The Most Polluted Cities in the U.S.

Published

47 seconds ago

on

May 14, 2024 Graphics & Design The Most Polluted U.S. Cities in 2024

According to the World Health Organization, air pollution is responsible for 7 million deaths annually, and could cost the global economy between $18–25 trillion by 2060 in annual welfare costs, or roughly 4–6% of world GDP.

And with predictions that 7 in 10 people will make their homes in urban centers by mid-century, cities are fast becoming one of the frontlines in the global effort to clear the air.

In this visualization, we use 2024 data from the State of the Air report from the American Lung Association to show the most polluted cities in the United States.

What is Air Pollution?

Air pollution is a complex mixture of gases, particles, and liquid droplets and can have a variety of sources, including wildfires and cookstoves in rural areas, and road dust and diesel exhaust in cities.

There are a few kinds of air pollution that are especially bad for human health, including ozone and carbon monoxide, but here we’re concerned with fine particulate matter that is smaller than 2.5 microns, or PM2.5 for short.

The reason for the focus is because at that small size, particulate matter can penetrate the bloodstream and cause all manner of havoc, including cardiovascular disease, lung cancer, and chronic pulmonary disease.

The American Lung Association has set an annual average guideline of 9 µg/m³ for PM2.5, however, the World Health Organization has set a much more stringent limit of 5 µg/m³.

The 21 Worst Polluted Cities in the U.S.

Here are the top 21 most polluted cities in the U.S., according to their annual average PM2.5 concentrations:

RankCity, StateAnnual average concentration, 2020-2022 (µg/m3) 1Bakersfield, CA18.8 2Visalia, CA18.4 3Fresno, CA17.5 4Eugene, OR14.7 5Bay Area, CA14.3 6Los Angeles, CA14.0 7Sacramento, CA13.8 8Medford, OR13.5 9Pheonix, AZ12.4 10Fairbanks, AK12.2 11Indianapolis, IN11.9 12Yakima, WA11.8 13Detroit, MI11.7 T14Chico, CA11.6 T14Spokane, WA11.6 15Houston, TX11.4 16El Centro, CA11.1 17Reno, NV11.0 18Pittsburgh, PA10.9 T19Kansas City, KS10.8 T19Las Vegas, NV10.8

Six of

Disinflation Expected To Resume In April CPI Report

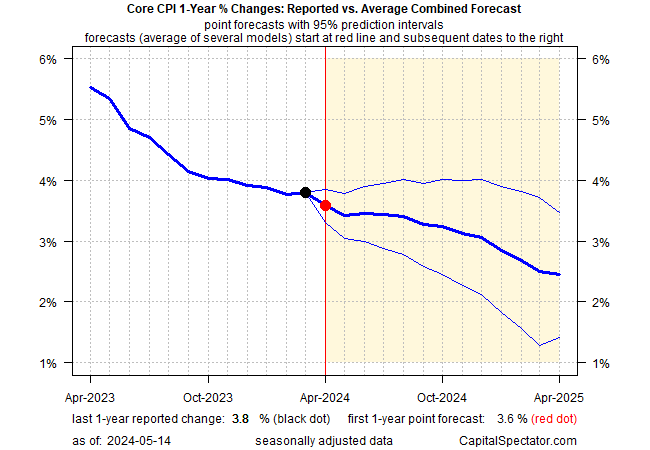

US consumer inflation data was surprisingly firm in March, raising the stakes for tomorrow’s April report (Wed., May 15). Another round of disappointing numbers would arguably confirm that the recent disinflation trend is in serious trouble. No one can rule out that possibility, but I’m expecting we’ll see disinflation will return in some degree.

In particular, the year-over-year change in core CPI is expected to ease to 3.6% through April, based on the point forecast for CapitalSpectator.com’s ensemble model. The prediction interval leaves room for an upside surprise, although the odds that core CPI will accelerate are quite low. The worst-case scenario, according to this modeling, is that core CPI’s 1-year trend holds steady.

