Here’s what to expect from the April jobs report on Friday

Nonfarm payrolls are expected to show a gain of 240,000 for the month, according to the Dow Jones consensus that also sees the unemployment rate holding steady at 3.8%. The labor market has been full of surprises this year, topping Wall Street estimates at a time when many economists expected hiring to have slowed down. Markets also will be closely watching the wage numbers. A jobseeker takes a flyer at a job fair at Brunswick Community College in Bolivia, North Carolina, on April 11, 2024. Allison Joyce | Bloomberg | Getty Images

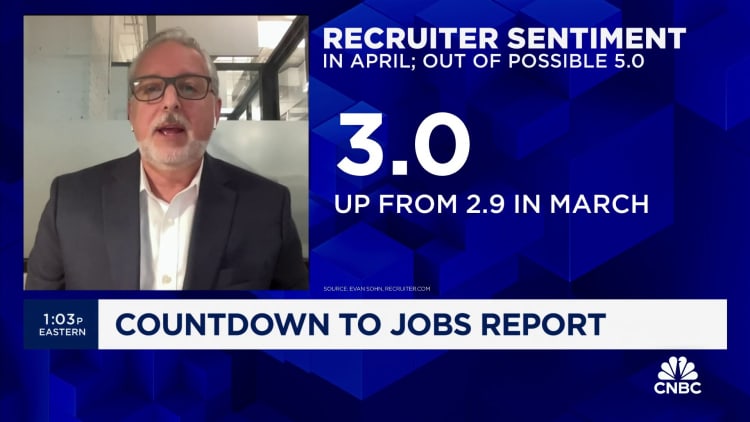

Hiring likely continued at a brisk pace in April as investors look for any cracks in the labor market that could sway the Federal Reserve.

Nonfarm payrolls are expected to show a gain of 240,000 for the month, according to the Dow Jones consensus that also sees the unemployment rate holding steady at 3.8%.

If that top-line number is accurate, it actually would reflect a small step back from the average 276,000 jobs a month created so far in 2024. In addition, such growth could add to the Fed’s reluctance to lower interest rates, with the labor market humming along and inflation still above the central bank’s 2% target.

“There are definitely still tailwinds left,” said Amy Glaser, senior vice president of business operations at job staffing site Adecco. “For April, the name of the game is steady-Eddie as resiliency continues, and then we’re looking forward to some of the seasonal trends we would expect going into the summer.”

April’s jobs market featured more strength in health care and leisure and hospitality, Glaser added. Those have been two of the major sectors for employment growth this year, with health care adding about 240,000 jobs so far and leisure and hospitality contributing 89,000 jobs.

However, growth in the coming months could spread to areas such as education, manufacturing and warehousing, part of the usual seasonal trends as educators look for alternative employment in the summer and students head out seeking jobs, she said.

“I don’t expect to see major surprises this month based on what I’m seeing on the ground,” Glaser said. “But we’ve been surprised before.”

Beating expectations

Indeed, the labor market has been full of surprises this year, topping Wall Street estimates at a time when

CNBC

BHP says Anglo deal structure is not a negative reflection of South Africa

Stay informed with free updates

Simply sign up to the Mining myFT Digest — delivered directly to your inbox.

BHP has said its proposed takeover of Anglo American, which excludes its South African platinum and iron ore assets, was not a reflection of negative views of the country.

In its first material statement since tabling a bid for Anglo last week, Australian-headquartered BHP sought to “clarify” perceptions that its planned spin-off of Anglo American Platinum and Kumba Iron Ore showed a lack of confidence in South Africa.

“The structure of BHP’s proposal . . . reflects the priorities for BHP’s portfolio and opportunity for synergies,” BHP said in a statement on Thursday. It “does not reflect a view of South Africa as an investment destination and is based on portfolio and commodity considerations”.

The statement came as BHP chief executive Mike Henry was in South Africa on a charm offensive, according to people familiar with the situation.

