In the latest instalment of the ‘Four graphs explaining’ series, experts consider the investment case and current state of the FTSE 100.

Vistra secures license to deliver fund admin services from Ireland

Vistra has secured authorisation from the Central Bank of Ireland (CBI) to provide fund administration services from Ireland. To support the expansion, Vistra Funds Services (Ireland) has appointed Aimee Gill, CEO and Head of Fund Accounting; Paul McDonald, Head of Investor Services; and Jacqueline Evbodaghe, Head of Risk and Compliance.

According to a press statement, Vistra’s expansion into fund administration services in Ireland aligns with its strategic growth ambitions and reflects its commitment to providing a “high quality and seamless end-to-end service for its clients”.

PE firm Cap10 appoints new Partner

Cap10, a specialist pan-European private equity firm based in London, has appointed Luca Bonanomi as Partner. Bonanomi has spent the last decade at Blackstone, most recently as a Managing Director in the firm’s private equity group.

In his new role, Bononami will be responsible for targeting unique investment opportunities and further establishing and scaling the Cap10 business in the mid-market space alongside existing Partners, Founding Partner Fabrice Nottin and CFO and COO Mandar Kulkarni.

Bonanami’s investing experience focuses on primary transactions across industrial niches, healthcare and life sciences, as well as business services.

Prior to Blackstone, he worked in the investment banking division at JP Morgan.

Paramount in talks with Sony and Apollo over acquisition

Paramount, the owner of MTV, Nickelodeon and Paramount Pictures will open negotiations with a bidding group led by Sony Pictures Entertainment and private equity giant Apollo Global after its exclusivity period with Hollywood studio Skydance ended on Friday, according to a report by The New York Times.

The report cites three unnamed people familiar with the matter in revealing that a special committee of Paramount’s board of directors met on Saturday and agreed to open discussion with Sony and Apollo, which last week submitted a non-binding letter of interest offering to acquire the company in a $26bn cash deal.

According to the NYT’s sources, the committee also decided to pursue further discussions with Skydance.

While the proposed deal would see Sony acquire a controlling stake in Paramount and Apollo a minority holding, given current US government restrictions on foreign ownership of broadcast networks, the bidding group will likely push for US-based Apollo to hold the rights to the CBS broadcast license, according to two of the sources familiar with the acquisition strategy.

Silver Oak Services Partners recapitalises Beary Landscaping

Lower middle market private equity firm Silver Oak Services Partners has led the recapitalisation of US service business Beary Landscaping alongside the company’s management.

Silver Oak invested alongside Brian Beary, Founder and CEO of Beary Landscaping, and other senior management. The existing management team will continue in their current roles and retain a significant ownership stake in the business.

In a statement, Silver Oak highlighted landscaping services as an attractive subsector for investment as part of a broader effort in facilities services, due to the recurring nature of revenue, low cyclicality and high degree of fragmentation.

Beary is actively looking for add-on acquisition opportunities.

Beary was founded in 1985 and provides recurring landscaping and snow removal services to utilities, multi-family living communities, office buildings and municipalities across Illinois, Indiana, Pennsylvania, Michigan and Wisconsin.

Colbeck Capital Management names Head of Originations

Middle-market private credit manager Colbeck Capital Management has appointed Jared Talisman as a Managing Director and Head of Originations.

Talisman most recently served as a Managing Director at Principal Alternative Credit, where he led and managed the sourcing, structuring and due diligence of non-sponsored private credit investments.

Prior to Principal Alternative Credit, Talisman was a Director at Stonehenge Capital. Talisman has also worked in investment banking at GrowthCap, North Sea Partners and Lehman Brothers.

Visualizing the Tax Burden of Every U.S. State

Published

31 seconds ago

on

May 8, 2024 Graphics/Design:

See this visualization first on the Voronoi app.

Visualizing the Tax Burden of Every U.S. State

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This map graphic visualizes the total tax burden in each U.S. state as of March 2024, based on figures compiled by WalletHub.

It’s important to understand that under this methodology, the tax burden measures the percent of an average person’s income that is paid towards state and local taxes. It considers property taxes, income taxes, and sales & excise tax.

Data and Methodology

The figures we used to create this graphic are listed in the table below.

StateTotal Tax Burden New York12.0% Hawaii11.8% Vermont11.1% Maine10.7% California10.4% Connecticut10.1% Minnesota10.0% Illinois9.7% New Jersey9.5% Rhode Island9.4% Utah9.4% Kansas9.3% Maryland9.3% Iowa9.2% Nebraska9.2% Ohio8.9% Indiana8.9% Arkansas8.8% Mississippi8.8% Massachusetts8.6% Virginia8.5% West Virginia8.5% Oregon8.4% Colorado8.4% Pennsylvania8.4% Wisconsin8.3% Louisiana8.3% Kentucky8.3% Washington8.0% New Mexico8.0% Michigan8.0% North Carolina7.9% Idaho7.9% Arizona7.8% Missouri7.8% Georgia7.7% Texas7.6% Alabama7.5% Montana7.5% South Carolina7.5% Nevada7.4% Oklahoma7.0% North Dakota6.8% South Dakota6.4% Delaware6.4% Tennessee6.1% Florida6.1% Wyoming5.7% New Hampshire5.6% Alaska4.9%

From this data we can see that New York has the highest total tax burden. Residents in this state will pay, on average, 12% of their income to state and local governments.

