Last month the spot price of gold reached an all-time high at $2,431 an ounce. Since then, the value of bullion has fallen slightly to around $2,300, a range that is still historically high, yielding about 25% over the past seven months.

“Gold has already metabolised the Federal Reserve’s expected downsizing of its monetary policy easing outlook for 2024, yet it is continuing its upward trajectory,” explained Ned Naylor-Leyland, manager of Jupiter AM Gold & Silver fund.

“This suggests that other factors are at play, such as the return of significant demand for physical gold, particularly from China and the Middle East. This wave of physical buying could be driven by a confluence of reasons, including inflationary concerns and rising geopolitical tensions in the Middle East.”

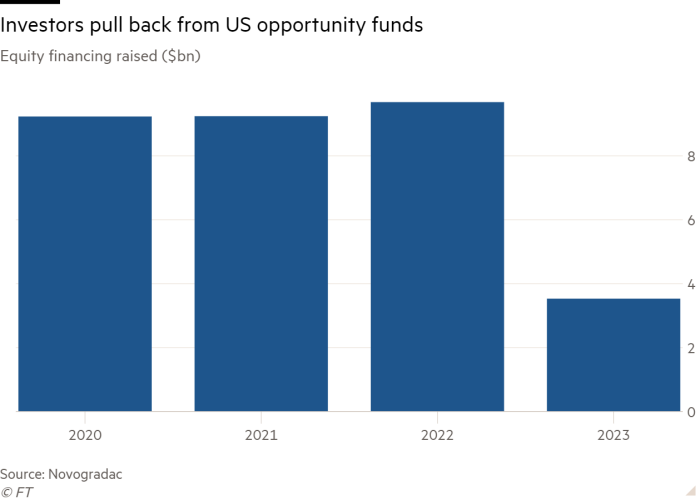

Curiously, $15.6 billion of client funds flowed out of precious metals exchange-traded funds (ETCs) over the past year, most recently at a monthly all-time-high rate in April. Amid such profit-taking, those investment vehicles clearly aren’t the drivers of globally elevated gold prices.

Who is Buying All this Gold?

China has become one of the most important gold buyers in the world. The China Gold Association (CGA) reported that the country’s gold consumption in 2023 amounted to almost 1,090 tonnes, an increase of 8.73% year-on-year. Another indicator of overall gold demand in China, the Shanghai Gold Exchange (SGE), reported a 95% year-on-year increase in demand in January 2024.

“Behind the record demand from China, an interesting demographic shift is taking place,” Ned Naylor-Leyland continued in his April 30 report. “Younger buyers, aged 25-34, have increased their share of total gold purchases from 16% to 59% in 2023. The decline in the stock market and local property values has contributed to the rise of the younger generation, but it is the form of investment that indicates the true nature of the demographic shift. Younger buyers in China are choosing to buy one-gram gold grains to preserve wealth for the long term.”

Such high demand may be confined to Asia for longer. According to co-founder of Flossbach von Storch Bert Flossbach, in the US, “the real interest rate on inflation-linked bonds is +2% and would have to fall significantly to make gold attractive again to US investors as an inflation hedge.”

On April 22, Flossbach wrote that “it is not possible to make serious predictions about the gold price. Over the past ten years, investors have enjoyed an annual increase in the