His visit comes days after the country’s mineral resources and energy minister Gwede Mantashe told the Financial Times that he did not support BHP’s bid, and later said that if companies did not want South African assets, “then they don’t want Anglo”.

Meanwhile, David Masondo, deputy finance minister and chair of the state-owned Public Investment Corporation that is Anglo’s second-biggest shareholder, said in an interview on Thursday that the decision to exclude South African assets was a “key issue” for him.

The deal, which was initially valued at £31bn, would be the biggest on record for the mining sector. Anglo rebuffed the offer last week, arguing that it undervalued the company, leaving analysts expecting a rival bid to emerge. BHP proposed an all-stock bid for London-listed Anglo to get access to a portfolio that includes copper mines in Chile and Peru. Copper is a metal vital to the transition to cleaner energy.

BHP’s decision to exclude South African assets is especially sensitive for the ruling African National Congress ahead of its toughest election since the end of apartheid. The 107-year-old Anglo is an iconic institution that has dominated the South African economy for most of the past century.

Masondo disputed that companies faced more onerous operating conditions in South Africa than in other jurisdictions and said President Cyril Ramaphosa was working to resolve the energy and rail problems that have made it difficult for miners to sell to international markets.

In Thursday’s statement, BHP said under the proposed deal, Anglo American Platinum — known as Amplats

Wall Street is confused and divided over how many times the Fed will cut rates this year

EU Sparks Controversy on Energy Charter Treaty Drop

European Union will withdraw from ‘anti-green’ treaty on environmental grounds, but sources warn of impact on renewable investments.

The European Parliament’s vote last week to withdraw from the controversial Energy Charter Treaty has been interpreted as a near-certain ‘death blow’ to a decades-old agreement that is widely perceived as outdated and anti-green.

But the decision, which lawmakers say is necessary to protect the European Union’s climate policies against litigation from fossil fuel companies, may not be as positive for the energy transition as some believe.

James Rogers, an international arbitration lawyer and partner at law firm Jenner & Block, said the EU’s withdrawal – which he said left the treaty “dead” – could inadvertently harm the bloc’s green energy ambitions by reducing investor protections against policy changes.

Set up in 1994 in the aftermath of the fall of the Soviet Union, in part to open up gas imports from Russia and eastern Europe, the ECT provides energy investors with legal protection against the policy whims of national governments. Governments that expropriate assets or arbitrarily change rules may be taken to arbitration under the treaty. More than 50 countries across Europe and Asia have signed up to the treaty since, with Japan its easternmost member.

But as climate change became a key policy concern in Europe in subsequent years, the ECT progressively turned into a weapon for fossil fuel companies to fight against green policies that harmed their interests. It was under the ECT that German utilities RWE and Uniper, for example, sued the Dutch government for €2.4 billion over its plan to phase out coal-fired power back in 2021.

Critics say the threat of a legal challenge under the ECT alone has a “chilling effect” on green policy – which is real but difficult to quantify.

Some of its members pushed to modernise the framework. But these efforts largely failed, and a growing number of European signatories have already left or plan to leave the treaty, including the UK, France, Germany, Spain and Poland. The EU’s departure now turbo-charges that trend.

“Finally, the fossil dinosaur treaty is no longer standing in the way of consistent climate protection, as we no longer have to fear corporate lawsuits demanding billions of euro in compensation brought before private arbitration tribunals,” Anna Cavazzini, Member of the European Parliament and Rapporteur for the Trade Committee, said following the vote last week.

Not anti-green

According to

Stocks making the biggest moves midday: Apple, Peloton, Wayfair, Carvana and more

Janus Henderson set to march into Europe with Tabula acquisition

Stay informed with free updates

Simply sign up to the Exchange traded funds myFT Digest — delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Global asset manager Janus Henderson has bought London-based Tabula Investment Management as it seeks to exploit growing demand for actively managed exchange traded funds outside the US.

Janus is already the fourth-largest provider of active fixed income ETFs in the US, according to Morningstar data, with $14.2bn of its $335bn of assets under management held in the structure.

It said the acquisition was driven by a push to “enhance its partnership with its UK and European client base, which is increasingly looking at active ETFs, and to reach key growing markets in Latin America, the Middle East and Apac”. Financial terms were not disclosed.

Europe’s near-ubiquitous Ucits funds structure is highly popular in much of Latin America and Asia, allowing funds domiciled in Europe to provide a springboard for expansion to much of the world outside of the US.

The ETF industry was once synonymous with benchmark-tracking passive funds but active ETFs have expanded rapidly in the US in recent years, partly because the American tax system has favoured ETFs over mutual funds, but also because active managers have lost their fears that the transparency inherent in ETFs would allow others to front-run their investment decisions.

Active ETFs held $530bn of assets in the US at the end of 2023, 8.5 per cent of the broader ETF market, according to Morningstar.

The trend is less advanced in Europe, where ETFs have no tax advantage over mutual funds, but interest in active ETFs has jumped over the past year with active ETF AUM increasing by €10bn to €33.8bn representing 1.9 per cent of the wider ETF market, according to Morningstar.

Take up has been stronger in parts of the Apac region, with active ETFs accounting for 29.4 per cent of the $93bn South Korean ETF market and 11.8 per cent of Australia’s $65bn ETF sector. In 2023 active ETFs took 86.7 per cent of all net ETF flows in Korea, according to Morningstar.

“The European ETF market is undergoing a significant transformation, growing considerably and mirroring trends observed in the US market where active management is increasingly being incorporated into the ETF wrapper,” Janus chief executive Ali Dibadj told analysts on a conference call Thursday. The company noted that nearly

Why, deep down, we’re all ultramarathoners

Jasmin Paris is not built like ordinary mortals. Last month she won a moment of fame after completing the Barkley Marathons, a race so brutal that only 19 men have managed to finish in the past 35 years. Paris is the first woman to complete the race. It is not Paris’s first brush with greatness. Five years ago, she won the Spine Race: 268 miles along the Pennine Way in January, when it is dark 16 hours a day, cold enough to be covered in snow but warm enough for the rain to soak through everything, and where every snatched minute of sleep is a minute conceded to one’s rivals. As the mother of a breastfeeding daughter, Paris had the additional disadvantage of having to express milk at rest stops, but she nevertheless beat both the Spine Race record and the men trying to keep pace with her. Her nearest challenger, Eugeni Roselló Solé, had to be rescued four miles from the finish line after he became dangerously cold and disoriented. The eventual winner of the men’s race, Eoin Keith, was about 50 miles behind Paris when she crossed the finish line.

Paris recently told the BBC she wanted to inspire people, particularly women. I suspect most people feel more awestruck than inspired; Superman does not inspire me to try flying.

The agony involved in these endurance races defies belief. I think not just of the winners, but competitors such as Roselló Solé, who spectacularly dropped out of the Barkley Marathons in 2019. A former winner of the event, he had to quit part way through in 2020, 2022, 2023 and 2024. And yet he keeps returning.

Why would anyone subject themselves to this? A quarter of a century ago, the behavioural economist George Loewenstein addressed that question. He focused on the experiences of mountaineers and polar explorers, which he summarised as “unrelenting misery from beginning to end”, and dangerous, too. He wanted to expand upon George Mallory’s reported answer to the question, “Why do you want to climb Everest?” (“Because it’s there.”) Mallory died near the summit in 1924.

The question should intrigue anyone interested in human decision-making. Textbook economics merely states that people act so as to satisfy some consistent set of preferences, but preferences are defined only as whatever it is that people are trying to satisfy. Surely it is not useful to

Gazprom plunges to worst loss in decades as sales to Europe collapse

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Russian energy giant Gazprom plunged to its biggest loss in at least a quarter of a century after gas sales more than halved in the fallout from Vladimir Putin’s war in Ukraine.

The loss of Rbs629bn ($6.9bn) in 2023 underlines how the Russian president’s invasion of Ukraine has ravaged the state-owned natural gas monopoly, leading to plummeting sales to Europe, its main source of income.

Gazprom’s revenues fell almost 30 per cent year on year to Rbs8.5tn, with gas sales dropping from Rbs6.5tn in 2022 to Rbs3.1tn.

The company’s Moscow-listed shares fell more than 4.4 per cent on the news. Most Russian analysts had expected it to make a small profit.

Analysts said the losses showed how Gazprom, once a cash-rich “national champion” that used its stronghold over Europe’s energy supply as a geopolitical weapon, had failed to adapt to losing the EU market.

Gazprom’s revenue from gas sales outside Russia fell from Rbs7.3tn in 2022 to Rbs2.9tn last year, a drop analysts said was mostly driven by the loss of its European sales.

European countries, meanwhile, have had greater success than expected in finding alternative sources of gas: Russia’s share of Europe’s gas imports dropped from 40 per cent in 2021, the last full year before the invasion, to 8 per cent in 2023, according to EU data.

The results showed that what was once Gazprom’s core business — selling gas to Europe — had become a lossmaking millstone only partially offset by profits from its oil sales, analysts said.

Profit from oil, gas condensate, and petroproducts rose to Rbs4.1tn, up 4.3 per cent on the previous year, showing how Russian exporters have successfully navigated western attempts to limit the Kremlin’s revenue from energy sales.

But those efforts were not enough to stop Gazprom making a loss.

“The loss of revenues from Europe is an unfixable problem without going back into Europe,” said Craig Kennedy, a Harvard-affiliated scholar and former vice-chair at Bank of America. “It was cross-subsidising the rest of the business and they are finally being forced to show this in their accounts.”

The losses showed how the war had made this prewar model unsustainable, Kennedy added.

The Kremlin has sought to avoid liberalising domestic gas prices, forcing Gazprom to borrow to cover its mounting losses.

“The state’s response to them is just, let’s go borrow more,” he added.

The pursuit of Anglo American highlights a global copper problem

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

After its £31bn bid for Anglo American was rebuffed last week, BHP — the world’s largest mining group — is mulling an improved offer. Other suitors may emerge too. On the surface, the effort to acquire the UK-listed mining group’s complex and sprawling business may seem more trouble than it is worth. But it is what is below ground that is luring buyers.

Anglo American owns lucrative copper mines in Chile and Peru, and prices for the shiny red metal have been soaring recently. Analysts at Citigroup last month said the commodity had entered a bull market. It is hard to disagree. Contracts for copper futures have been rising well above the spot price since the start of 2023.

Copper is an essential raw material for economic growth. It has widespread application in homes, factories, energy grids and power generation. It is also used in renewable technologies including electric vehicles, solar panels and wind turbines. Artificial intelligence data centres rely on copper too for powering and wiring. All that demand is rubbing up against only gradual increases in supply.

The acquisition of Anglo American’s mining sites, however, makes little contribution to boosting global copper output. It means shifting assets from one owner to another, rather than actually creating new ones. It highlights a worrying reality: it is simpler and cheaper to buy out a rival copper miner than to build a new mine. This raises significant concerns for meeting the rising copper demands of the global economy and the green transition.

Copper demand could double by 2035 and lead to supply shortfalls even under optimistic assumptions, according to S&P Global forecasts. Chile, Australia and Peru have the largest known copper reserves. China’s production of refined copper has surged in recent years, but given the huge global demand, the commodity superpower cannot be relied upon to plug the production gap.

The pipeline of new projects is thin, and exploration budgets for copper have fallen since the early 2010s. Copper mining is a capital-intensive endeavour. Some analysts think prices would need to rise by about 20 per cent from current levels to attract investment in new projects. Even if prices get there, there are broader challenges.

It can take well over a decade to move from discovery to production, by which time profitability and politics may have turned