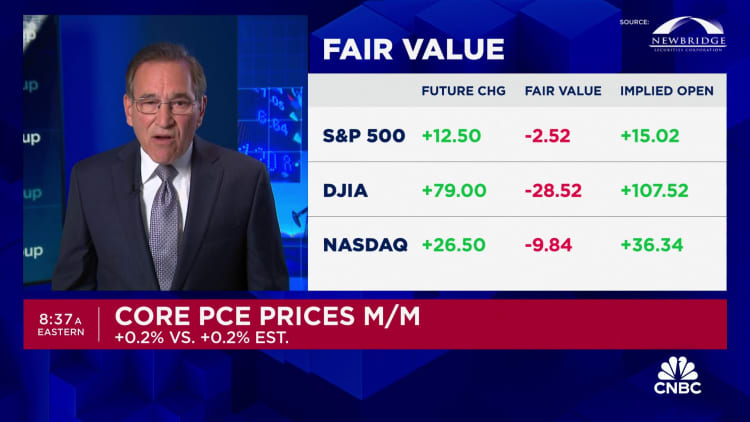

The Fed’s preferred inflation measure rose 0.2% in April, as expected

The personal consumption expenditures price index excluding food and energy costs increased 0.2% in April and 2.8% from a year ago. Headline PCE rose 0.3% and 2.7%, respectively, in line with estimates. Personal income increased 0.3% on the month, matching the estimate, while spending rose just 0.2%.

Inflation rose about as expected in April, with markets on edge over when interest rates might start coming down, according to a measure released Friday that is followed closely by the Federal Reserve.

The personal consumption expenditures price index excluding food and energy costs increased just 0.2% for the period, in line with the Dow Jones estimate, the Commerce Department reported.

On an annual basis, core PCE was up 2.8%, or 0.1 percentage point higher than the estimate.

Including the volatile food and energy category, PCE inflation was at 2.7% on an annual basis and 0.3% from a month ago. Those numbers were in line with forecasts.

Fed officials prefer the PCE reading over the more closely followed consumer price index, which the Labor Department compiles. The Commerce Department measure accounts for changes in consumer behavior such as substituting less expensive items for costlier alternatives, and has a wider scope than the CPI.

“The core index came in at 2.8%. That’s fine, but it’s been trading in a range for five months now, and that’s pretty sticky to me,” said Dan North, senior economist for North America at Allianz Trade. “If I’m [Fed Chair Jerome] Powell, I’d like to see that start moving down, and it’s barely creeping. … I’m not reaching for the Pepto yet, but I’m not feeling great. This is not what you want to see.”

A 1.2% rise in energy prices helped push up the headline increase. Food prices posted a 0.2% decline on the month.

Goods prices rose 0.2% while services saw a 0.3% increase, continuing a normalization trend for an economy in which services and consumption provide much of the fuel.

Along with the inflation reading, Friday’s release included data about income and spending.

Personal income increased 0.3% on the month, matching the estimate, while spending rose just 0.2%, below the 0.4% estimate and off March’s downwardly revised 0.7%. Adjusted for inflation, the spending numbers showed a 0.1% decline, due in large part to a 0.4% decrease in spending

CNBC

MiddleGround Capital completes LS Starrett Company take-private deal

The LS Starrett Company, a manufacturer of precision measuring tools, cutting equipment and metrology systems, has been taken private by an affiliate of private equity firm MiddleGround Capital in an all-cash transaction.

Founded in 1880 by Laroy S Starrett and incorporated in 1929, the LS Starrett Company caters for the industrial, professional and consumer end markets.

The company will operate as a wholly owned subsidiary of MiddleGround, which has over $3.5bn of AUM and makes control equity investments in middle market business-to-business industrial and specialty distribution businesses.

Lincoln International advised Starrett.

Bill Ackman selling stake in Pershing Square at $10.5 billion valuation, aiming for IPO one day

Bill Ackman’s firm is raising $1.05 billion in a funding round, worth 10% of his management company Pershing Square, according to a source familiar with the matter. The hedge-fund manager is eyeing an initial public offering in the U.S. down the road, but he hasn’t hired bankers or started that process officially yet, the source said. Bill Ackman, Pershing Square Capital Management CEO, speaking at the Delivering Alpha conference in New York City on Sept. 28, 2023. Adam Jeffery | CNBC

Billionaire investor Bill Ackman is selling a 10% stake in Pershing Square, aiming to eventually take his investment firm public.

Ackman’s firm is raising $1.05 billion in a funding round, worth 10% of the management company and implying a valuation of $10.5 billion, according to a source familiar with the matter. Investors on the deal are institutional and family offices who prefer to remain anonymous, the source said.

The Wall Street Journal first reported on the moves. Pershing Square declined to comment.

With the funding round, the hedge-fund manager is eyeing an eventual initial public offering in the U.S., but he hasn’t hired bankers or started that process officially yet, the source said.

Two years ago, Ackman named Ryan Israel chief investment officer, marking the first time the billionaire hedge-fund manager appointed someone else to run day-to-day investing for the firm. Ackman serves as CEO, with ultimate control over decision-making, although he has said that Israel would be his successor to run the firm if he got hit by a “pie truck.”

Pershing Square had $18.6 billion in total assets under management as of the end of April. Most of its capital is in Pershing Square Holdings, a closed-end fund that trades on European stock exchanges.

Ackman has become one of the world’s most prominent hedge-fund investors after years of market-topping returns and vocal activist campaigns. He also gained a wide following on social media platform X with 1.2 million followers, commenting on issues ranging from antisemitism to the presidential election.

Earlier this year, Ackman unveiled plans to offer a new investment vehicle listed on the New York Stock Exchange, a move to leverage his following among Main Street investors. He is launching a publicly traded closed-end fund, investing in 12 to 24 large-cap, investment-grade, “durable growth” companies in North America.

The popular investor’s hedge fund held

CNBC

BCP expands government services platform with Apogee acquisition

Services and infrastructure-focused private equity management firm Bernhard Capital Partners has acquired technology solutions provider Apogee Engineering for its government services platform.

Financial terms of the transaction have not been disclosed.

According to a press statement, Apogee offers services and solutions focused on its “four core competencies – digital transformation, science and technology, adaptive acquisition, and program management – to a diversified and growing base of government clients”.

BCP established its government services platform in 2023 with the acquisition of Duotech Services. The platform aims to improve the efficiency, reliability, cybersecurity and modernisation of physical and technological platforms utilised by government personnel globally.