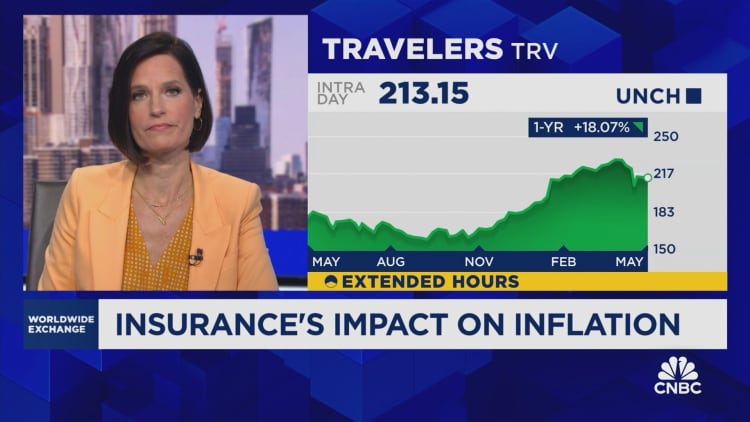

Soaring auto insurance costs have been a principle driver behind inflation over the past year, but there could be relief on the way, according to Bank of America. Motor vehicle insurance cost was up 22.6% from a year ago, the largest annual increase since 1979, according to Bank of America. Recent trends probably do not “mean that your premium will fall, but we think the rate of increase should slow,” BofA economist Stephen Juneau said. Rows of new Tesla cars are seen in a holding area near a customer collection point on April 15, 2024 in London, England. Leon Neal | Getty Images

Soaring auto insurance costs have been a principle driver behind inflation over the past year, but there could be relief on the way, according to Bank of America.

The bank’s economists see several driving factors behind the run-up in costs to ease in the months ahead, possibly taking some of the heat off a category that has pushed the Federal Reserve to keep up its inflation fight.

“The turbocharged increases in motor vehicle insurance premiums are a response to underwriting losses in the industry. Insurers saw losses,” BofA economist Stephen Juneau said in a note. However, he added, “There are signs that many insurers are getting back to profitability.”

Primarily, the hit to insurers, which has been passed on to consumers, arose from three sources: higher vehicle prices, increased costs for repairs and “more accidents as driving trends returned to normal,” Juneau said.

There’s some good news on that front.

Sales prices for new and used vehicles have been trending lower in recent months and are down 0.4% and 6.9%, respectively, on a 12-month basis, according to Bureau of Labor Statistics data through April. Also, repair and maintenance services costs were flat in April though still up 7.6% from a year ago.

Motor vehicle insurance costs, though, continued to soar.

The category rose 1.8% in April on a monthly basis and was up 22.6% from a year ago, the largest annual increase since 1979, according to Bank of America.

In the CPI calculation, auto insurance has a weighting of nearly 3%, so it’s a significant component.

The recent trends probably do not “mean that your premium will fall, but we think

CNBC