Breaking this down into its three components, the average New Yorker pays 4.6% of their income on income taxes, 4.4% on property taxes, and 3% in sales & excise taxes.

At the other end of the spectrum, Alaska has the lowest tax burden of any state, equaling 4.9% of income. This

Schroders tables FCA application to launch private equity LTAF for wealth market

Subject to regulatory approval by the regulator, this new LTAF will provide wealth investors with access to a private equity strategy managed by Schroders Capital, the firm’s private asset investment arm. The asset manager unveiled the UK’s first LTAF, Schroders Capital Climate+, last year for UK defined contribution pension funds. In February this year, the firm launched the Schroders Greencoat Global Renewables+ LTAF, also for the DC market. Outgoing Schroders UK wealth head Doug Abbott: Retail LTAF will offer alternative route to private markets Currently, the majority of the LT…

Schroders tables FCA application to launch private markets LTAF for wealth clients

Subject to regulatory approval by the regulator, this new LTAF will provide wealth investors with access to a private equity strategy managed by Schroders Capital, the firm’s private asset investment arm. The asset manager unveiled the UK’s first LTAF, Schroders Capital Climate+, last year for UK defined contribution pension funds. In February this year, the firm launched the Schroders Greencoat Global Renewables+ LTAF, also for the DC market. Outgoing Schroders UK wealth head Doug Abbott: Retail LTAF will offer alternative route to private markets Currently, the majority of the LT…

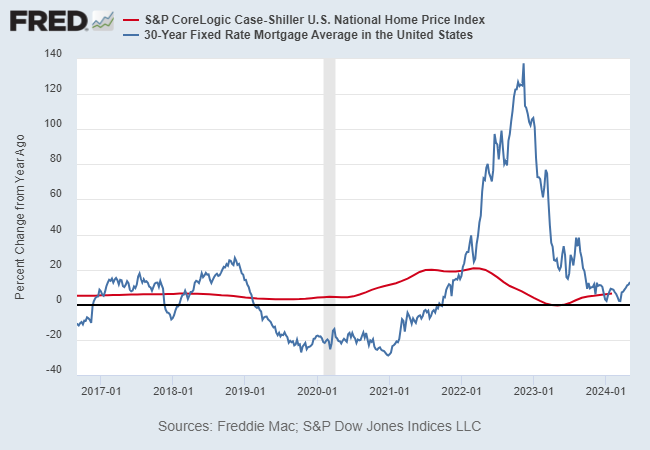

Will Housing Inflation Keep Interest Rates Higher For Longer?

Housing is among the most interest-rate sensitive sectors of the economy. It’s also one of the most cyclical and crucial inputs for the business cycle. On that basis, one could reasonably expect that the sharp runup in interest rates over the past two years would have crushed the trend in housing prices. For a while that was the effect, but the dramatic slide in the year-over-year change in US house prices is accelerating again. The reflation is moderate so far, at least compared with 2021-2022. But it’s notable that housing prices are once more looking resilient after the Federal Reserve’s most aggressive tightening policy in decades and before rate cuts have arrived.

Recent history tells the story. After the Fed began raising interest rates quickly in early 2022, the 30-year mortgage rate rose sharply, more than doubling by late-2022 vs. its year-earlier level. The strong year-over-year rise in housing prices at the time soon took a hit, falling from roughly a 20% annual increase in late-2022 to flatlining in 2023. But in recent months housing prices have revived, and are increasing more than 6% a year, based on S&P Core-Logic US National Home Price Index.

The revival in a firmer housing price trend is striking for several reasons. First, it arrives before the Fed has started cutting interest rates. In fact, market expectations for rate cuts have been pushed further into the future and so any relief for housing in the form of lower borrowing costs is on track to be delayed.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Meanwhile, the year-over-year change in housing is once again rising at a rate that’s faster than consumer inflation. That implies that housing is again a contributing factor to the sticky inflation problem the Fed is grappling with this year.

Another implication is that once the Fed starts cutting rates, which may start as early as September, according to Fed funds futures, policy easing could further strengthen the recent revival in housing inflation, which would contribute to the sticky inflation challenge.

The reflation in housing prices is also conspicuous because it’s again rising faster than year-over-year economic growth, based on nominal GDP. US output rose 5.4% in the first-quarter vs. the year-ago level – below the rate of growth for housing prices.

“The housing market is proving