Writing in a research note, analysts Julian Roberts, Tom Mills, Laura Gris Trillo and Fangfei Li highlighted the consortium led by CVC has until 5pm on 19 June to confirm whether or not it will make a further offer. Rejected by HL’s board, the 26 April 985p per share offer was made at a 30% premium to the contemporary share price. However, on the back of the news, HL’s share price has traded considerably higher, currently at 1,066p per share, according to data from Morningstar Direct. Hargreaves Lansdown rejects bid from private equity consortium The move has squeezed the short po…

SJP CEO Mark FitzPatrick joins IA board in triple appointment

FitzPatrick, is joined by Northern Trust Asset Management’s John McCareins and State Street Global Advisors’ Ann Prendergast, who replace former CEO of JO Hambro Capital Management UK Alexandra Altinger, head of EMEA at BlackRock Stephen Cohen and HSBC AM CEO Nicolas Moreau, whose three-year terms come to an end. The IA thanked the three outgoing directors for their “involvement and dedication.” Prior to his stint at the top of SJP, FitzPatrick worked with Deloitte for 26 years until 2017, focusing on financial services in the UK, Europe and South Africa. In July 2017, FitzPatrick joined…

BoE confirms 20 June rates decision but cancels all speeches prior to election

A spokesperson for the bank confirmed to Investment Week there would be neither speeches nor public statements from central bank officials, however, essential business would continue. AJ Bell attacks ‘counterproductive’ GB ISA as dividend jumps 21% This includes the 20 June interest rate decision, which will be the last move from the BoE before the public goes to the polls. The same practice will be adopted for the Financial Stability Report, which will still be published on 27 June. The accompanying press conference, however, has been cancelled.

Investors Harness AI to Halt Deforestation

Technology is playing a “groundbreaking” role in PRI stewardship programme, which is gearing up to engage target companies across multiple sectors.

Advances in artificial intelligence (AI) have allowed global asset owners to take a novel approach to company engagement, through a campaign aimed at halting the destruction of the world’s tropical forests. Spring, a stewardship initiative launched last year by the UN-supported Principles for Responsible Investment, uses the large language models…

Subscribe

Subscribe to ESG Investor to gain access to the leading platform for news, analysis, and interviews across sustainable investing. Select subscribe below to view our subscription packages or you can email us at subscriptions@esginvestor.net to discuss your options.

Request a Trial

Get in touch today to discuss a trial giving you unrestricted and unlimited access to ESG Investor for you and/or your team(s) for a limited period. Email us at subscriptions@esginvestor.net

Recommended for you

Wall Street stocks hit record high as Nvidia market cap powers past $2.5tn

Standard DigitalWeekend Print + Standard Digital

wasnow $75 per month

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Levine Leichtman Capital Partners partially exits Law Business Research

Los Angeles-based private equity firm Levine Leichtman Capital Partners will partially exit portfolio company Law Business Research through a partnership with global asset manager ICG, which will see LLCP return capital to its investors while remaining a shareholder alongside ICG.

LBR is an investment of Levine Leichtman Capital Partners Fund VI.

In a press statement, LLCP said that ICG’s support would facilitate further international expansion, investment in product development and continued growth.

Andrew Alexander, Managing Director of LLCP, added that LBR had “built a scalable technology platform, bolstered its suite of proprietary products and successfully expanded into additional markets”. LBR’s acquisitions include Globe Business Media Group, Docket Navigator, Legal Monitor and MBL.

LBR is an information services business aimed at the global legal, intellectual property and governance, risk and compliance markets. The company employs around 500 across London, Hong Kong, New York, Austin and Washington DC.

Raymond James and Willkie Farr & Gallagher advised LLCP and LBR on the transaction, while Lincoln International and Ropes & Gray advised ICG.

Capital Group and KKR partner to offer private assets to wider audience

Standard DigitalWeekend Print + Standard Digital

wasnow $75 per month

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Nikhil Rathi warns private equity firms to be more cooperative

Nikhil Rathi, chief executive of the Financial Conduct Authority, has urged private equity firms to provide more information or face stricter regulatory measures, according to a report by City AM.

