In a speech at the ECONDAT conference on 10 May, published by the BoE on Thursday (23 May), she said the inflationary episode of the last few years has prompted a “reappraisal of the evidence that is needed” to support policymaking during large economic shocks. However, in order to do so, the central bank needs to start from the “evidence itself”, as forecasting models are only “as good as the data that is fed into them”, Dhingra argued. Ben Bernanke calls on Bank of England to consider publishing interest rate projections For instance, the MPC member outlined that, had the BoE had…

UK retail sales fall 2.3% in ‘dull and wet’ April

According to data from the Office for National Statistics published today (24 May), there was a significant contraction compared to March, when retail sales fell by 0.2%. April saw sharp declines in household goods and non-food store sales, which dropped by 5.4% and 5.1%, respectively, while food store sales registered a more moderate decline of 0.8%. The drop in retail sales followed a “dull and wet month” that discouraged shoppers from making in-store purchases, the ONS said. Meanwhile, petrol sales also dropped by 4.9% in April, as more retailers reported a rise in fuel prices…

John Redwood will not stand as an MP in upcoming General Election

Writing in his personal blog today (24 May), the MP, who has held the role since 1987, said he has decided “not to put my name forward in the forthcoming election”. “I have other things I wish to do,” Redwood added, noting that his last day as an MP will be 30 May. Rishi Sunak confirms 4 July General Election In his 37 year parliamentary career, Redwood held several government posts, including secretary of state for Wales, minister within the Department of Environment, minister for trade and industry, and parliamentary under-secretary for trade and industry. He is also chief glo…

Franklin Templeton rebrands Metaverse UCITS ETF to include AI and blockchain

According to Franklin Templeton, the name change, effective from 7 June, has been made to “better reflect” the ETF’s exposure to multiple industries in the underlying index, which comprises publicly listed companies from around the world that are investing in the metaverse. In addition, the index methodology for the ETF will change to increase the number of companies it tracks from 60 to 75, given “this nascent segment is evolving, and more companies are qualifying for index inclusion”. Franklin Templeton launches three active fixed income ETFs At the same time, the Franklin AI, M…

Aviva Investors names Fraser Lundie global head of fixed income

He will report to CIO Daniel McHugh and hold overall responsibility for the global rates, investment grade, high yield, emerging market debt and global liquidity teams. Lundie joins from Federated Hermes, where he served as head of fixed income for public markets, first joining the firm in 2010 as a senior credit portfolio manager. Prior to that, Lundie began his career as an investment associate at Fortis Investments in Paris, where he also held portfolio management and senior positions within the fixed income team. Trio of Aviva Investors funds fail to deliver value to investors …

Deep Dive: Tight credit spreads on US corporates heightens domestic volatility risk

While the overall economic picture is improving, with inflation in developed countries falling closer to target, ongoing regional specific issues have amplified the credit risk of more economically sensitive firms, including in the US, according to Adam Whiteley, portfolio manager of the BNY Mellon Global Credit fund. Deep Dive: Divergence of MPC votes proves BoE’s avoidance of groupthink Whiteley said absolute yields on US corporate bonds “remain attractive” as the health of the US economy “appears to be advancing well”, with positives such as the International Monetary Fund projecti…

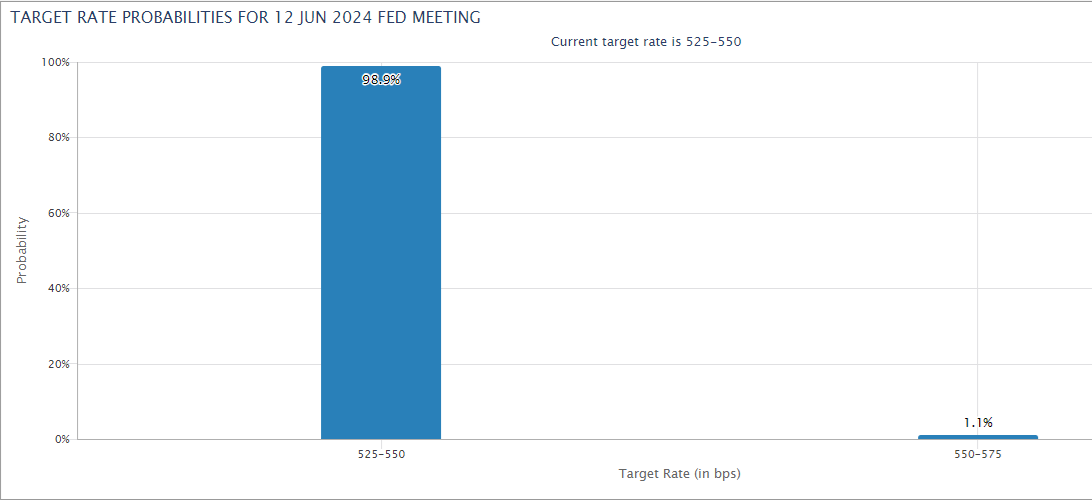

Fed Funds Futures Market Starts To Flirt With Rate Hike Possibility

The monetary policy outlook has been uncertain, but primarily in terms of the timing of the first rate cut. But that’s starting to change as Fed funds futures price in the possibility of a rate hike. To be clear, the implied probability for a hike is extremely low: no more than 1%. But the fact that market sentiment is pricing in any chance of a hike marks a shift.

It’s debatable if this shift is significant or just market noise. As for the central bank, Fed policymakers have communicated in recent months that rate hikes are unlikely while remaining cagey about the timing of rate cuts. Fed funds futures still don’t communicate any conflict with that outlook – the priced-in probabilities are still overwhelmingly skewing to no change or rate cuts for the next several FOMC meetings. For example, the market is estimating a roughly 50% probability for a rate cut at the Sep. 18 FOMC meeting, according to CME data. Meanwhile, confidence is high that the next Fed meeting (Jun. 12) will leave rates unchanged, although the slight possibility of a rate hike is peeking out with a 1.1% implied probability.

The policy-sensitive US 2-year Treasury yield is also pricing in a lower Fed funds target rate, which is currently 5.25% to 5.50%. By contrast, the 2-year yield yesterday (May 23) traded moderately lower at 4.91%. To be fair, the 2-year rate has been anticipating a rate cut for more than a year. In any case, this widely followed rate suggests the crowd is still erring on the side of rate cuts vs. hikes as the next policy change.

In recent days, however, economic data suggests the economy remains resilient, which suggests that it’s premature to dismiss the possibility of rate cut. Notably, PMI survey data for May indicates that the US economy rebounded sharply after April weakness. Meanwhile, jobless claims remain low, which implies that the labor market will continue to expand at a healthy pace in the near term.

The key variable is the path of inflation. The latest numbers show renewed signs of progress with disinflation, but the latest Fed minutes remind that while rate hikes are still a very low probability, the possibility is on the minds of policymakers, or so it appears if you read between the lines in the latest review of the May 30-Apr. 1 FOMC meeting:

Participants remained highly

Bond funds: a refuge as interest rates fall?

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Which investment platform has the lowest fees?

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Emmanuel Faber is on a mission

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital