Former Goldman Sachs partner starts healthcare PE firm

Former Goldman Sachs partner Jo Natauri has launched Invidia Capital Management, a New York-based healthcare services-focused private equity firm, with investment from global alternative asset management solutions provider GCM Grosvenor.

Invidia will focus on upper-middle market investment opportunities in North America.

Natauri most recently served as Global Head of Private Healthcare Investing at Goldman Sachs, where she was also a member of the bank’s corporate investment, sustainable investing and life sciences investing committees. She left Goldman Sachs last December after a 17-year tenure.

Invidia has so far hired Vince Cuticello as Chief Administrative Officer and Chief Compliance Officer; Alice Kennon as Head of Operations and Capital Formation; and six additional investment team members with experience at Goldman Sachs, TPG, KKR, Barclays, Partners Group and Ontario Municipal Employees Retirement System.

In a statement, Goldman Sachs’ CEO David Solomon described Natauri as “an important leader in growing Goldman’s healthcare franchise in the private equity group”.

He added: “She’s well-positioned to lead next-generation healthcare investing and to have an impact on the direction of healthcare.”

JPMorgan identifies private credit as “crucial expanding area”

Private credit is a “crucial expanding area” within commercial and investment banking, according to a report by Alternative Credit Investor quoting Troy Rohrbaugh, co-chief executive of commercial and investment banking at JPMorgan Chase.

At JPMorgan’s investor day in New York on Monday, Rohrbaugh said: “Private credit is a very important growing space and we believe we have an advanced strategy across the entire commercial and investment bank.”

Earlier this year, JPMorgan acknowledged the potential of direct lending in the private credit sector and suggested that the overall private credit market could exceed $3tn (£2.4tn).

In February, Bloomberg reported that the bank had been in discussions with FS Investments and Octagon Credit Investors to broaden its private credit business.

Rohrbaugh informed investors that the bank is the largest financier of private credit portfolios and will continue to be a major player in the sector. He also disclosed that the bank has allocated funds to invest in direct loans for corporate borrowers.

Rohrbaugh added: “We are also developing a co-lending programme to increase the amount of capital we can deploy in the sector.

“Whether it’s a broad, direct or broadly syndicated loan, we can be truly agnostic to our corporate clients’ borrowing needs.”

JPMorgan’s chairman and CEO Jamie Dimon affirmed the bank’s renewed focus on private credit.

Rohrbaugh also shared his perspective that the US Basel III regulation will involve participation in private credit on both sides of the market, through lending and borrowing.

He stated: “We believe this will not only benefit our clients but also be beneficial to our business.

“Despite these growth opportunities, we will face capital headwinds given the Basel III endgame, but we anticipate a more measured and manageable rule outcome compared to the original proposal.”

Eir Partners Capital closes Eir Partners Investment Program II at $496m

Miami-based private equity firm Eir Partners Capital has closed its Eir Partners Investment Program II with $496m in capital commitments, having closed its predecessor, Eir Partners Program I, at $255m in 2021.

The fund secured commitments from financial institutions, insurance companies, family offices, funds-of-funds, endowments and foundations, according to a press release.

Eir said that Eir Partners Investment Program II would “continue to invest in disruptive companies that have proven market fit and scale demonstrating outsized organic growth potential coupled with accretive M&A opportunities”.

Eir Partners Capital’s investments focus on healthcare technology and tech-enabled services.

Lazard Frères & Co and Kirkland & Ellis advised on the formation of Eir Partners Investment Program II.

First UK crypto ETPs to launch on May 28

Stay informed with free updates

Simply sign up to the Exchange traded funds myFT Digest — delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

The UK’s first cryptocurrency exchange traded products are finally set to begin trading next week, almost a decade after the first such vehicles appeared in Sweden.

WisdomTree and 21Shares have been given the green light by the Financial Conduct Authority, the City regulator, to list ETPs investing in “physical” spot bitcoin and ether, the two most popular digital tokens, on the London Stock Exchange on May 28.

However, the ETPs — which form part of a barrage of similar vehicles expected to list on the LSE — will only be available to professional investors because the FCA has ruled that “crypto derivatives are ill-suited for retail consumers due to the harm they pose”.