At the Association of Corporate Treasurers, Rathi said that the valuations of private firms have been “under pressure” over the past year, emphasising the need for buyout houses to cooperate with the regulator to avoid stricter action.

Rathi clarified that the immediate response should not be stringent regulation. He expressed the need for more evidence before declaring a systemic issue in the private finance sector.

However, Rathi refrained from labeling the issue as a “systemic risk,” distinguishing his stance from that of the Bank of England, which has warned that a sudden drop in valuations could jeopardise the stability of the financial system.

During a speech for UK Finance last month, Rebecca Jackson, Executive Director for Authorisations, Regulatory Technology & International Supervision at the Bank of England, described “a creeping sense of complacency among firms” with regards to understanding the business of subscription financing or compiling data on loss history in this type of business.

She warned that the bankruptcy of multiple portfolio companies could expose banks to severe, unexpected losses and potentially pose a systemic risk.

The Bank of England has instructed banks to start stress testing their exposure to private equity due to concerns that lenders may not fully understand the associated risks. Rathi added that the FCA has been assisting the Bank of England in its efforts to investigate banks’ exposure to the sector.

Stocks making the biggest moves before the bell: Nvidia, Live Nation, Snowflake and more

Market Trends Continue To Lean Into A Bullish Signal

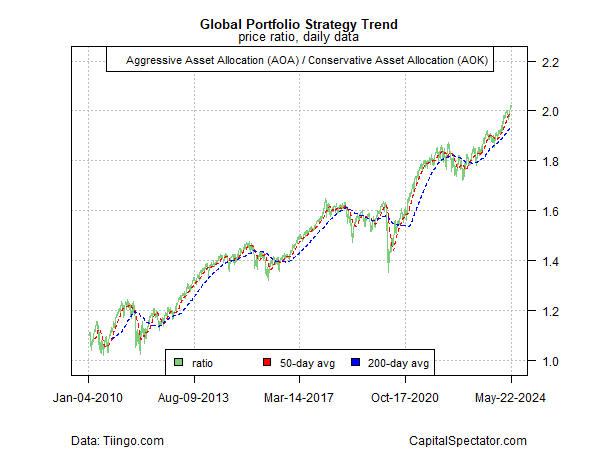

The old saw that markets climb a wall of worry is alive and kicking. Although there are plenty of warnings from analysts who see trouble ahead, trend profiles show no fear, via several pairs of ETF proxies for profiling the appetite for risk, based on prices through yesterday’s close (May 22).

What some see as a gravity-defying run higher extends similar profiles from earlier this year (see here and here). The party must end eventually, as all bull runs do, but for the moment the bias for risk-on remains conspicuous.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

The net-positive bias still looks strong generally via an aggressive global asset allocation portfolio (AOA) vs. its conservative counterpart (AOK). At the start of the trading week this ratio touched a new record high before edging down on Tuesday and Wednesday.

The US equities market isn’t quite as hot as AOA:AOK, but its close, based on the ratio US stocks (SPY) vs. a low-volatility subset (USMV).

A key bellwether for stocks these days is the semiconductor industry (SMH), which is on track to rise for a fifth straight week. Relative to the broad market (SPY), this ratio looks set to reach a new peak soon.

A possible early warning sign that the bulls are becoming tired is the recent drop in housing stocks (XHB) relative US equities overall (SPY). This ratio has fallen in recent days, closing yesterday at the lowest level since February.

Meanwhile, the recent rally in medium-term US Treasuries (IEF) vs. shorter-term counterparts (SHY) is stalling again, suggesting that the long-running bear market in bonds has yet to run its course.

A potentially worrisome sign for the overall risk appetite is the rebound in inflation-indexed Treasuries (TIP) vs. conventional government bonds (IEF). The market appears to be flirting with a new run of reflation, but is still on the fence. This ratio remains well short of its previous peak in October. If and when TIP:IEF sets a new high, it would signal trouble for animal spirits.