Berkshire Hathaway shares rose in premarket trading Monday after Warren Buffett’s conglomerate reported a surge in operating earnings as well as a record cash hoard. Berkshire’s Class A shares were higher by 1.1% in the premarket. Meanwhile, Class B shares gained about 0.6%. Berkshire Hathaway shares have already outperformed this year, with each share class having advanced more than 10%. The S&P 500 is up by more than 7% this year. Warren Buffett poses with Martin, the Geico gecko, ahead of the Berkshire Hathaway Annual Shareholder’s Meeting in Omaha, Nebraska on May 3rd, 2024. David A. Grogan | CNBC

Berkshire Hathaway shares rose in premarket trading Monday after Warren Buffett’s conglomerate reported a surge in operating earnings as well as a record cash hoard.

Berkshire’s Class A shares were higher by 1.5% in the premarket. Meanwhile, Class B shares last gained about 1.2%.

Those moves come after the conglomerate posted first-quarter operating profit of $11.22 billion, up 39% from the year-ago period, mainly driven by an increase in insurance underwriting earnings. Operating profit measures earnings encompassing all of Berkshire’s businesses.

Stock chart icon Berkshire Hathaway Class B

The strength in the insurance businesses, particularly its crown jewel Geico, comes as the sector as a whole benefits from stronger demand and increased pricing power. Insurance underwriting earnings rose to $2.598 billion, a 185% increase from $911 million in the year-earlier quarter. Geico earnings swelled 174% to $1.928 billion from $703 million a year prior.

Berkshire’s cash hoard swelled to a record, partly due to the holding company’s inability in recent years to find a suitable acquisition target. Cash soared to a record $188.99 billion in the first quarter, up from $167.6 billion in the fourth quarter.

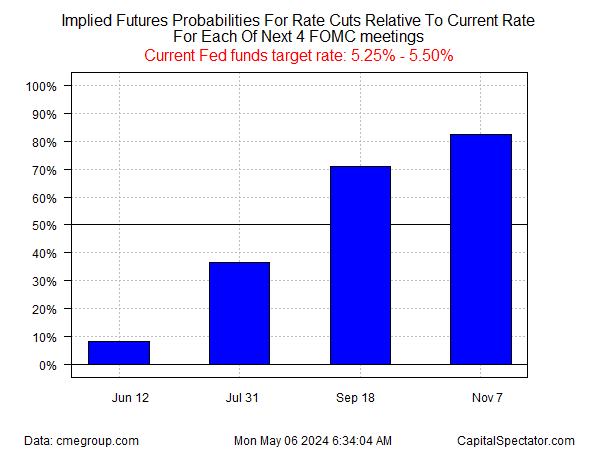

“We had much-improved earnings in insurance underwriting. And then our investment income was almost certain to increase,” Buffett said Saturday at the conglomerate’s annual shareholder meeting in Omaha, Nebraska. “And I said that in the annual report because yields are so much higher than they were last year. And we have a lot of fixed, short-term investments that are very responsive to the changes in interest rates.”

Berkshire Hathaway shares have already outperformed this year, with each share class having advanced more than 10%. The S&P 500 is up by more than 7% this year.

Class A shares marked