The stance is in sharp contrast to stock exchanges across much of continental Europe, as well as Australia, Brazil, Canada, Hong Kong and the US, which offer crypto ETPs to both retail and institutional investors.

US-listed spot bitcoin ETFs already boast combined assets of $50bn, despite only launching in January, with about 80 per cent of this held by retail investors, according to regulatory filings.

A series of other crypto ETP managers, including ETC Group and CoinShares, are known to have filed to list vehicles on the LSE, ideally also on May 28 if they receive regulatory sign-off from the FCA in time.

“The FCA approval of our crypto ETPs’ prospectus is a significant step forward for the industry and UK-based professional investors seeking exposure to the asset class,” said Alexis Marinof, head of Europe at WisdomTree, which has $111bn under management globally.

“While UK-based professional investors have been able to allocate to crypto ETPs via overseas exchanges, they will soon have a more convenient access point. FCA approval in this respect could result in greater institutional adoption of the asset class, as many professional investors have been unable to gain exposure to bitcoin and other cryptocurrencies due to regulatory limitations and uncertainty,” he added.

WisdomTree’s Physical Bitcoin (BTCW) and Physical Ethereum (ETHW) ETPs will have fees of 0.35 per cent, the same as equivalent vehicles listed in a number of continental European exchanges.

Ophelia Snyder, co-founder of 21 Shares, which will cross-list its existing Bitcoin and Ethereum Staking ETPs in the UK, with fees of 1.49

CFPB says buy now, pay later firms must comply with U.S. credit card laws

The Consumer Financial Protection Bureau declared on Wednesday that customers of the burgeoning buy now, pay later industry have the same federal protections as users of credit cards. The agency unveiled what it called an “interpretive rule” that deemed BNPL lenders essentially the same as traditional credit card providers under the decades-old Truth in Lending Act. The BNPL market is dominated by fintech firms like Affirm, Klarna and PayPal. Rohit Chopra, director of the CFPB, testifies during a House Financial Services Committee hearing on June 14, 2023. Tom Williams | Cq-roll Call, Inc. | Getty Images

The Consumer Financial Protection Bureau declared on Wednesday that customers of the burgeoning buy now, pay later industry have the same federal protections as users of credit cards.

The agency unveiled what it called an “interpretive rule” that deemed BNPL lenders essentially the same as traditional credit card providers under the decades-old Truth in Lending Act.

That means the industry — currently dominated by fintech firms like Affirm, Klarna and PayPal — must make refunds for returned products or canceled services, must investigate merchant disputes and pause payments during those probes, and must provide bills with fee disclosures.

“Regardless of whether a shopper swipes a credit card or uses Buy Now, Pay Later, they are entitled to important consumer protections under long-standing laws and regulations already on the books,” CFPB Director Rohit Chopra said in a release.

The CFPB, which last week was handed a crucial victory by the Supreme Court, has pushed hard against the U.S. financial industry, issuing rules that slashed credit card late fees and overdraft penalties. The agency, formed in the aftermath of the 2008 financial crisis, began investigating the BNPL industry in late 2021.

Surging debt

The use of digital installment loan-type services has ballooned in recent years, with volumes surging tenfold from 2019 to 2021, Chopra said during a media briefing. Among CFPB concerns are that some users are given more debt than they can handle, he said.

“Buy now, pay later is now a major part of our consumer credit market as these loans provide a meaningful alternative to other options for consumers,” Chopra told reporters. “The CFPB wants to make sure that these new competitive offerings are not gaining an advantage by sidestepping longstanding rights and responsibilities enshrined under the

CNBC

Chinese sovereign bond trading suspended after frantic retail buying

Standard DigitalWeekend Print + Standard Digital

wasnow $75 per month

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthMake and share highlightsFT WorkspaceMarkets data widgetSubscription ManagerWorkflow integrationsOccasional readers go freeVolume discountFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