Another factor that suggests that disinflation will continue: the lag effects of monetary policy, which have been relatively hawkish over the past two years. Consider how the year-over-year changes in broad M2 money supply (advanced 12 months) compare with the 1-year change in core CPI. As the chart below suggests, the recent negative comparisons in M2 point to more disinflation ahead.

Timing, of course, is open for debate and so the negative 1-year trend in M2 may not be relevant for any given monthly CPI report. What’s more, the M2-CPI chart above raises a warning for the disinflation outlook, namely: time is running out. The net change in the M2 trend is still negative, but the depth of the contraction is fading and looks set to turn positive soon. The implication: monetary policy’s ability to promote a disinflationary bias is fading.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Meantime, market expectations remain aligned with an ongoing disinflation forecast, or so the policy-sensitive US 2-year Treasury yield suggests. Although this key rate’s implied forecast has been wrong for some time — i.e., that the Federal Reserve will cut interest rates — the crowd is sticking to its dovish outlook, per the ongoing 2-year rate trading well below the current Fed funds rate.

Finally, a simple model using unemployment and headline CPI continue to suggest that monetary policy is tight, which suggests that a disinflationary wind is still blowing.

The acid test, of course, is how the actual CPI results stack up. As it turns out, economists are also projecting that core CPI will ease to a 3.6% year-over-year rate, based on

Border dispute hinders Niger’s China-built oil pipeline

Standard DigitalWeekend Print + Standard Digital

wasnow $85 per month

Billed Quarterly at $199. Complete digital access plus the FT newspaper delivered Monday-Saturday.

What’s included

Global news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts10 monthly gift articles to shareGlobal news & analysisExpert opinionFT App on Android & iOSFT Edit appFirstFT: the day’s biggest stories20+ curated newslettersFollow topics & set alerts with myFTFT Videos & Podcasts20 monthly gift articles to shareLex: FT’s flagship investment column15+ Premium newsletters by leading expertsFT Digital Edition: our digitised print editionEverything in PrintWeekday Print EditionFT WeekendFT Digital EditionGlobal news & analysisExpert opinionSpecial featuresExclusive FT analysisPlusEverything in Premium DigitalEverything in Standard DigitalGlobal news & analysisExpert opinionSpecial featuresFirstFT newsletterVideos & PodcastsFT App on Android & iOSFT Edit app10 gift articles per monthExclusive FT analysisPremium newslettersFT Digital Edition10 additional gift articles per monthFT Weekend Print deliveryPlusEverything in Standard DigitalFT Weekend Print deliveryPlusEverything in Premium Digital

Aquila Energy Efficiency shareholders oversubscribe £17.5m tender offer

In a tender offer launched on 19 April, AEET proposed to purchase 18.6% of its issued share capital, representing around 18.6 million shares at a set price of 94.28 pence, a total of £17.5m. The trust said in a stock exchange notice on Monday (13 May) that the tender was significantly oversubscribed as 90.2 million shares were validly tendered, representing around 90% of AEET’s share capital. Number of investment trust share buybacks hits record high but effectiveness called into question Shareholders who tendered a percentage greater than their basic entitlement (18.6%), will have…

UBS makes AT1 bonds worth $5bn available for equity conversion

In a statement on Monday (13 May), the Swiss lender said that as of 10 May, the instruments would be subject to equity conversion and no longer subject to write-down in the occurrence of a trigger or viability event. The future of AT1 bonds one year on from the collapse of Credit Suisse The decision covers four outstanding AT1 issuances made since November 2023, three amounting to a total of $4.5bn and another valued at 650 million Singapore dollars ($480m). In November, UBS issued its first AT1 bonds since taking over Credit Suisse in March 2023, when $17bn wor…

