Stay informed with free updates

Simply sign up to the Financial & markets regulation myFT Digest — delivered directly to your inbox.

Unfair banking practices, inadequate regulation and barriers to accessing finance for smaller businesses risk blocking growth and innovation in the UK, an influential cross-party group of MPs has warned.

A report published on Wednesday by the House of Commons Treasury select committee found that a “difficult environment” for small and medium enterprises risked “disincentivising risk-taking, innovation and, potentially, growth”.

The findings conclude a parliamentary probe into the difficulties encountered by SMEs seeking finance after being hit by the Covid-19 crisis and an energy shock linked to Russia’s invasion of Ukraine.

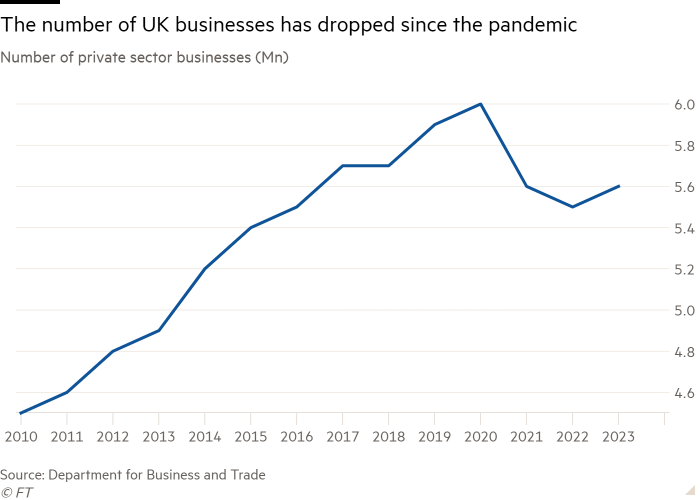

The number of private sector businesses rose steadily from 4.5mn in 2010 to 6mn in 2020 before dropping sharply to 5.6mn in 2023, according to the department for business and trade.

Dame Harriett Baldwin, Treasury committee chair, said banks and regulators could “do more” to help SMEs, which make up 99 per cent of UK businesses.

An earlier finding, published by the committee as part of the investigation, found that more than 140,000 SMEs had their bank accounts closed last year.

“There’s no hiding from the fact smaller firms have had a torrid time over the last few years,” said Baldwin. “Unfortunately, what we have found over the course of the inquiry is that there are some instances where banks and regulators are making a tough world . . . needlessly tougher.”

The MPs made a series of recommendations including that the Financial Conduct Authority oblige banks to share the number of accounts they shut each quarter as well as the reason behind the decision.

The committee said “legitimate businesses” in “undesirable sectors”, such as defence, pawnbroking and amusement machines, in particular, had been closed or denied accounts based on the nature of their work.

It also recommended giving the Financial Ombudsman Service new powers to address unfair requests for guarantees in light of “evidence claiming that lenders were requiring disproportionate personal guarantees for smaller businesses seeking finance”.

The committee urged the government to deliver on its pledge made in October to introduce legislation to crack down on debanking. Ministers have committed to raising the minimum notice period that banks must give customers before closing an account from two to three months.

Data shared with the committee by the Impact Investing Institute, a non-profit organisation that promotes impact investing, found that the success rate for SME applications for bank loans dropped from