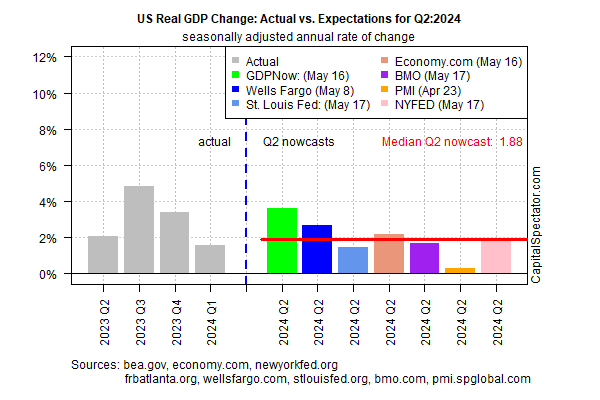

US Economy Still On Track For Modest Pickup In Growth For Q2

US economic activity is expected to post a modestly firmer increase in the second-quarter, based on the median estimate for a set of nowcasts compiled by CapitalSpectator.com. More than half of the quarter’s data sets have yet to be published, but the early clues continue to skew positive.

Output for the April-through-June period is projected to rise 1.9% (seasonally adjusted real annual rate), a modest pickup over Q1’s 1.6 advance. If the median Q2 nowcast is correct, the economy will post its first improvement over the previous quarter since the surge in output in 2023’s Q3.

With less than half of the quarter’s data set published there’s still a high degree of uncertainty about Q2’s outlook. But today’s update is encouraging in that the 1.9% nowcast for Q2 is essentially unchanged from the previous estimate (published on May 3).

Despite the relatively upbeat profile, there are several risk factors lurking, including negative sentiment. A new poll of Americans “wrongly believe the US is in an economic recession,” reports The Guardian.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Meanwhile, the US Consumer Sentiment Index weakened in May to its lowest reading in six months. “While consumers had been reserving judgment for the past few months, they now perceive negative developments on a number of dimensions,” reports Joanne Hsu, surveys of consumers director. “They expressed worries that inflation, unemployment and interest rates may all be moving in an unfavorable direction in the year ahead.”

It’s unclear how much of an impact that sentiment will have on the real economy, but it’s certainly a headwind in some degree. Nonetheless, today’s GDP nowcast suggests that the economy may be stabilizing if not firming up relative to Q1.

A possible early sign of trouble for later this year is the ongoing slowdown in labor market growth. Year-over-year private payrolls growth has ranged from 1.6% to 1.8% in recent months through April. A print below 1.6% in the upcoming May report would mark the slowest trend since the economy rebounded from the pandemic – a possible warning sign for the second half of 2024.

Meanwhile, retail sales growth has turned sluggish lately and so the May update will be widely watched.

For some economists, recession risk is already estimated as high for later this year. “Firms are hiring at a lower rate. Firms

Adenia Partners exits Ghanaian advertising company DDH

Ghanaian private capital fund manager Injaro Investment Advisors has acquired Outdoor Holding Limited via its fund, Injaro Ghana Venture Capital Fund, from Africa-focused private equity firm Adenia Partners.

Outdoor Holding controls a majority stake in Ghanaian out-of-home advertising company DDP Outdoor. Injaro said that it would collaborate with DDH to “grow its market share by expanding its advertising service offering”.

IGVCF focuses on Ghanaian SMEs across financial services, food and agribusiness, education, healthcare, manufacturing and industrial services.

In a statement, Jerry Parkes, a Managing Director at Injaro, said that the firm remained “focused on the founder’s vision of a versatile market-leading advertising partner that delivers exceptional customer service”.

Nnennia Ejebe, a Partner at Adenia, said that her firm had put DDH on a trajectory for long-term commercial success having “invested to improve health and safety in line with best practices, introduced new processes and systems, and supported the professional development of its employees”.

Close Brothers AM net inflows and performance gains boost total assets to £19.6bn

In a stock exchange notice published today (22 May), CBAM’s managed assets rose to £18.5bn – up from £17.7bn the previous quarter – while its total assets hit £19.6bn, £1.1bn higher than the £18.5bn reported at the end of January. The surge in net inflows came on the back of “marginally” improved market conditions, according to Adrian Sainsbury, CEO of Close Brothers, who argued that despite the “period of uncertainty, we are committed to executing our strategy and protecting our valuable franchise”. Wage inflation hits Close Brothers Asset Management as profits shrink 27% Followin…