Evelyn Partners hits record £61.8bn AUMA despite slowing net inflows

In a trading update published today (14 May), the wealth manager posted a 4.6% increase in AUMA in the three months to 31 March, up from £59.1bn at the end of 2023, largely aided by new business and positive market movements. Net inflows into the business significantly decreased compared to a year earlier however, dropping to £300m from £700m in the first quarter of 2024, primarily due to increased redemptions. Evelyn Partners nets record £3.1bn inflows in 2023 as assets reach all-time high Group operating income increased by 9.5% over the three-month period to £178m, with growth a…

Fintech firm Klarna says 90% of its employees are using generative AI daily

Fintech firm Klarna says over 87% of its employees are using generative AI tools, including OpenAI’s ChatGPT and its own internal AI assistant. The biggest users of generative AI in the company are those in non-technical groups, including communications (92.6%), marketing (87.9%), and legal (86.4%), Klarna said. Klarna has been touting AI as a major boon to its bottom line as the company has pushed to steer its narrative away from the heady days of 2020 and 2021. Rafael Henrique | SOPA Images | LightRocket via Getty Images

Swedish financial technology company Klarna said Tuesday that nearly 9 out of 10 employees in its 5,000-strong workforce are now using generative artificial intelligence tools in their daily work.

Klarna, which lets individuals split their purchases into interest-free, monthly installments, said over 87% of its employees are using generative AI tools, including OpenAI’s ChatGPT and its own internal AI assistant.

The biggest users of generative AI in the company are those in non-technical groups, such as communications (92.6%), marketing (87.9%) and legal (86.4%), Klarna said.

At those rates, Klarna is seeing much higher adoption of generative AI within the company than in the broader corporate world.

According to a survey by consultancy firm Deloitte, 61% of people working with a computer use generative AI programs in their day-to-day work — sometimes without their line manager being aware.

Klarna has its own internal AI assistant, called Kiki.

According to the firm, 85% of all its employees now use Kiki, and the chatbot now responds to an average of 2,000 queries a day.

Key uses of generative AI

Klarna said a key use of generative AI — namely, OpenAI’s ChatGPT — by its communications teams was in evaluating whether press articles written about the company are positive or negative.

Klarna’s lawyers are using ChatGPT Enterprise, the business-grade version of OpenAI’s tech, to create first drafts of common types of contract, cutting the hours it takes to draft up a contract.

“You still need to adapt it to make it work for your particular case but instead of an hour you can draft a contract in ten minutes,” Selma Bogren, senior managing legal counsel at Klarna, said in a press statement.

AI as a boon to the bottom line

Klarna has been touting AI as

CNBC

Charles Stanley’s Paris Jordan: Managers could be left behind by SDR

Indeed, it is possible that the aim of encouraging sustainable investing and minimising greenwashing could be compromised. Firstly, starting with the positives, the FCA has proposed to extend the labelling regime to CIPs, including Model Portfolio Services, which aligns the proposal of labelling products as per the first SDR paper. This now brings DFM’s who provide MPS and multi-asset solutions to financial advisers back in line and levels the playing field between solutions which were unitised(/funds) and model portfolios. Where some firms ran both, there were concerns that, despi…

Clarion Capital Partners appoints General Counsel and Chief Administrative Officer

Private equity and private credit investment firm Clarion Capital Partners has appointed Jeff Sipos as General Counsel and Chief Administrative Officer. Sipos previously worked at Clarion from 2011 to 2015.

Most recently, Sipos served as General Counsel and Corporate Secretary of North America at global specialty insurance business Ascot Group; and as Associate General Counsel at Coaction Specialty Insurance, formerly ProSight Specialty Insurance. In these roles, he oversaw the legal functions across acquisitions, divestitures, litigation, governance, investor relations, regulatory compliance, human resources and equity compensation.

Jeff began his career at Locke Lord and Kirkland & Ellis, where he specialised in general corporate law, mergers and acquisitions, and acquisition finance, all with a focus on insurance or private equity. Following his law firm experience, Jeff served as a Vice President at KBC Financial Products.