There are many ways to monitor recession risk, but any one indicator in isolation is flawed. Context in the form of reviewing a wide variety of metrics is essential for minimizing noise. But in the search of early warning signs of trouble it’s useful to focus on the labor market, which is arguably the key driver of economic strength and weakness. Caution is still required, but a particular measure of the ebb and flow of payrolls is signaling a warning and so it’s worthwhile to take a closer look.

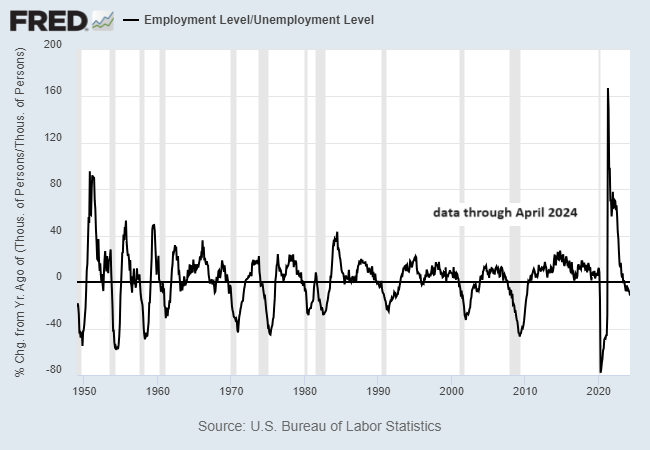

For a big-picture measure of how the labor market is faring in terms of the business cycle I favor the rolling 12-month change of the ratio of employment to unemployment, based on the household survey data published by the Labor Dept. According to this indicator, trouble is brewing.

Note that the one-year change has been negative since last summer. History suggests that when this metric falls below zero, the risk of an NBER-defined recession is elevated.

Using this indicator alone signals that a recession, if it hasn’t yet started, is imminent. The caveat is that no one indicator is flawless, especially in the post-pandemic era, during which several economic indicators have become distorted as business-cycle-analysis tools. Consider the US Treasury yield curve, which was once considered virtually infallible as a recession indicator. But it’s long-running inversion is now considered a false signal by many economists.

Will the labor market indicator in the chart above prove to be more reliable? Rather than trying to guess the correct answer, a better approach is to monitor a wide variety of metrics, which is the modeling focus in the weekly updates of the US Business Cycle Risk Report. Aggregating a wide variety of economic and financial indicators still reflects a growth bias. For example, the newsletter’s primary business cycle indicator – Composite Recession Probability Index (CRPI) – estimates low recession risk as of May 3.

That’s not a reason to dismiss the labor market indicator above – it could be a genuine warning that recession risk is rising. In fact, it’s one of the inputs into the modeling that informs the analysis for the US Business Cycle Risk Report.

But it’s prudent to avoid relying on any one indicator. If the labor market’s rollover via the first chart above is an accurate signal that a recession tipping point has been reached, it will